TurboTax’s quick informationBeginning value: $89 |

TurboTax is the most well-liked tax submitting software program in america. Nonetheless, many individuals have been left questioning if TurboTax remains to be the only option to file their taxes after the Federal Commerce Fee stated that TurboTax engaged in misleading promoting, selling “free” tax providers to customers that have been ineligible for them.

On this information, we examine TurboTax’s pricing plans and break down its professionals and cons that can assist you resolve if TurboTax is the precise tax submitting software program in your wants.

TurboTax’s pricing

TurboTax On-line provides 5 pricing plans, three for people and two for enterprise taxes.

TurboTax

This plan prices between $0 and $129 to file, relying on whether or not or not you qualify for a free federal return. State returns value $64 every if you happen to don’t qualify for the free model. This plan allows you to add tax paperwork by snapping images and in addition consists of AI-Powered Intuit Help. Even the free plan comes with TurboTax’s most refund and 100% accuracy ensures. All of TurboTax’s particular person pricing plans additionally include assist, together with this free fundamental plan.

Reside Assisted

This plan prices between $89 and $219 to file federal returns, with $59 or $69 for every state return. It consists of on-demand assist from tax specialists with a median of 12 years’ expertise and a ultimate skilled assessment earlier than you file. You’ll additionally get year-round assist from tax specialists with this plan, in case you could have questions exterior of tax season.

Reside Full Service

This plan begins at $129 to file federal returns, with $69 for every state return. With this plan, a neighborhood tax skilled can be matched to your scenario and can put together, signal and file your return in your behalf. This plan consists of each W-2 and 1040 kinds.

Reside Assisted Enterprise

This enterprise tax software program plan begins at $489 to file a federal return for your small business, with $64 for every state return. It consists of on-demand assist from tax specialists in addition to audit protection. This plan is particularly designed for companies that should file their taxes as an S-corp, Partnership (GP, LP, LLP) or Multi-member LLC.

Nonetheless, it’s solely obtainable in a restricted variety of states: Alaska, Arizona, California, Colorado, Florida, Georgia, Illinois, Missouri, Minnesota, North Carolina, Nevada, New York, Ohio, Pennsylvania, Rhode Island, South Dakota, Texas, Utah, Virginia, Washington and Wyoming.

Reside Full Service Enterprise

This plan begins at $1,169 to file a federal return for your small business, with $64 for every state return. With this plan, a enterprise tax skilled can be matched to your scenario and can put together, signal and file your return in your behalf. Audit protection can be included on this plan, which is offered in all 50 states.

