What’s a robo-advisor?

A robo-advisor is a digital monetary advisor powered by synthetic intelligence (AI) that employs an algorithm to ship an automatic number of monetary advisory companies. Usually provided by brokerage corporations, equivalent to Charles Schwab, Constancy Investments and E-Commerce, robo-advisors are a sort of skilled system optimized for monetary companies, particularly for investing and portfolio administration recommendation.

A robo-advisor is one instance of a software program robotic, not a bodily robotic. Nevertheless, the software program supporting robo-advisors capabilities equally to the AI which may drive a robotic. Buyers talk with their robo-advisors by way of smartphone apps or over the net.

How do robo-advisors work?

There are greater than 200 totally different robo-advisor companies accessible. Most comply with this primary work construction:

- When new purchasers register for robo-advisor companies, they need to full a short questionnaire containing demographic and cognitive questions. Ordinary questions embody the shopper’s age, gender, revenue, investing objectives, liabilities, present property and diploma of threat tolerance. These information factors are used for asset allocation in a portfolio and to foretell how an individual responds to inventory market ups and downs.

- Robo-advisors use an algorithm and complicated software program to course of these responses and create a diversified portfolio of exchange-traded funds or index funds. Usually, a monetary or funding skilled selects the investing choices.

- As soon as the funds are invested, the software program mechanically rebalances the portfolio to make sure it stays near the goal allocation.

- Some robo-advisors supply reside consultations or entry to a licensed human monetary planner who will help prioritize aims and make solutions for attaining them. Customers can hook up with their funding accounts to observe progress, make adjustments or proceed pursuing their aims.

Robo-advisors could make prospects cash

Robo-advisor software program can select shares for portfolios based on the steadiness desired by purchasers and supply restricted monetary recommendation. Much like different skilled techniques, robo-advisors use AI applied sciences together with a information base to simulate the judgment and conduct of an skilled human with specialist-level information in a selected area.

Monetary establishments can get monetary savings by using digital assistants to cope with comparatively easy requests and move on extra complicated requests to human advisors. Human brokers usually use robo-advisors to reply extra rapidly to buyer requests.

Provided that monetary advisors are sometimes well-paid, the software program is comparatively cheap to amass and keep. Many within the monetary sector additionally see robo-advisors as a method of getting investing recommendation to the lots, with related price financial savings.

It is also thought that robo-advisors might promote monetary literacy as a result of buyers may take extra time to discover portfolio choices with out feeling pressured to resolve, which could occur when coping with a human.

Forms of robo-advisors

Relying on their stage of technical capabilities, scope or income mannequin, robo-advisors might be divided into the next three classes.

Robo-advisors based mostly on technical competency

These robo-advisors are labeled as both simplistic or complete.

Simplistic robo-advisors use conventional profiling to construct a portfolio. Potential buyers are required to finish a short questionnaire to evaluate their threat urge for food. The investor’s purpose whereas constructing a portfolio is considered when evaluating this info.

Complete robo-advisors use AI and information to achieve a deeper understanding of the investor profile and forecast conduct along with the everyday threat profile questionnaire. The information informs the robo-advisor concerning the consumer’s present web price, commitments, spending patterns and conduct in varied settings and circumstances, whereas the AI learns concerning the consumer and the very best funding for his or her profile.

For example, INDmoney, which is a full-stack private finance platform, makes use of machine studying to immediately supply prospects extremely tailor-made recommendation in actual time.

Robo-advisors based mostly on the income stream

Whereas some robo-advisors obtain a fee from the product’s producer, others cost buyers an advising price. The previous poses a battle of curiosity as a result of its pricing may have an effect on its suggestions. However the latter is free from any such conflicts as a result of it would not depend on the producer for its income. Therefore, the investor is its solely allegiance. The advising price may vary from 10 to 50 foundation factors — a normal measure for rates of interest and different monetary points — whereas an advisor usually expenses a fee of 100 foundation factors.

