Key takeaways

|

Everybody loves a payday, however how do you resolve how typically they need to occur for what you are promoting? Is it higher to pay extra regularly, making paychecks smaller in worth individually? Or is it value it to run payroll much less regularly, thereby minimizing the variety of instances it needs to be processed in a 12 months?

These are necessary questions, and ones with out common solutions. So, let’s dive into what to think about when setting payroll schedules, the varieties of payroll schedules at your disposal, which schedules match your scenario, and the way to decide on and implement one to assist what you are promoting wants.

What’s a payroll schedule?

A payroll schedule is a recurring monetary schedule for companies, on the finish of which, paychecks are calculated and issued for employees who labored for the corporate. This will occur month-to-month, weekly, or someday in between.

To be extra particular, payroll is for inner, on-staff workers (e.g., W-2 workers within the U.S.); this doesn’t sometimes embrace contractors and freelancers. These exterior contributors sometimes bill the corporate as a vendor or enterprise accomplice would, and issuing cost to them could or could not occur on a set schedule. Even when a contract cost schedule is in place, it’s often fully separate from the payroll schedule.

Prior to now, companies would write or print bodily checks for workers to money (therefore the time period “paycheck”). Today, payroll is most frequently dealt with electronically, with payroll software program or another answer issuing direct deposits on the finish of every pay interval.

Sorts of payroll schedules

There are primarily 4 varieties of payroll schedules:

- Month-to-month.

- Semimonthly.

- Biweekly.

- Weekly.

Month-to-month schedule

Month-to-month payroll occurs as soon as every month.

Payroll date

Month-to-month paychecks occur on the identical date every month, sometimes the start, the mid-point, or the month’s finish.

Complete yearly pay intervals

Month-to-month payroll runs 12 instances over the course of a calendar or fiscal 12 months. This schedule favors salaried workers, these with massive commissions and recurring bonuses, and even freelancers in some instances.

Professionals

- Fewer transactions imply fewer payroll intervals and fewer payroll calculations, presumably resulting in decrease payroll bills.

- Crew members by no means must guess when the subsequent paycheck will roll out, because it’s the identical day every month.

- Extra calculations, akin to commissions and advantages deductions, are simpler to make as a result of they don’t need to be unfold over a number of pay intervals. There are accounting advantages to month-to-month payroll, akin to monitoring labor prices by month extra simply.

Cons

- This schedule is the one most regularly prohibited by legal guidelines and laws, which frequently mandate extra frequent funds to employees.

- Nobody likes ready for his or her paycheck, and relying on when a brand new workforce member begins, month-to-month payroll could depart them ready for a month or longer for his or her first test.

- For employees who’re extra financially delicate to adjustments or errors, a minor glitch, error, or missed cost may spell catastrophe if they’ve to attend one other month for a repair.

Semimonthly schedule

Semimonthly is a quite common schedule, consisting of two funds monthly, roughly 15 days aside. This schedule advantages salaried workers, particularly when the corporate provides a big quantity of noncompensatory advantages.

Payroll date

The recurring pair of pay dates differ by group, but it surely’s often one of many following:

- 1st and fifteenth.

- fifth and twentieth.

- tenth and twenty fifth.

- fifteenth and thirtieth.

Complete yearly pay intervals

With every month damaged into two pay intervals, corporations run payroll 24 instances by 12 months’s finish.

Professionals

- Shorter pay intervals imply new hires see their first checks in as few as two weeks.

- Deductions, fee and bonus pay, and different calculations are simple to make, as any month-to-month worth is solely unfold over two pay intervals.

Cons

- Month-to-month dates don’t change, however the day of the week for payroll does, making payroll a bit arduous to foretell each for workers and finance groups.

- Not all months have the identical variety of days, and a few payroll dates fall on weekends or financial institution holidays, leading to some minor inconsistencies on paycheck quantities and pay dates, relying on firm coverage.

- Hourly workers typically have their work weeks break up throughout a number of pay intervals, particularly when payroll runs in the course of the week, complicating cost calculations akin to additional time pay.

Biweekly schedule

This payroll schedule runs each two weeks, regardless of months or different calendar divisions. It provides better advantages for groups with primarily hourly employees who could must calculate additional time frequently.