TurboTax’s key options

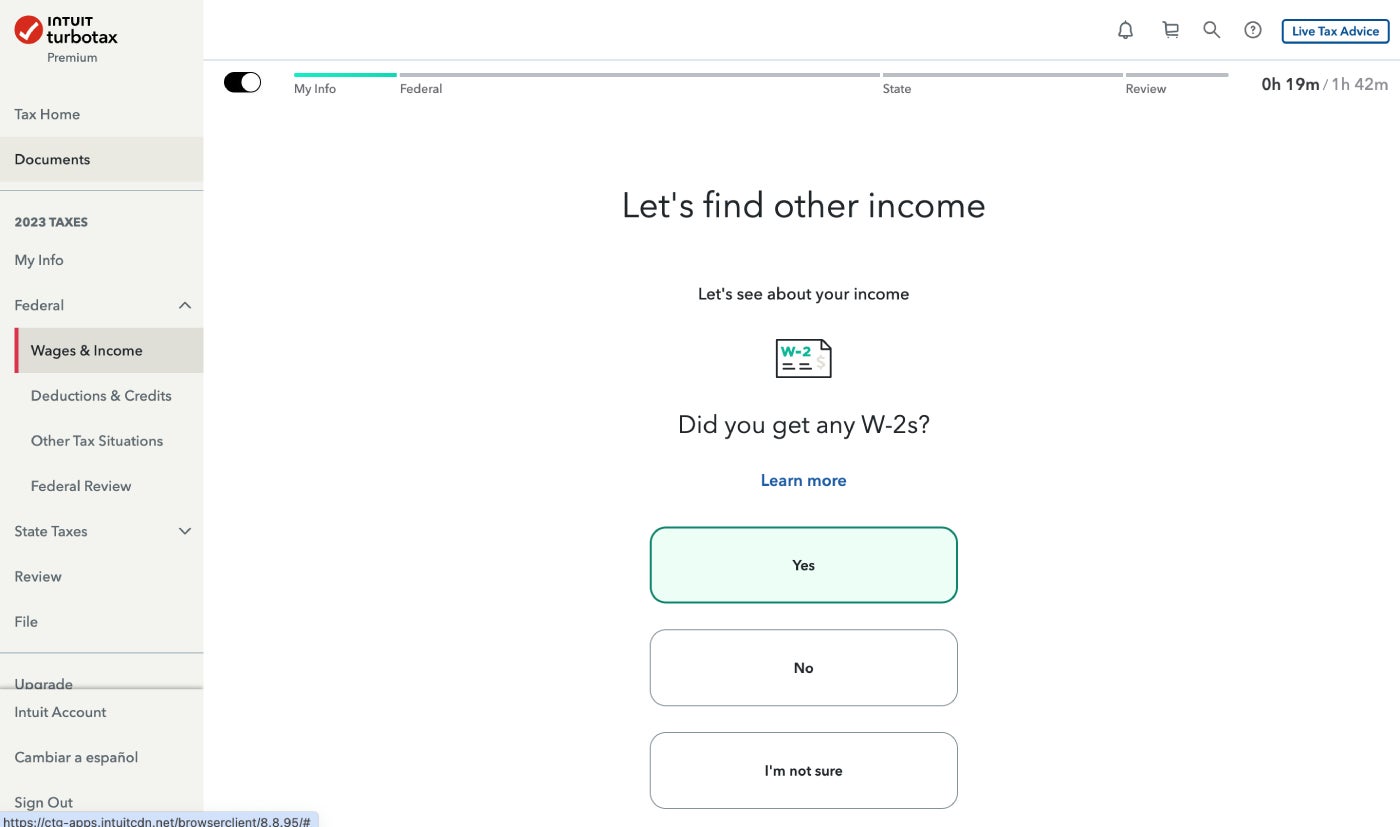

DIY tax submitting interface

TurboTax’s software program interface is nicely designed and intuitive to navigate, even if you happen to’ve by no means used TurboTax or one other tax submitting software program earlier than. The software program will stroll you thru the complete course of step-by-step and even offer you an estimate for a way a lot time it would take so that you can file your taxes by yourself. Solely a restricted quantity of knowledge and prompts are displayed on every display, so that you received’t get overwhelmed as you’re employed by means of every step.

First, you’ll put in your private info, similar to your full title and Social Safety quantity, then you definitely’ll fill out your federal tax return utilizing info out of your W-2 or 1099 kinds. After you’re completed with the federal return, you’ll be prompted to create a state return, if relevant. Lastly, you’ll assessment your federal and state returns after which submit them for submitting.

Reside Assisted

For those who choose to file your private taxes with Reside Assisted, you’ll undergo the DIY tax software program and fill out your return by yourself, however you’ll additionally get entry to a workforce of on-demand tax specialists, by way of cellphone, chat and dwell on display. This may be accessed by clicking on the “Live Assist” button within the higher right-hand nook of the interface.

While you entry Reside Assisted assist, you’ll enter some details about your query, then TurboTax will join you with somebody who ought to perceive your particular tax scenario. Nonetheless, in the event that they aren’t in a position that can assist you, then you’ll be able to ask to be transferred to a brand new skilled.

You may share your TurboTax display with the tax skilled, however you can not share some other tax paperwork with them, which could be fairly limiting, relying on the complexity of your scenario. Your private info, similar to your Social Safety quantity, can even be obscured so the tax skilled can’t see it once you share your in-progress return with them.

Tax specialists can be found seven days every week from 5 a.m. to 9 p.m. PT from the January date the IRS begins accepting tax returns by means of the April submitting deadline. From mid-April by means of early January, they’re obtainable Monday by means of Friday from 5 a.m. to five p.m. PT.

Reside Full Service

With TurboTax’s Reside Full Service plans, you’ll be matched with a devoted tax skilled, who will do both your small business or private taxes begin to end and assessment them with you earlier than submitting. After you’re matched together with your tax skilled, they may share the hours they’re obtainable. You may as well attain the opposite full-service specialists on the identical customer support hours we outlined above within the earlier part if you happen to need assistance when your assigned skilled is unavailable. In case your identical tax skilled is offered, you’ll be able to work with them year-round if you want.

