Working your first payroll is thrilling, but it surely will also be overwhelming and even just a little intimidating. How have you learnt when you’re doing every part appropriately? What when you don’t have all the data you want?

That can assist you out, we’ve put collectively the last word step-by-step guidelines to your first payroll run, together with a listing of all of the important paperwork that you simply’ll want.

First payroll run step-by-step guidelines

Step 1: Collect all of your paperwork

You’ll need a number of paperwork to run your first payroll, together with an Employer Identification Quantity (EIN) and types W-4 or W-9 for workers. We’ve put collectively a grasp guidelines of all of the paperwork you’ll want within the subsequent part, so discuss with that as you put together to run your first payroll.

Step 2: Open a payroll checking account

To run payroll, you will have a enterprise checking account, not a private one. Most corporations use a devoted checking account for payroll solely so that cash doesn’t get blended in with different funds. When you don’t presently have a enterprise checking account put aside for payroll, think about setting one up.

Step 3: Choose a pay interval

Subsequent, you’ll must determine how usually you will pay workers. Many companies observe a biweekly fee schedule, whereas others choose twice a month and even as soon as a month. Take a look at our information to pay intervals when you need assistance figuring out a payroll schedule to your firm. You’ll want to adjust to all related authorities rules when deciding on a pay interval.

Step 4: Arrange your payroll software program

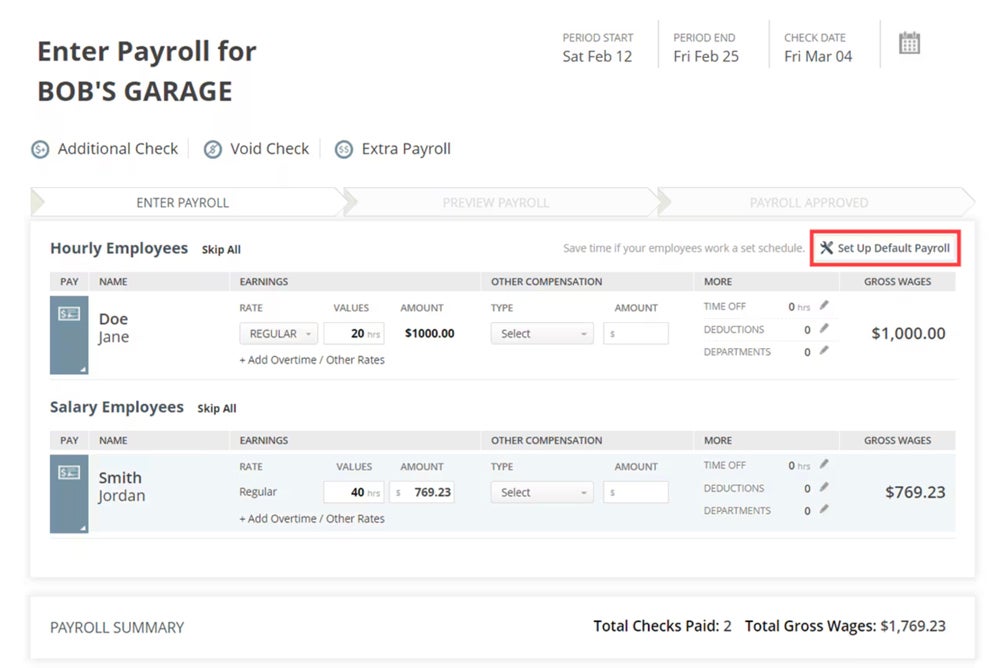

When you’re utilizing payroll software program (versus working payroll manually), you’ll must arrange your payroll software program earlier than working payroll for the primary time. A user-friendly payroll software program corresponding to SurePayroll will stroll you thru the setup course of to make sure you have every part you must run your first payroll efficiently.

Haven’t selected a payroll software program platform but? See our prime picks for the finest payroll software program of 2024.

Step 5: Get employee’s compensation insurance coverage

Out of all 50 states, 49 of them mandate that companies should have employee’s compensation insurance coverage to function and pay workers (Texas is the one exception). Some states require it, even when you will pay a single worker. Evaluation your state’s necessities and get compliant employee’s compensation insurance coverage so that you’ll be able to run your first payroll.

Step 6: Calculate gross pay

Now it’s time to really begin determining how a lot to pay workers. To begin, you must calculate gross pay for every worker (a.ok.a., wages earlier than taxes, advantages and different deductions are taken out).

