Payroll experiences serve many functions, from double-checking payroll tax calculations to really submitting your small business taxes. There are a number of sorts of payroll experiences and associated varieties to select from, which generally is a little complicated to navigate.

Learn on to be taught which payroll experiences should be filed with the USA authorities and the way typically.

What’s a payroll report?

A payroll report is a abstract doc that features data comparable to pay charges, hours labored, wages earned, profit deductions made, taxes withheld and paid day without work remaining. Payroll experiences are used to confirm tax funds and different monetary data.

Advantages of payroll experiences

Fee accuracy

Usually checking your payroll experiences will allow you to affirm that each one funds are correct and detect early warning indicators within the occasion of fraud.

Authorized and tax compliance

Constant, appropriate monitoring of wages and deductions will make it simpler to shortly file error-free taxes at quarterly and annual intervals, decreasing your danger of an audit or advantageous.

File holding

Frequent payroll experiences create a clear paper path that can allow you to shortly collect all crucial data within the occasion of a possible audit.

PTO monitoring

Payroll experiences will allow you to see how a lot paid day without work workers are taking, whether or not it’s an excessive amount of or not sufficient.

Budgeting and monetary administration

Payroll experiences are one in every of many various kinds of experiences that may help with correct budgeting and forecasting, enhancing the monetary well being of your small business over time.

Forms of payroll experiences employers have to file

Kind 941

Kind 941 is named the Employer’s Quarterly Federal Tax Return. It consists of data like wages paid to workers, federal revenue tax withheld from workers’ wages, and each worker and worker contributions to Medicare and Social Safety taxes.

Kind 944

Small companies which are allowed to file taxes yearly (versus quarterly) will file Kind 944, the Employer’s Annual Federal Tax Return, versus Kind 941. Companies which are allowed to file Kind 944 sometimes owe lower than $1,000 for federal revenue, Medicare and Social Safety taxes for the whole yr.

Kind 940

Kind 940 is named the Employer’s Federal Unemployment Tax Act (FUTA). Funds are often due yearly, on January 31 of the next calendar yr.

Kind W-2

Kind W-2 is named the Wage and Tax Assertion, and it lists complete gross wages, some tax deductions and advantages for every worker. Workers want this type to file their particular person taxes, which is why employers should present copies of Kind W-2 to workers and all relevant governments by January 31 of the next calendar yr.

Kind W-3

Kind W-3 is named the Transmittal of Wage and Tax Statements. It summarizes all of a enterprise’ wage and tax statements for the Social Safety administration. Kind W-3 should be submitted alongside Kind W-2 on January 31. Kinds W-2 and W-3 shouldn’t be confused with Kind W-4, which is a distinct doc that’s required to run payroll within the first place.

State payroll experiences

Every state has its personal legal guidelines about when payroll experiences should be filed and what varieties should be used for submitting. Seek the advice of together with your state’s legal guidelines to make sure you have probably the most up-to-date data and deadlines.

Native payroll experiences

Some cities and counties additionally cost extra revenue tax, which necessitates the submitting of extra payroll experiences and varieties. Due dates could also be annual or quarterly — seek the advice of with native legal guidelines to find out whether or not you have to file extra experiences.

Forms of different payroll experiences

Payroll abstract experiences

These experiences present high-level data comparable to gross and web wages and tax withholdings for a sure date vary. Payroll abstract experiences could be created for people, groups, departments or the whole group.

Payroll element experiences

It is a extra detailed report that reveals line-by-line contribution and compensation data, often for a single worker.

Payroll tax legal responsibility experiences

These experiences present how a lot payroll taxes employers have withheld from worker wages, how a lot they’ve paid authorities companies and the way a lot they nonetheless owe.

Retirement contributions

This report summarizes contributions made to retirement accounts by each workers and employers.

Paid day without work

These experiences present how a lot time workers have taken off for the yr to this point and the way a lot PTO they’ve remaining on their stability.

Staff’ compensation

These experiences are used to precisely calculate employees’ compensation insurance coverage premiums primarily based on the present complete payroll quantity.