Payroll date

This payroll schedule is often run so checks will be issued and pay deposited on the finish of a pay week. Which means that most biweekly payroll runs are each different Friday.

Complete yearly pay intervals

Since this payroll schedule is damaged up into 14-day increments somewhat than much less constant month-to-month cycles, it ends in 26 pay intervals.

Professionals

- Extra time, vacation work pay, and different pay concerns that issue closely into hourly workers’ compensation are simpler to trace and calculate utilizing a biweekly methodology.

- Facilitates placing all employees on an similar pay schedule, minimizing accounting labor for various classes and pay scales of employees.

- Advantages employees with fluctuating or intermittent schedules.

- Staff obtain a “bonus” paycheck two months of every 12 months.

Cons

- Profit calculations are extra complicated, particularly for months with three pay dates.

- Having to run payroll thrice in a month generally is a tough enterprise expense to justify.

- Pay intervals that stretch into the subsequent month make calculating taxes, charges, and month-specific particulars tough.

Weekly schedule

Weekly pay schedules run each seven days. As essentially the most fast type of widespread recurring cost, this strategy is most helpful for companies and industries the place work shifts are variable, labor is seasonal, or work hours fluctuate dramatically.

Payroll date

Pay intervals for weekly schedules often begin on Saturday, Sunday, or Monday, with the week’s finish often taking place on Friday. In different phrases, after your first week at a job, with weekly payroll, each Friday is payday.

Complete yearly pay intervals

Since checks are minimize each week, there are 52 checks issued to employees from January 1st to December thirty first.

Professionals

- Shift employees, hospitality employees, part-time crews, and even freelancers all want weekly cost somewhat than having to attend a number of weeks for compensation.

- As essentially the most frequent schedule, weekly payroll minimizes the worth, and thus the expense, of every payroll run.

- Any inconsistencies, errors, or anomalies in hours, calculations, or in any other case are just one week away from the suitable adjustment with the subsequent test.

Cons

- Calculating payroll is a job unto itself, and the extra regularly it occurs, the extra labor is required over the 12 months.

- If the variety of transactions is a consider the price of utilizing digital companies to run payroll, this pay frequency maximizes that price by operating the very best quantity and frequency of funds.

- Whereas weekly paychecks make money stream extra predictable and regular for employees, it doesn’t essentially do the identical for the enterprise (i.e., if there’s ebb and stream to the enterprise’s earnings, weekly paychecks could also be tough to cowl throughout a drought).

Which pay schedule must you use?

This can be a arduous query to reply except you’re searching for details about particular industries or companies; nonetheless, there are two normal guidelines:

- The much less steady or predictable what you are promoting’s money stream, the extra it advantages from longer pay intervals.

- The much less constant the work schedule or paycheck worth, the extra helpful shorter pay intervals are on your employees.

How to decide on a payroll schedule

To decide on a payroll schedule, first contemplate what you are promoting wants, together with your money stream and HR limitations. Then, assess your workers’ wants, international and state labor legal guidelines, and any limitations related to the payroll instruments you employ. Right here’s a take a look at every of those steps and the best way to full them.

1. Take into account what you are promoting wants

When deciding a payroll schedule, contemplate the next enterprise wants, together with your organization’s money stream schedules and labor limitations.

Money stream

Some companies have extra leeway than others on the subject of protecting payroll prices. For instance, a big retailer possible has funds flowing in day by day, making it simpler to decide on a bi-weekly pay interval. Another companies, like startups, could need to work your complete month to collect sufficient inflowing money to cowl payroll prices.

