Retail tech has come a great distance for the reason that invention of money registers. One point-of-sale system can now handle stock, observe gross sales, and settle for funds — all on the go together with one POS terminal. Inexpensive cell terminals additionally enable companies to adapt to the always evolving in-person cost strategies similar to purchase now, pay later (BNPL) and QR codes.

To convey you insights into this fashionable cost expertise, I leveraged my seven years of expertise reviewing POS methods and cost methods, my diploma in monetary administration, and certificates funds expertise.

What’s a POS Terminal?

A degree-of-sale, or POS terminal, is a compact enterprise {hardware} that comes with built-in POS software program and a card reader to simply accept money, card, and different types of non-cash transactions like present playing cards. Terminals additionally usually have, or are linked to, cloud-based POS software program to replace enterprise info similar to stock ranges and gross sales in real-time.

Historical past of Money Registers and POS Techniques

Earlier than the POS terminal, there was the money register. Invented by James Ritty, a saloon proprietor from Ohio, in 1879, the money register was designed to precisely document transactions to assist customers with their bookkeeping.

The Nationwide Money Register (NCR) ultimately bought the invention in 1884. Throughout this time, electrical motors, money drawers, and paper rolls for receipts have been added to the money register.

Do you know? Tech monopolies will not be only a Twenty first-century downside. In 1921, the U.S. Authorities filed fits in opposition to NCR beneath the Sherman Antitrust Act. On the time, NCR managed 95% of the money register market.

IBM launched the primary restaurant computer-based POS system in 1973, which got here with an digital money register (ECR) and a client-server on the again finish. Nevertheless it wasn’t till 1979 that Visa and Mastercard launched the magstripe expertise for accepting bank card funds on the level of sale.

When the web grew to become obtainable, Europay, Visa, and Mastercard additionally developed EMV chips on bank cards in 1993, considerably bettering bank card processing. Quickly after, pioneers like PayPal, Verifone, and Ingenico developed cell card readers, permitting companies to simply accept funds anyplace.

Finally, PayPal transitioned away from its fundamental cell card readers and, together with different rivals like Sq., launched POS terminals that provide higher safety and extra superior cost capabilities. As POS expertise superior, main cost processors launched what at the moment are known as “Smart Terminals” that mixed superior POS options.

How can POS terminals enhance enterprise operations?

The appearance of the web enabled POS methods and terminals to evolve right into a extra environment friendly enterprise answer. These days, terminals provide faster and safer cost processing, buyer engagement instruments, higher stock management, and extra cost channels.

Learn extra: Finest POS methods for small enterprise

How do POS terminals work?

The position of the POS terminal within the POS ecosystem is to compute the entire price of the transaction, settle for cost, and hold a document of the transaction.

Throughout checkout

At checkout, prospects convey merchandise to the POS terminal for buy. The vendor scans the product barcode with a barcode scanner, which generates a corresponding SKU quantity throughout the POS system’s stock catalog. The product info, together with the listing worth, is then displayed, and the consumer enters the amount to get the entire price.

When gathering cost

As soon as the entire worth is displayed, the client presents their most popular cost methodology.

- If money or different non-card funds: The vendor enters the tender quantity to immediate the money drawer.

- If card: the vendor will both swipe, insert, or faucet the cardboard within the space the place the cardboard reader is positioned within the POS terminal.

- If cell and different digital cost: the client will current proof of cost on their cell system for the consumer to document the affirmation code

Within the again finish, a cost authorization request is initiated at this level. The transaction and cost information is encrypted and transmitted by the service provider’s cost processor, then despatched to the related monetary establishments for verification. If the client’s financial institution confirms that funds can be found, the transaction might be licensed, and cost approval might be displayed on the POS terminal. In any other case, a declined cost discover might be displayed, and the client might be requested to supply a unique cost supply.

Logging the transaction

Lastly, a receipt for the finished transaction might be generated and supplied to the client. A duplicate of the receipt is stored by the consumer. For card transactions, a transaction receipt is generated in triplicate, and one is given to the client. On the again finish, the POS system additionally data the sale and adjusts the obtainable stock in real-time.

Learn extra: POS deployment guidelines

What are the important thing options to search for in a POS terminal?

The POS terminal is a mix of software program and {hardware} parts.

{Hardware} setup

{Hardware} is a vital characteristic of a POS terminal. For it to finish its process, the POS terminal ought to have, at minimal:

- A pc-operated system that runs the POS software program.