Observe that this service is totally digital, as TurboTax doesn’t have bodily workplace areas like its most important competitor H&R Block. Nonetheless, you could probably have the choice to decide on an unbiased TurboTax Verified Professional, that are unbiased tax professionals who’re vetted by TurboTax and supply the power to satisfy in particular person.

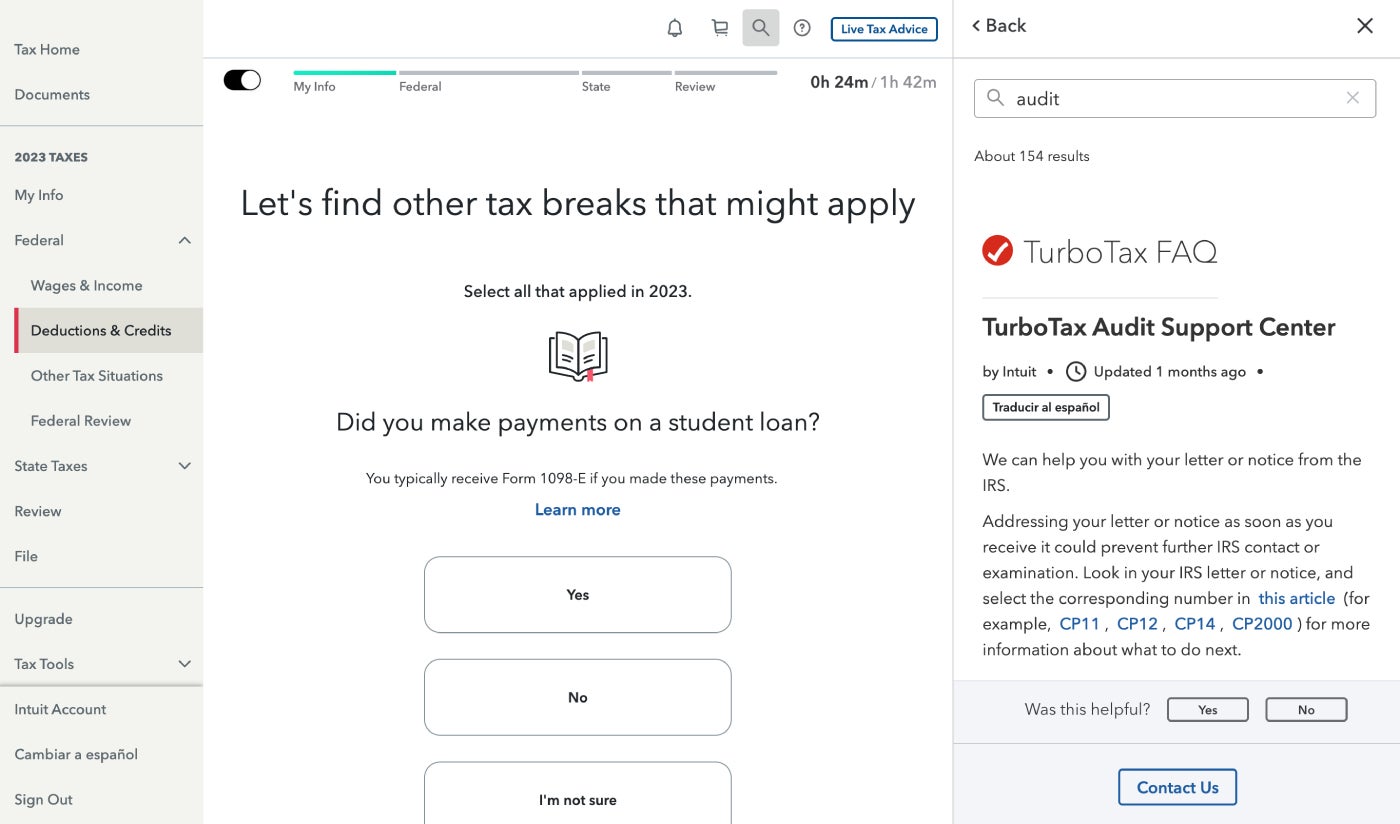

Audit assist and protection

All three of TurboTax’s private tax plans include an audit assist assure. With audit assist, you get free one-on-one steerage within the occasion of an audit. They are going to educate you about what to anticipate, and how you can put together for an audit, however they received’t truly characterize you in entrance of the IRS. Audit protection is included in each of the enterprise plans, and it can be added on to the private plans for a further price. With audit protection, you get full audit illustration by a licensed tax skilled, together with illustration in entrance of the IRS.