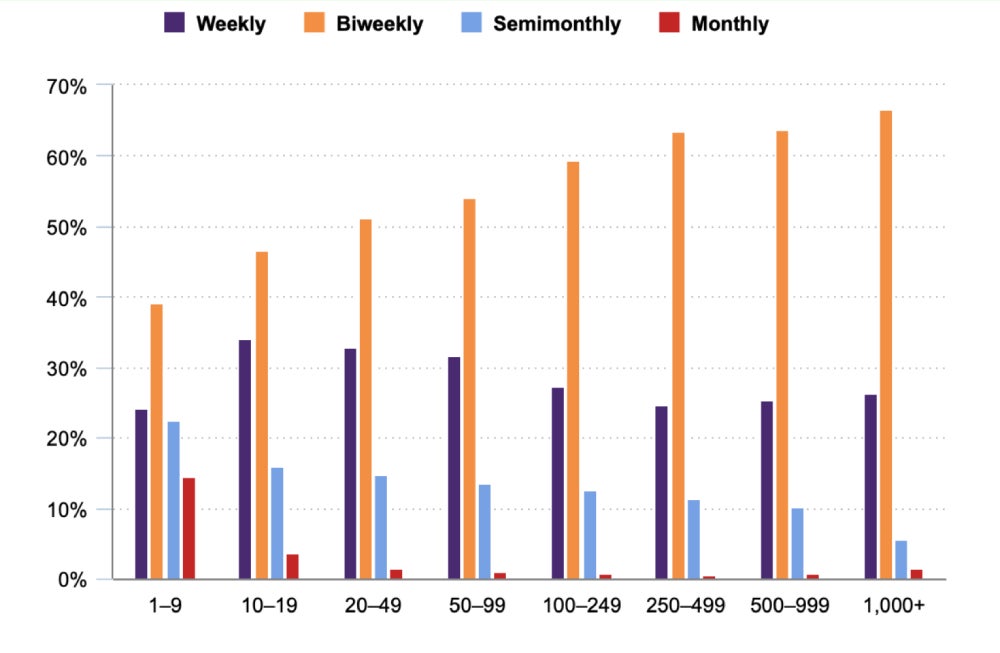

For instance this fact, contemplate these 2023 pay frequency statistics from the U.S. Bureau of Labor Statistics:

- Firms with greater than 50 workers usually tend to pay workers bi-weekly.

- Firms with greater than 20 workers are exponentially much less more likely to pay month-to-month.

HR limitations

Your HR division should juggle many tasks, akin to setting and upholding conduct insurance policies all through your group, recruiting and onboarding new hires, managing worker conflicts, and guaranteeing worker efficiency opinions are scheduled and accomplished on time. Operating payroll a number of instances a month might not be possible inside their time constraints.

Alternatively, if they’ve entry to payroll automation instruments, operating payroll a number of instances a month could not require extra labor or time invested. Or, maybe you lean on an expert employer group (PE) like ADP TotalSource to run your payroll, thereby easing your inner HR employees’s tasks, even when you implement extra frequent pay runs every month.

So, when selecting a payroll schedule, contemplate your HR employees’s present obligations, their bandwidth to satisfy these expectations, and the instruments they’ll make use of to ease their workloads.

2. Take into account your workers’ wants

Now that you understand what pay schedules are doable on your HR division, it’s time to match a type of pay schedules to your worker preferences as carefully as is possible. Contemplating your workers’ preferences when selecting a payroll schedule may also help you each retain and appeal to high expertise. When contemplating your workers’ wants, rigorously stability their preferences towards your organization’s bandwidth to run payroll.

To discover worker preferences, contemplate the varieties of workers you use. For instance, hourly workers and shift workers typically have variable paychecks every payday and smaller paychecks than their salaried counterparts; as such, they could want a weekly or bi-weekly pay schedule to make sure smaller pay gaps when dwelling paycheck to paycheck. Quite the opposite, salaried workers could want a month-to-month schedule or one which runs each 15 days to allow them to predict their pay quantities every pay interval.

One other issue to think about is market expectations. Some industries routinely supply sure pay intervals over others, and these expectations are shared by skilled business workers. For instance, corporations within the medical, development, hospitality, trucking, and customer support industries typically pay weekly.

3. Take into account state laws and legal guidelines

Every state points its personal legal guidelines relating to how typically you will need to pay workers, typically the minimal pay interval allowed. When you pays workers extra regularly than the state permits, you can not pay them much less regularly. For instance, listed below are some pay frequency legal guidelines by state:

- Alaska: Requires pay both semi-monthly or month-to-month at a minimal.

- Arizona: Requires no less than two pay intervals monthly not more than 16 days aside.

- California: Firms should pay workers no less than twice a month on the times designated as common paydays with some exceptions.

- Kansas: Requires employers pay workers no less than month-to-month.

- Texas: Requires workers be paid semi-monthly, semi-weekly, or month-to-month. Nevertheless, solely workers who’re exempt from additional time in keeping with the Truthful Labor Requirements Act (FLSA) will be paid month-to-month; all different workers should be paid extra regularly.