- A card reader for accepting card funds (swipe, faucet, or dip).

- A thermal printer to generate receipts, or different technique of delivering receipts.

You might also wish to contemplate:

- A barcode scanner to scan barcodes that pulls up product info.

- A money drawer (for countertop terminals) for storing money and different non-card funds in the event you plan to simply accept money.

Cost gateway

The cost gateway is a software program part embedded within the POS system. That is the checkout window on the system show the place the consumer enters the client’s cost info. The cost gateway will show the obtainable cost strategies relying in your cost processing settings. Additionally it is the cost gateway’s position to encrypt the transaction information earlier than sending it to the cost processor for authentication.

Cost processor

The cost processor connects to the cardboard community and different monetary establishments that authorize the switch of funds from the client’s supply to the service provider. Cost processors are built-in into the POS terminal and provide instruments for processing playing cards, ACH, digital checks, contactless funds, and extra.

Stock administration

Stock administration is a main characteristic of a POS system and key to an environment friendly POS terminal. The system instantly updates stock ranges with each transaction accomplished, returned, or refunded from the POS terminal. Fixed stock monitoring helps stop stockouts.

Transaction reporting

One of many main capabilities of a easy money register is to maintain gross sales data. With a contemporary POS system, each transaction accomplished in a POS terminal not solely data the sale but additionally generates buyer profiles and updates obtainable stock. It might categorize transactions in a number of methods, similar to by worker, checkout counter, buyer, product, and extra.

Loyalty and rewards

Whereas not a key part, a loyalty and rewards program built-in into the POS system can considerably enhance buyer relationships. With this characteristic, a service provider can additional analyze buyer buying habits and create tailor-made campaigns that prospects will wish to take part in. This helps companies to construct a stable buyer base and hold them engaged.

High POS terminals in 2024

With all of the POS methods and terminals in the marketplace as we speak, selecting the best choice for your enterprise will be difficult. Beneath, I offer you our high POS terminal suggestions for fashionable enterprise sorts:

Sq. Terminal

The Sq. Terminal is Sq.’s all-in-one cell POS terminal. It comes with built-in POS software program that may work as a stand-alone or as a second display to the Sq. Register and a built-in card reader for swipe, EMV chip, and NFC contactless transactions. What’s nice about Sq. is that it provides industry-specific POS software program that may be put in into the Sq. Terminal at no further price. Although not optimized for lengthy hours of handheld cost processing, the Sq. Terminal is compact sufficient for accepting funds table-side and for straightforward setup in farmers markets and popup shops.

Specs:

- Worth: $299 or $27/mo for 12 months

- Guarantee: One-year restricted guarantee, 30-day free return

- Funds accepted: Chip playing cards (EMV), NFC playing cards, Apple Pay, Google Pay, Samsung Pay, Afterpay, Money App Pay (QR code), Magnetic-stripe playing cards with free magstripe reader plug-in

- Offline cost obtainable

- Connectivity: Wifi, Ethernet

- Within the field:

- Sq. Terminal {hardware}

- Energy adapter

- Energy adapter cable

- Receipt paper roll

- Equipment:

- Hub for Sq. Terminal

- Extra paper rolls

- {Hardware}: White, fabricated from metallic and molded plastic, weighs 417g, 5.6in L x 3.4in W x 2.5in H