TurboTax professionals

- Intuitive design that’s straightforward to make use of.

- A number of pricing plans and ranges of assist to select from.

- On-demand tax recommendation choices.

- Step-by-step questionnaire is straightforward to fill out.

TurboTax cons

- Costlier than different opponents.

- No in-person possibility obtainable.

- Reside Assisted assist could also be restricted.

Options to TurboTax

| Software program | TurboTax | H&R Block | FreeTaxUSA | TaxAct |

|---|---|---|---|---|

| Free federal returns | For easy returns solely | For easy returns solely | All federal returns | Restricted to sure states and revenue ranges |

| Free state returns | Restricted | Restricted | No | No |

| In-person assist possibility | No | Sure | No | No |

| Beginning value (for federal return) | $89 | $55 | $0 | $49.99 |

| Beginning value (for state return) | $59 | $49 | $14.99 | $39.99 |

H&R Block

H&R Block is the closest competitor to TurboTax, providing most of the identical options. Its pricing plans are extra inexpensive than TurboTax, although. Its free plan additionally has barely expanded capabilities, which implies extra individuals could possibly file free of charge utilizing H&R Block as a substitute of TurboTax. H&R Block additionally has bodily workplaces all through america, so you’ll be able to meet with a tax skilled in particular person if you happen to choose that to digital.

FreeTaxUSA

If TurboTax’s pricing is just too steep for you, then FreeTaxUSA is without doubt one of the most inexpensive TurboTax alternate options. Its title is a bit deceptive as a result of it isn’t 100% free: FreeTaxUSA fees $0 for a federal return however $14.99 for every state return. It additionally provides a number of paid add-ons, similar to deluxe or professional assist and audit protection, however these are all non-obligatory.

Top-of-the-line issues about FreeTaxUSA is that it doesn’t set an revenue restrict for a free federal return, which TurboTax does — that means everybody will get to file a free federal tax return with FreeTaxUSA, no matter how a lot cash they made the earlier 12 months.

TaxAct

TaxAct is one other different to TurboTax that gives many on-line and offline software program choices to select from. Along with totally different plans for private tax returns, it additionally provides bundle pricing for different enterprise constructions, similar to partnerships and S firms, which can be interesting to small-business house owners. Reside tax recommendation could be added to any pricing plan, together with the free plan, for $39.99. TaxAct additionally ensures an even bigger refund than some other tax software program at the moment in the marketplace.

Evaluation methodology

To assessment TurboTax, we signed up for the free model of its tax software program. We additionally consulted consumer critiques and product documentation throughout the writing of this assessment. We weighed elements similar to pricing, skilled recommendation, dwell help and consumer interface design when evaluating TurboTax.

FAQ

Is TurboTax truly good?

TurboTax on-line could be very nicely designed and simple to make use of, and the interface is intuitive to navigate. The questionnaire-based, step-by-step information additionally simplifies the DIY tax submitting course of.

Is it higher to purchase TurboTax or use it on-line?

The desktop model of TurboTax is usually cheaper than TurboTax on-line. Nonetheless, not each laptop and working system helps TurboTax desktop. The desktop model can be up to date much less usually than the net model, so it could really feel extra clunky and fewer intuitive.

Is TurboTax value it?

Whereas TurboTax is without doubt one of the dearer tax software program obtainable, it’s additionally extraordinarily intuitive and simple to make use of and comes with a number of assist choices. Because of this, many taxpayers nonetheless discover that TurboTax is well worth the price ticket — however there are many extra inexpensive TurboTax opponents if you wish to discover different choices.

What’s the drawback with TurboTax?

The Federal Commerce Fee issued an opinion that TurboTax beforehand engaged in misleading promoting, selling “free” tax providers to customers that have been ineligible for it. TurboTax made it appear as if all or most customers have been eligible to file free federal and state returns, when surely solely a small minority of individuals qualify for the free model.

Which is best, TurboTax or H&R Block?

H&R Block is TurboTax’s closest competitor, however it provides a number of benefits over TurboTax, together with cheaper pricing plans and the choice to get in-person help at an H&R Block workplace.