4. Take into account your payroll software’s scheduling limitations

Now that you understand your organization’s HR bandwidth, your workers’ preferences, and your state’s necessities, take into consideration the payroll software’s scheduling limitations.

Variety of month-to-month pay runs

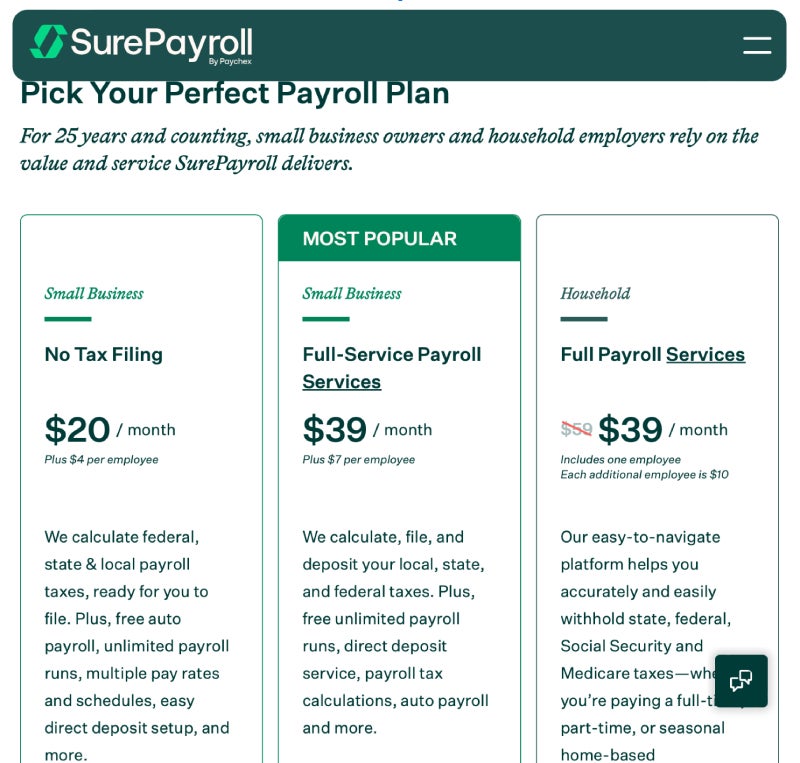

Some payroll suppliers permit for less than month-to-month funds, whereas others supply limitless payroll runs monthly. If your organization makes use of payroll software program that enables for limitless month-to-month payroll runs, you have got extra choices, permitting you to even pay workers weekly. In case your chosen payroll software can not accommodate your pay frequency wants, chances are you’ll must improve your plan or contemplate one other supplier.

Automations to scale

As well as, contemplate what instruments you have got at your disposal to run payroll effectively; this lets you higher perceive what payroll frequency your employees can deal with. For instance:

- Whereas Patriot lets you pay workers as many instances as you need in the course of the month, it doesn’t supply automated payroll options in both of its payroll plans.

- Gusto prices virtually twice as a lot as Patriot monthly however provides limitless payroll runs monthly and the choice to run payroll on autopilot.

If you happen to’re interested in Patriot and Gusto, take a look at their web sites beneath.

4 steps to implement a payroll schedule

To implement a payroll schedule, observe these steps:

- Use the data and insights out of your payroll schedule choice course of to both verify the instruments you have got will work properly or choose new ones.

- Arrange your payroll instruments to accommodate your scheduling wants.

- Set your payroll schedule.

- Talk your pay schedule insurance policies to your workers.

Right here’s an in depth take a look at the best way to full every of those steps.

1. Select your payroll software

Your first step to implementing your payroll schedule is to decide on a payroll software program or service that may accommodate your pay frequency. Additionally contemplate in case your chosen payroll software provides options that assist you to automate payroll as wanted.

In case your present payroll plan doesn’t accommodate your chosen pay frequency, one other tier or an add-on could convert it into one which does. So, test together with your supplier to find out its additional capabilities and limitations.