For hourly workers, you’ll must overview their timecards for accuracy and calculate any essential extra time and paid day without work. For salaried workers, you don’t have to fret about extra time, however you will have to calculate any paid day without work.

You’ll additionally must account for any further pay, corresponding to commissions, bonuses and retroactive pay, for all workers. Payroll software program like SurePayroll will robotically do these calculations for you, dashing up the method and rising accuracy.

Step 7: Calculate internet pay

Subsequent, you must calculate all deductions and subtract them from the gross pay to get every worker’s internet pay. First, calculate pre-tax or tax-exempt changes, which embrace profit premiums, retirement fund contributions, HSA contributions and expense reimbursements.

Then calculate taxes and withhold federal revenue tax, Medicare tax, Social Safety tax, state revenue tax, native taxes and wage garnishments. Lastly, account for after-tax withholdings, corresponding to Roth IRA contributions. Once more, utilizing payroll software program will automate these calculations in your behalf.

Step 8: Evaluation the maths

Whether or not you calculate payroll manually or use payroll software program, you must overview the maths earlier than processing payroll to make sure all calculations are right. This can enable you to keep away from pricey errors, disgruntled workers and even authorities penalties for incorrect taxes.

Step 9: Distribute funds and pay stubs

When you’ve double-checked every part, it’s time to really pay your workers. Most workers might be paid by way of direct deposits, however you can too pay them by means of bodily paper checks or pay playing cards. You must also generate a pay stub for every worker and ship it to them so that you each have a file of the payroll run.

Paperwork wanted to run your first payroll

Beneath, we’ve put collectively a guidelines of all of the paperwork you will have to run your first payroll. For a extra in-depth clarification of those paperwork, see our devoted information that explains the paperwork you’ll want for payroll in additional element.

Firm tax data

- Employer Identification Quantity: That is utilized by the U.S. federal authorities to trace your tax deposits. You may get an EIN without spending a dime in a couple of minutes by means of the IRS web site. See our information that explains what an EIN is for extra data.

- State Company ID Quantity: That is much like an EIN and is used to trace your tax deposits to the state authorities.

- State unemployment insurance coverage contribution charge: All 50 states and D.C. have an unemployment tax that’s levied on corporations, however each fees a special charge and constructions their UI program in another way.

- Payroll tax deposit schedule: Principally federal and state taxes are due quarterly, but it surely’s all the time a good suggestion to double-check the dates.

Worker paperwork

- Private data: You’ll want every worker’s full authorized title, date of start and present tackle as a way to pay them.

- Employment begin or termination date: Since that is your first payroll run, you’ll in all probability be utilizing the worker’s begin date.

- Tax submitting quantity: This might be both the worker’s Social Safety quantity or their Taxpayer Identification Quantity (TIN), which has similarities to an EIN for people.

- Pay charge and compensation particulars: This consists of not simply the hourly charge or salaried wages however all essential compensation data, corresponding to fee charges and bonuses.

- Withholding data: This specifies how a lot cash must be withheld from every paycheck to cowl the worker’s contributions to advantages and taxes.

- Kind I-9: This way verifies every worker’s eligibility for employment within the U.S.

- Kind W-4: This way summarizes all of this data for every worker.

- Kind W-9: This way summarizes all of this data for every unbiased contractor.

Firm data

- Firm checking account: You’ll need an organization checking account to pay workers and taxes.

- Firm contributions: As an employer, you could contribute to sure advantages, corresponding to medical health insurance.

Regularly requested questions

When establishing payroll, what must you do first?

When establishing payroll for the primary time in america, you must acquire an Employer Identification Quantity (EIN) and collect different essential paperwork. Within the U.S., you can’t run payroll except you could have an EIN, so that you want it to maneuver ahead.

Why is a payroll guidelines vital?

A payroll guidelines is crucial in order that your calculations are as correct as doable. When you don’t have a payroll guidelines, then you definitely would possibly neglect to incorporate extra time, miscalculate deductions or neglect to withhold taxes — all of that are pricey errors to repair.

How lengthy does payroll take to be processed?

From begin to end, it may well take as much as every week for payroll to be processed. Relying on how massive your organization is, it might take a number of days to really run payroll and get all the required approvals. As soon as payroll is finalized and submitted, it usually takes one to 4 days for direct deposits to really be made to workers’ financial institution accounts.