- After-sale assist: 24/7

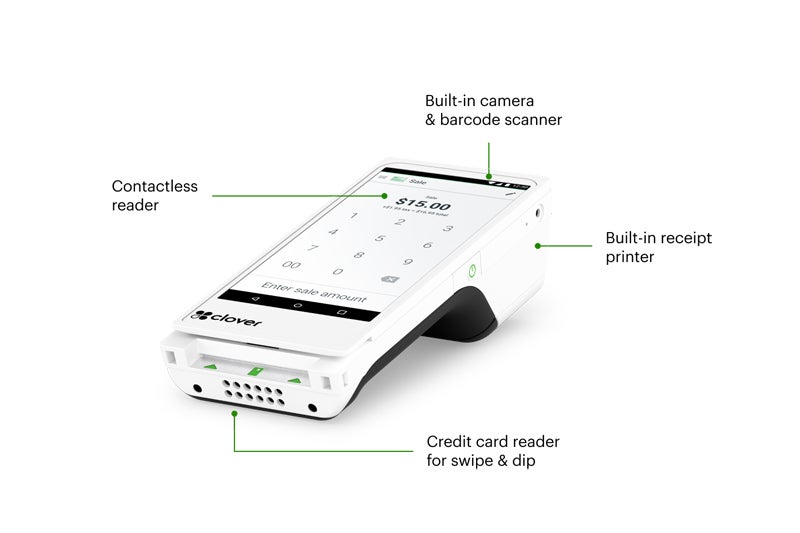

Clover Flex

The Clover Flex is a smooth and transportable POS terminal designed for handheld transactions. It’s geared up with a 6-inch shade touchscreen and built-in digicam, receipt, and barcode scanner. The Clover Flex additionally has an embedded magnetic stripe, EMV chip, and NFC contactless reader to course of funds. Retailers should buy this with or with out POS software program, however you’ll want the software program in the event you intend to make use of the Flex as an extension of a countertop POS system. The Clover system is exclusive as a result of it’s suitable with plenty of cost processors.

Specs:

- Worth: $599 or $35/month

- Guarantee: One-year restricted guarantee

- Funds: Accepts chip, swipe, and contactless funds like Apple Pay®, Google Pay™, and Samsung Pay®

- Show: 6″ LCD shade contact display

- Digital camera/Scanner: 1D/2D barcode scanner/digicam

- Receipt printer: Constructed-in thermal dot receipt printer

- Safety: Clover Safety end-to-end encryption

- Connectivity: Wi-Fi and LTE connectivity

- Battery life: 8 hours for traditional SMB

- After-sale assist: 24/7

- Buy choices:

- Flex Pocket (with out built-in receipt printer)

- Clover POS software program (retail or restaurant) at $14.95 or $49.95 monthly

- Within the field:

- Clover Flex {hardware}

- Charging cradle

- Energy wire

- Energy brick (battery)

- Elective PIN entry assist

- One roll of receipt paper

- Fast begin information

Toast Go2 handheld POS

Toast’s handheld system is a stand-alone POS and cost terminal with built-in POS software program, a card reader, and receipt printer. The {hardware} is industry-grade, with IP54 safety in opposition to mud and water harm, and constructed to face up to drops as much as 4 ft. Ideally suited for busy sit-down eating places, the Toast Go2 comes with desk seating and reservation administration instruments, plus customized tipping, invoice splitting, and signature seize options.

Specs:

- Worth: Startup package $0 or $494.10 + $50/mo

- Guarantee: One-year restricted guarantee

- Funds: Accepts NFC, EMV, and conventional MSR bank cards, Apple Pay, Google Pay, and different contactless funds

- Sturdiness: Restaurant-grade. Dropproof as much as 4 ft, IP54 rated for mud and water resistance

- Show: 6.4-inch touchscreen

- Dimensions: 7.87” L x 0.79” W x 3.74″ H

- Product Weight: 1.13 lbs

- Battery life: As much as 24 hours

PayPal Terminal

The PayPal Terminal is a stand-alone POS {hardware} designed equally to Sq. Terminal. Nevertheless, {hardware} instruments like barcode scanners, thermal printers, and charging docks are non-compulsory. The PayPal Terminal comes with a built-in card reader able to faucet, EMV chip, and contactless funds and PayPal’s POS software program. The starter package additionally features a preloaded SIM card for continued web entry and uninterrupted cost processing. The PayPal Terminal is right for promoting in farmers’ markets, commerce reveals, and popup shops that cater to vacationers who pay with worldwide bank cards.

Specs:

- Worth:

- Primary PayPal Terminal: $199

- With barcode scanner: $239

- Equipment:

- Printer and magnetic charging dock: Plus $70 (with fundamental Terminal) or Plus $60 (with Terminal and barcode scanner)

- Guarantee: One-year restricted guarantee, 30-day return

- Funds: Chip, faucet, PIN, and NFC funds

- Battery life:

- Standby – As much as 48 hours

- Operational – As much as 12 hours

- With Zettle Printer & Dock – fixed

- Dimensions: 5.4in L x 3in W x 0.6 in H

- Weight: 210 grams

- Connectivity: WiFi, 3G/4G

- Darkish grey, fabricated from metallic and molded plastic

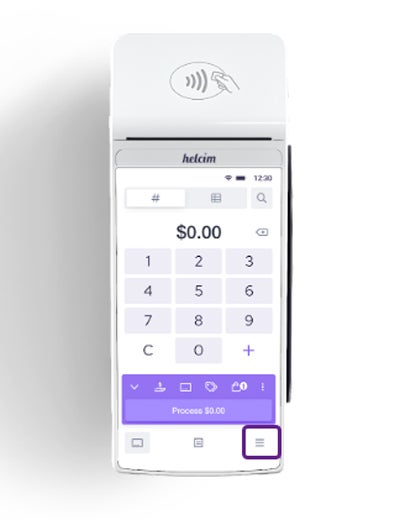

Helcim Good Terminal

The Helcim Good Terminal comes with stand-alone POS software program, a coloured contact display show, and a built-in receipt printer. It connects to the web through WiFi and accepts card and digital pockets funds through faucet, chip, and PIN. It might additionally settle for funds for Helcim invoices through handbook card entry. The system lacks a digicam or barcode scanner, so it’s higher fitted to skilled providers and eating places than retail. However what makes Helcim Good Terminal stand out is its pre-approved and built-in surcharging characteristic, which you’ll toggle on and off for each transaction.

Specs:

- Worth: $329 or $30 for 12 months

- Equipment: Charging dock $50

- Funds: Accepts chip, faucet, PIN, and contactless funds like Apple Pay®, Google Pay™

- Guarantee: One-year restricted guarantee, 14-day return

- Connectivity: WiFi

- Dimensions: 7.87in L x 3.07in W x 2.20in H

- Weight: 1.1 lbs

- Within the field:

- Helcim Good Terminal

- Charging Cable (USB-C to USB-A)

- Extra USB-C Cable

- Receipt paper rolls x2

How do you select the proper POS terminal for your enterprise?

The precise POS terminal for your enterprise is dependent upon your wants and the mix of {hardware}, cost processing, and software program that may greatest swimsuit you.

In contrast to 10 or 15 years in the past, when companies needed to determine whether or not they needed an on-premise or cloud-based POS, as we speak, most POS methods completely provide cloud setups. Nevertheless, contemplate the next elements when selecting a POS terminal for your enterprise:

Out there cost strategies

The very best POS terminal ought to assist all main bank cards and digital funds. It also needs to have the ability to settle for some other cost strategies you wish to assist, together with present playing cards, keyed-in funds, and purchase now, pay later (BNPL) installment choices. The precise cost processor may also present you choices to make use of price optimization applications similar to surcharging and comfort charges to reduce your processing prices.

Learn extra: Finest service provider providers

Charges

Talking of processing prices, cost processing charges are arguably probably the most vital issue when selecting a POS terminal. {Hardware} prices for cost processing differ from free to tons of of {dollars}, relying on your enterprise wants. Nevertheless, recurring prices for accepting funds will have an effect on your income probably the most. Select a supplier that gives you probably the most financial savings based mostly in your gross sales quantity. Just remember to solely pay for cost processing options that you simply at the moment want.

Safety

No matter your enterprise measurement or {industry}, transaction safety ought to be a significant consideration as you deal with delicate buyer info. To reduce safety dangers, work solely with degree 1 Cost Card Trade (PCI) accredited cost processors. This ensures that your supplier provides the most recent safety features, similar to end-to-end encryption, consumer authentication, machine studying fraud detection, and chargeback administration instruments.

Learn extra: Information to POS safety

Out there integrations

Your POS terminal ought to have entry to key functionalities similar to stock, consumer relationship administration (CRM), loyalty and rewards, and reporting. You also needs to search for different third-party integrations for instruments you could want, similar to accounting and native supply. With the ability to combine all these options into one platform helps in creating an environment friendly enterprise administration answer.

Connectivity

A dependable POS terminal stays linked and works effectively with minimal downtime or failed transaction requests. For this, you must select a cost terminal {hardware} with a number of connectivity choices similar to Bluetooth, WiFI, and LAN, in addition to non permanent offline cost processing throughout an influence outage. Additionally, contemplate the terminal’s energy supply and battery life in opposition to your typical enterprise day and transaction quantity.

Trade-specific options

Trade-specific options additionally play a job in cost terminals. The truth is, the early restaurant POS terminals already had a kitchen ordering integration. Foreign money conversion can be one of many early options permitting retailers to simply accept worldwide funds.

Search for any industry-specific instruments your enterprise wants earlier than selecting a POS terminal. For instance, fundamental and customized tipping is obtainable from some cost processors. Whereas eating places desire native supply performance, a retailer would possibly want a transport characteristic as an alternative.