2. Arrange your payroll instruments

When you’ve chosen your plan, most payroll software program supply a guided setup. For instance, if you decide right into a Roll by ADP payroll plan, you will need to first obtain the Roll by ADP app from both the Apple App Retailer or the Google Play Retailer. Then, the app guides you thru setup utilizing a chat-based dialog. For instance, so as to add workers, you’ll be able to merely ship a “hire employee” message throughout the app and the system will information you on the best way to add your worker.

In case you are migrating from one payroll supplier to a different, most suppliers supply knowledge migration companies. For instance, Rippling extracts all knowledge out of your previous supplier and imports it into your Rippling software program account. Then, to make sure payroll accuracy, you’ll be able to run a comparability report between the final paycheck you processed together with your prior payroll software program and Rippling’s first payroll run.

3. Arrange your payroll schedule

On this step, arrange your payroll schedule inside your chosen payroll software. Most payroll software program assist you to fill out kinds to set your payroll schedule. For instance, in OnPay, to arrange a bi-weekly or weekly pay schedule, you will need to first click on “add new” after clicking to increase the “subsequent scheduled payroll run“ tile inside your OnPay dashboard.

From there, you’re prompted to fill out a easy kind to call your pay schedule, your pay frequency, and the dates you need your first pay interval to start and finish. Then, click on “update” and overview your pay intervals on the supplied calendar for accuracy.

4. Talk payroll schedule insurance policies to workers

It’s necessary to incorporate payroll schedule insurance policies in your hiring paperwork. If you do, word any holidays that will alter your pay schedule and supply an evidence of how you’ll deal with these alterations.

Subsequent, you’ll be able to present workers with a payroll calendar for the 12 months; many payroll software program suppliers supply them totally free. For instance, QuickBooks Payroll provides free pay schedule templates for quite a lot of pay frequencies. You’ll be able to obtain and print them, or create them in Phrase or Google Sheets for digital distribution.

As well as, many payroll software program supply workers a self-serve portal that delineates when their payday is and the quantity they are going to obtain every pay interval. Staff can entry this data 24/7, even when your HR representatives will not be within the workplace.

Payroll schedules: Ceaselessly requested questions (FAQs)

What’s the most typical payroll schedule?

Biweekly and semimonthly are the most typical pay schedules, with the previous being extra standard amongst hourly labor forces and the latter being extra regularly used amongst salaried employees.

What’s the finest payroll schedule for hourly workers?

Weekly and biweekly pay schedules are higher suited to hourly groups and crews, offering quicker funds, simpler accounting, and extra predictable bills general.

How does a payroll schedule work?

No matter the kind of compensation, the variables concerned, or the native laws, payroll for any given worker is outlined by a set begin and finish level for the timeframe. No matter calculations are concerned in figuring out their pay quantity is then utilized inside that timeframe, and the paycheck issued.

Payroll schedules are a predetermined format for setting the beginning and finish date of those pay intervals, so the enterprise, the employees, and the related governing our bodies know what to anticipate.

How do I select a payroll schedule?

To decide on a payroll schedule, first contemplate what you are promoting wants, together with your money stream schedule and your HR division’s time constraints. Then, additionally contemplate state legal guidelines round minimal pay intervals monthly, your workers’ wants and preferences, and what capabilities you have got in your payroll instruments to enact particular schedules, akin to what number of pay runs are permitted monthly and if automation instruments can be found.

How do you modify your payroll schedule in payroll software program?

Most apps have a local course of for setting and altering a payroll schedule, although steps inside every software program’s person interface differ by vendor, app, and software program model. Needless to say making a change typically requires that tax bureaus and governing our bodies be notified to keep away from opposed authorized penalties.

How do I create a payroll calendar?

The simplest approach to create a payroll calendar is to make use of payroll software program that lets you specify a payroll run cadence, akin to weekly, bi-weekly, or month-to-month, then automate the calendar creation course of. Most of those instruments additionally present an worker self-service portal that offers workers entry to this calendar and supplies reminders of upcoming pay days. One other means of making a payroll calendar is through the use of a payroll calendar template that aligns together with your pay frequency, like those supplied by QuickBooks Payroll.

What are widespread processing charges with payroll?

Labor from monetary professionals, checking account and transaction prices, and software program subscription charges are all items of this puzzle, particularly if companies need payroll to be digital, not to mention automated. In some instances, companies lower your expenses in the event that they run payroll 12 instances a 12 months versus 24 instances.