Robo-advisors based mostly on the scope

Based mostly on the extent of their performance, scope-based robo-advisors might be labeled in a number of methods. Whereas some robo-advisors may solely supply recommendation on mutual funds, the bulk can information buyers on a variety of economic merchandise and property.

Benefits and limitations of robo-advisors

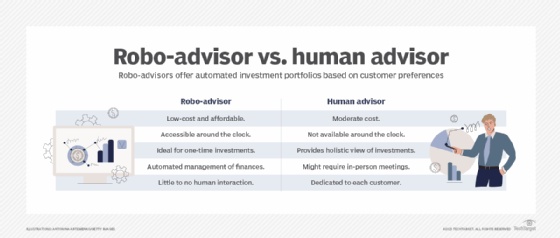

Robo-advisors have made prudent monetary planning and funding administration accessible to all individuals, not simply the rich. The next are some benefits and limitations of robo-advisors:

Benefits of robo-advisors

- Low-cost. Robo-advisors are a reasonable different to conventional monetary advisors. On-line platforms can present the identical companies for a low advisory price by eradicating or limiting the necessity for human involvement. Robo-advisors usually cost low portfolio administration charges and supply a variety of companies.

- Accessible. When in comparison with human advisers, robo-advisors are sometimes extra accessible as a result of they provide a platform that is accessible across the clock, all 12 months spherical. Buyers can entry robo-advisors from anyplace at any time utilizing an web connection.

- No monetary experience is required. Robo-advisors are a superb alternative for inexperienced persons in investing. Even with out the monetary experience required to make sensible choices, an individual can begin investing rapidly.

- Time-savings. Robo-advisors are an amazing possibility for individuals who haven’t got the time for funding administration and would favor to place their portfolios on autopilot. As soon as a robo-advisor account and automatic deposits are arrange, there’s little to no interplay wanted from the investor.

- Complete companies. Robo-advisors present a variety of companies that deal with all points of economic planning. These companies embody retirement accounts, tax-strategy plans and portfolio rebalancing. The robo-advisor can handle the portfolio, make sure the investor is on observe to perform their monetary objectives and decrease any liabilities — all from one platform.

- Much less capital required. When utilizing robo-advisors, it prices far much less cash to start investing. A typical baseline for minimal property is between $3,000 and $5,000 USD. One fashionable robo-advisor, Betterment, waives the minimal sum of money required to open an account for its primary providing.

- Environment friendly. Earlier than robo-advisors, if somebody wished to execute a transaction, they might name or meet with a monetary advisor, clarify their wants after which anticipate the advisor to execute their trades. All of this may now be accomplished by urgent only a few buttons.

Limitations of robo-advisors

- Nonspecific funding choices. If an individual has particular concepts, they cannot inform their robo-advisor to purchase a selected inventory they wish to spend money on. As an alternative of giving particular info, it would, as an illustration, supply a variety of prospects or ask a possible investor whether or not they wish to take dangers or be conservative. Because of this, robo-advisors may not be perfect for individuals who wish to make their very own monetary choices.

- Inadequate for classy monetary wants. Robo-advisors are an excellent start line for individuals who have a small account and no prior funding information. Nevertheless, individuals searching for extra superior companies equivalent to property planning, tax administration, belief fund administration or retirement planning may discover robo-advisors inadequate for his or her monetary wants.

- Restricted entry to human advisors. Some robo-advisers solely present human help for technical and account-related points, leaving nobody to deal with inquiries about an individual’s investments. Others use a hybrid methodology that lets them seek the advice of with funding advisors. Nevertheless, normally, a consumer is likely to be required to keep up a minimal account steadiness or pay increased administration prices, and even then, a specialised advisor may not be accessible.

- Incomplete view of economic property. The robo-advisor can suggest and handle an account based mostly on the knowledge it has, but it surely will not have a whole view of the shopper’s varied property and investments. Whereas some techniques let customers join all of their monetary accounts, they could nonetheless not obtain the identical quantity of individualized steering as they might from a monetary advisor who understands the complexity of their monetary state of affairs.