Payroll service expenses

This report summarizes the prices related to the payroll service supplier, comparable to software program prices and payroll processing charges.

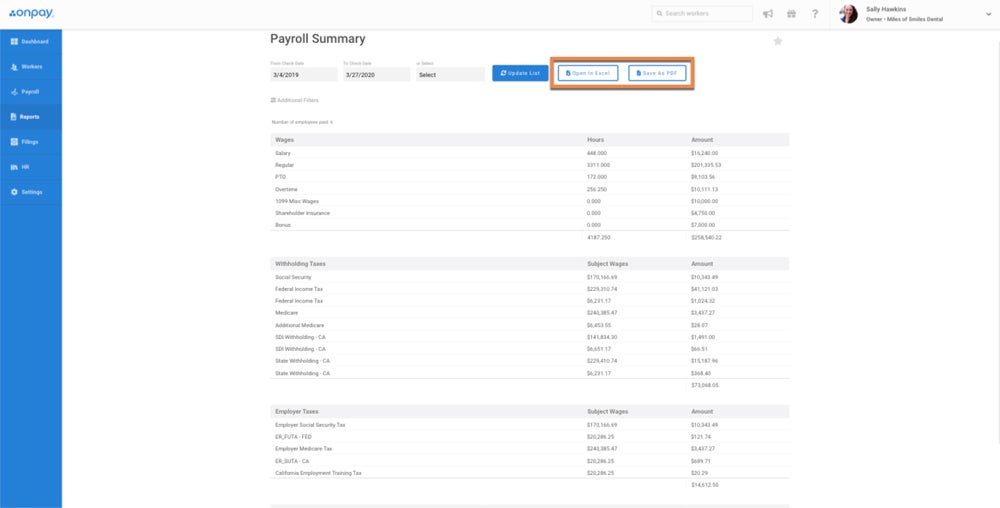

Payroll report instance

This payroll report instance from OnPay reveals high-level data for the whole small enterprise, which consists of six workers. As you possibly can see, it breaks out wage, tax and PTO data every by itself line in order that the enterprise proprietor can clearly see how a lot has been paid and what’s nonetheless owed.

Tips on how to run a payroll report

Most payroll software program platforms make it extraordinarily straightforward to generate payroll experiences. Whereas every has its personal distinctive interface, most do observe the identical fundamental steps to generate a payroll report:

- Log in to the payroll software program.

- Navigate to the experiences menu.

- Choose the payroll or tax report that you simply want.

- Make changes to the yr, payroll schedule or workers as crucial.

- Generate the report, then export, share or print it to your data.

Continuously requested payroll report questions

How do I make a payroll report?

To create a payroll report, navigate to the report part of your payroll software program. Choose the payroll report, set parameters for the dates and workers, then generate the payroll report and share it as wanted.

What’s a month-to-month payroll report?

A month-to-month payroll report sometimes shows wages paid to workers, federal revenue tax withheld from workers’ wages, and each worker and worker contributions to Medicare and Social Safety taxes for the interval of 1 calendar month. It could additionally embody extra data, comparable to PTO balances.

What payroll experiences are due quarterly?

Kind 941, the Employer’s Quarterly Federal Tax Return, is the one federal return that should be filed quarterly. Verify with state and native governments to see if there are extra experiences that you must file quarterly.

What payroll experiences are due yearly?

The next payroll experiences are due yearly:

- Kind 944, Employer’s Annual Federal Tax Return.

- Kind 940, Employer’s Annual Federal Unemployment Tax Act.

- Kind W-2, Wage and Tax Assertion.

- Kind W-3, Transmittal of Wage and Tax Statements.

- Kind 1099-NEC, Nonemployee Compensation.

For extra data, try our information that explains when payroll taxes are due.

What are payroll experiences for the self-employed?

As a self-employed particular person, you’ll seemingly obtain Kind 1099-NEC out of your purchasers versus a Kind W-2. You’ll use the knowledge to file an annual tax return. Additionally, you will seemingly be required to file quarterly estimated tax funds all year long.