Safe cost options guarantee secure transfers amidst rising dangers of cybercrime and fraud. Uncover how third-party platforms like Zelle, Venmo, and CashApp provide quick, low-fee transactions whereas sustaining person safety.

In the case of safe cost transfers via banks, the method is extra advanced than it appears, particularly for transfers to or inside the USA. This complexity arises from strict banking rules, rising dangers of cash laundering, cybercrime, and on-line scams. Because of this, third-party providers are in excessive demand within the nation.

Among the many hottest choices are Zelle, MoneyGram, CashApp, and Venmo. Optimum Zelle and Venmo switch limits, clear CashApp commissions, and intensive MoneyGram performance – these are simply among the benefits of third-party cost options in comparison with conventional affords, for instance, Financial institution of America.

On this article, you’ll be taught concerning the professionals and cons of the preferred cost options in the USA.

Why Third-Get together Fee Options Are in Demand

Third-party cost options have gotten more and more in style attributable to their comfort, velocity, and ease of use. These platforms permit customers to ship and obtain cash immediately without having to undergo conventional banks, making them ultimate for private transactions, small companies, and freelancers.

Additionally they provide a extra user-friendly expertise with decrease charges and fewer restrictions than banks. Moreover, the rise of e-commerce and cellular funds has pushed demand for these providers, as they supply a fast and safe option to full transactions on-line. Providers akin to CashApp and Venmo for making transactions have comparable benefits:

- Along with the fundamental features, many different choices can be found to customers, particularly, working with the cryptocurrency Bitcoin, Ethereum, Litecoin, and so on.;

- Performing operations is simple, no have to waste time mastering the interface;

- Commissions are fairly low – there isn’t a noticeable burden on the funds;

- There’s a assist service the place you possibly can contact for recommendation or resolve an issue.

Such switch methods, even when not owned by particular banking organizations, can present bank-level providers, together with issuing a Visa or Mastercard debit or bank card. Customers additionally notice the supply of functions for Android and iOS and bonus accruals as benefits.

In style Fee Providers In The USA

There are a number of providers in demand amongst US residents. Let’s have a look at the options of every so you may make the best selection.

Zelle

You should utilize the appliance with out pointless difficulties. It is a appropriate instrument to switch cash to trusted individuals and other people you realize. Among the many benefits that the Zelle system has:

- free registration, no commissions;

- integration with financial institution functions is simple;

- inside Zelle, transfers are carried out directly;

- there isn’t a want to point the monetary particulars of the recipient;

- features for requesting cash and dividing bills can be found;

- you possibly can ship cash utilizing a QR code.

There are additionally some disadvantages:

- There aren’t any protecting measures for customers when fraudulent actions are detected;

- In Zelle, funds and transfers can solely be cancelled if the recipient doesn’t have an account – if there’s one, the operation can’t be cancelled;

- There are limits on quantities – $500 for sending, and $5000 for receiving day by day.

The applying is best suited for instances when you’ll want to ship cash to acquaintances, colleagues, family members, or buddies, for instance, in case you are in Chicago and another person is in Seattle. To make a switch, it is sufficient to know the recipient’s cellphone quantity or e-mail tackle: on this case, he’ll obtain a textual content message or e-mail concerning the pending cost.

Greater than 1,800 US banking and credit score establishments are built-in with the service. Due to this fact, you can too achieve entry via the service of your financial institution, whether it is included on this record. If not, this record should embody the recipient’s financial institution. To arrange an account, merely enter your private and cost info.

MoneyGram

The service is concentrated on performing monetary transactions with the power to obtain money. You’ll be able to register an account and full a transaction via the web site or the appliance: funds by way of smartphone make issues simpler.

Among the many benefits:

- Cash transfers made via MoneyGram are carried out in fifty currencies on the territory of 200 nations, the interface has been translated into greater than twenty languages;

- The corporate’s status and the reliability of the providers offered aren’t passable, the viewers is 150 million folks;

- Fee might be made in a wide range of methods, together with sending by way of MoneyGram from a card (debit or credit score), financial institution switch, money;

- It’s also possible to obtain funds to a checking account, in money, to an digital pockets, via the FastSend system;

- There’s a handy cellular utility.

CashApp

Initially, the service was developed as a instrument for dividing a test amongst a number of folks, and right now the viewers is fifty million customers. Via Money App, transfers are simple, together with utilizing a linked checking account or bank card. Within the latter case, a fee of three% is offered.

A number of benefits of utilizing CashApp:

- The applying is frequently up to date and is offered for smartphones on totally different working methods;

- Account division is carried out with out advanced manipulations;

- Person knowledge is reliably protected;

- The service simply integrates with banks; sending from a CashApp stability or linked account prices no further bills;

- On-line investing in securities and cryptocurrency is offered;

- Deposits are insured via the FCID system.

Though CashApp shouldn’t be a banking service, in truth, the person receives the identical set of providers as when interacting with a financial institution. It is a appropriate system for the restaurant enterprise and for another small companies: it’s simple to hold out calculations for salaries, tools purchases, and different areas.