- Lack of empathy. Robo-advisors have come beneath hearth for missing complexity and empathy given their restricted human interplay and present technical capabilities.

Laws of robo-advisors

The authorized standing of robo-advisors is identical as for human advisors. They’re required to register with the U.S. Securities and Alternate Fee and are sure by the identical guidelines and legal guidelines relating to securities as standard broker-dealers.

Most robo-advisors are additionally members of the Monetary Trade Regulatory Authority (FINRA). Anybody can use BrokerCheck, which is a free device FINRA supplies to buyers to assist them analysis robo-advisors simply as they might a human advisor.

The Federal Deposit Insurance coverage Company would not insure property managed by robo-advisors as a result of they’re investments in securities quite than financial institution deposits. Nevertheless, this does not mechanically indicate that purchasers are unprotected. For example, the Securities Investor Safety Company supplies insurance coverage for Wealthfront, a widely known robo-advisor within the U.S.

Robo-advisor companies

Robo-advisors supply the next monetary companies:

- Portfolio administration.

- Automated rebalancing of funding portfolios.

- Funding efficiency monitoring.

- Monetary planning instruments, equivalent to retirement calculators.

- Tax-loss harvesting and different tax-strategy choices on taxable accounts.

- Objective setting and monitoring.

- Customized funding suggestions.

- Socially accountable funding methods, equivalent to utilizing ideas of environmental, social and governance investing.

- Entry to human monetary advisors for added help and steering.

Most respected robo-advisors present aggressive prices, diversified portfolios, a variety of account settings and simply accessible customer support. Nevertheless, the robo-advisory market is consistently evolving and it is best to analysis and examine totally different suppliers to seek out the one which most accurately fits the investor’s wants and preferences.

Presently, suppliers of robo-advisory companies embody the next:

- Charles Schwab. Charles Schwab provides Schwab Clever Portfolios, which supplies a user-friendly platform. The service provides automated investing methods that construct, monitor and mechanically rebalance diversified portfolios based mostly on consumer objectives. Opening an account with this platform requires a minimal of $5,000.

- E-Commerce. E-Commerce supplies a variety of investing alternate options, equivalent to shares, bonds, mutual funds and exchange-traded funds (ETFs). This provides buyers the liberty to combine up their portfolios and choose property that swimsuit their particular person wants and tastes. E-Commerce additionally supplies reside buyer help.

- Constancy. Constancy provides a hybrid robo-advisor named Constancy Go, mixing digital funding companies with entry to human monetary planning and training. This strategy lets buyers get pleasure from each automated options and personalised monetary steering from actual advisors. Constancy would not cost any charges if the portfolio steadiness is beneath $25,000.

- SoFi. SoFi Make investments is right for newbie and passive buyers. It provides low charges and account minimums. This service supplies various investing choices starting from cryptocurrency to fractional shares to margin buying and selling. Whereas it is a robo-advisor, SoFi additionally provides entry to human monetary advisors at no extra price.

- Vanguard. This can be a low-cost possibility for all sorts of buyers and provides cheap ETFs and index merchandise. Vanguard supplies two robo-advisor choices: Vanguard Digital Advisor, a totally automated platform, and Private Advisor, a hybrid service that mixes automated portfolios with entry to human advisors.

- Wealthfront. Utilizing a brief questionnaire, Wealthfront creates a customized portfolio of low-cost index funds. It lets buyers customise their portfolios based mostly on particular pursuits, in addition to tax-loss harvesting, which is helpful for giant portfolios in taxed accounts. As well as, Wealthfront supplies entry to a devoted workforce of product specialists who’re registered with FINRA and have monetary designations starting from licensed monetary planner to licensed public accountant.

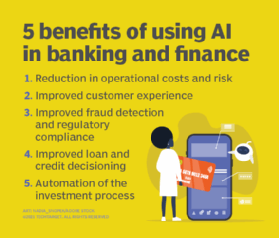

AI has been extensively included into the banking and finance industries. Find out how AI instruments are revolutionizing monetary companies and the problems to pay attention to.