Venmo

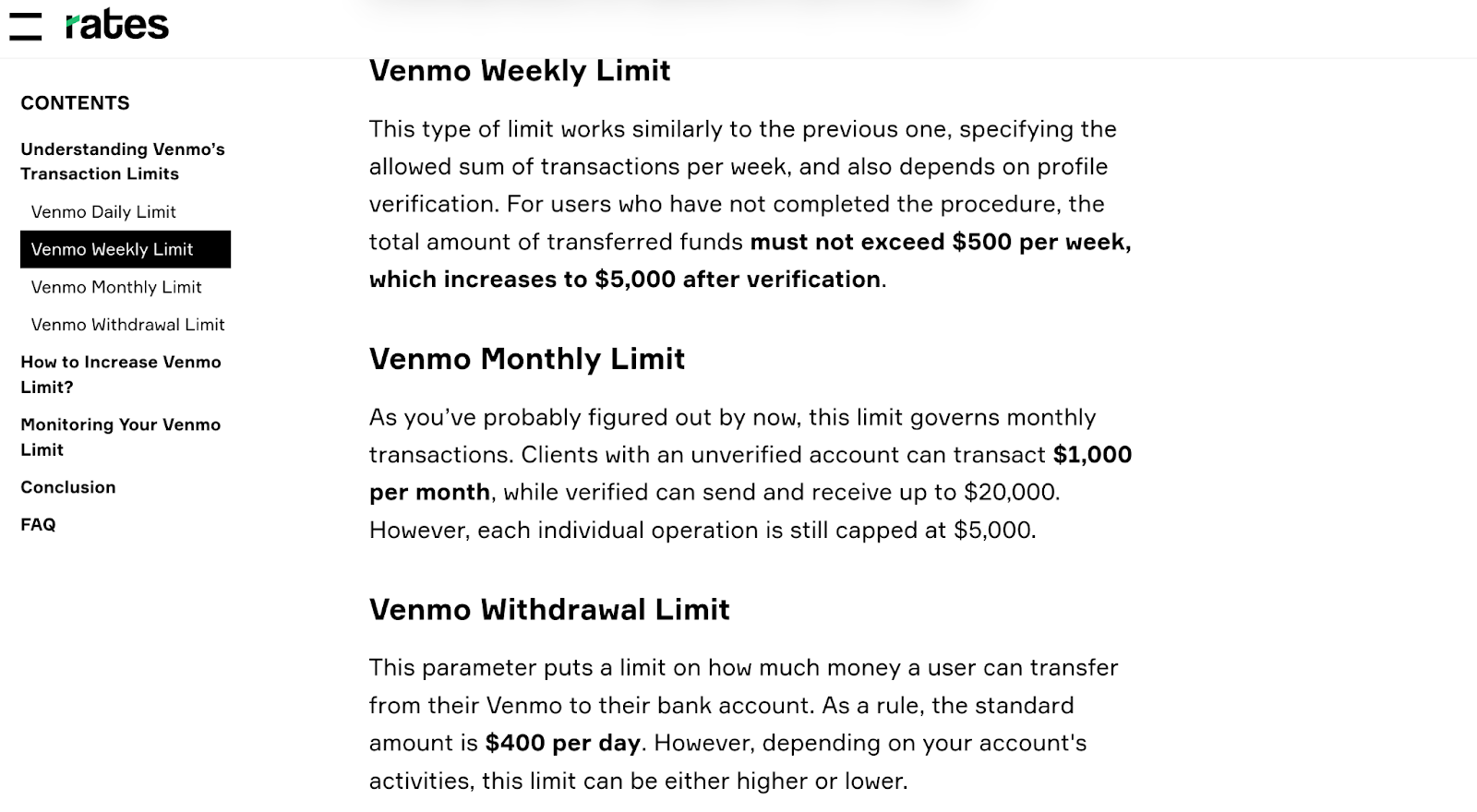

The service is designed for normal peer-to-peer funds. It’s appropriate for sending cash to members of the family, buddies, and colleagues. You’ll be able to ship and obtain funds in several methods. There are alternatives: you possibly can request a debit card (for adults or youngsters), in addition to a bank card, and obtain bonus accruals.

Benefits of this service:

- The interface is very simple, you possibly can instantly grasp all of the features, together with splitting an account and requesting cash from different customers;

- You can also make a switch utilizing Venmo without spending a dime, besides for immediate transactions and sending quantities from bank cards;

- Direct cost is offered in some functions and web sites;

- You’ll be able to, if you want, purchase in style cryptocurrencies (the service cooperates with in style crypto exchanges, together with Coinbase and Kraken).

Wrapping It Up

Zelle, CashApp, MoneyGram, and Venmo are geared toward American residents who’re fascinated by transferring funds inside the USA or sending worldwide funds. Due to this fact, use these platforms, however make sure the apps are downloaded via official app shops and not from third-party sources, the place the danger of scams and malware infections is considerably increased.