Cell funds are remodeling how customers and companies work together. As extra clients desire to pay utilizing their smartphones and different units, small enterprise homeowners want to remain forward of the curve. However what precisely are cellular fee providers, and the way do they work?

On this information, we’ll discover key cellular fee strategies, how they perform, and why they matter for what you are promoting. Whether or not you’re a brand new small enterprise proprietor or seeking to develop your fee choices, understanding these applied sciences will show you how to keep aggressive.

What are cellular funds?

Cell funds consult with any monetary transaction made by way of a cellular gadget, equivalent to a smartphone or pill. These funds can happen in particular person, on-line, or by an app. They use applied sciences like brief message service (SMS), cellular wallets, near-field communication (NFC), and fast response (QR) codes.

This methodology of transacting boasts a quicker, extra handy manner for purchasers to finish transactions. Prospects don’t should fumble with plastic financial institution playing cards and germ-laden money.

For small companies, accepting cellular funds can increase income, slash wait occasions, and dish out a seamless checkout course of. Plus, it alerts an embrace of the most recent expertise. This issue can lure in individuals pursuing a extra subtle shopping for expertise.

Right here’s a breakdown of six of the most well-liked cellular fee strategies:

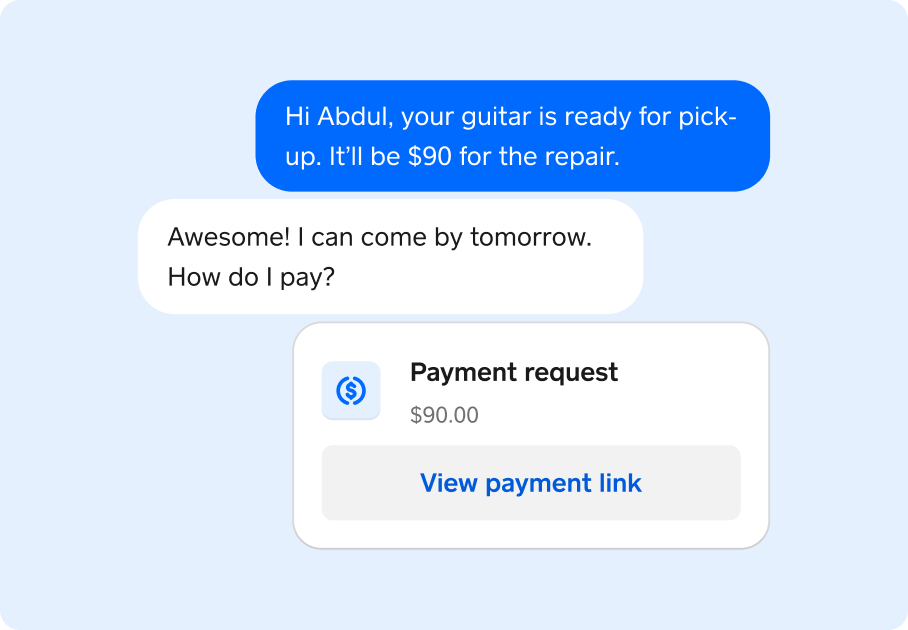

1. Textual content to pay funds

The time-honored textual content message doubles as a cash-sending automobile. SMS (brief message service) or textual content to pay funds allow clients to make purchases by way of textual content message. These transactions are sometimes accomplished by the shopper’s cellular pockets – which we’ll contact on later.

Although handy, textual content to pay shouldn’t be ideally suited for point-of-sale transactions that must be accomplished and verified shortly.

The way it works

The enterprise sends the shopper a invoice, bill, or fee request over textual content. The textual content sometimes features a safe fee hyperlink that’s encrypted for additional safety.

Why it’s necessary for small companies

SMS funds are perfect for companies needing a easy, easy-to-use choice. It’s handy for amassing payments or recurring funds.

Concerns

The simplicity of SMS funds is interesting from a buyer’s standpoint. Nonetheless, they’re extra weak to fraud and chargebacks. Plus, some cellular carriers cost per textual content message.

2. Cell wallets

Cell wallets like Apple Pay, Google Pockets, and Samsung Pay are well-known instruments. These apps retailer fee info digitally. This preloaded information permits customers to transact with a easy faucet.

The way it works

Prospects enter their credit score or debit card particulars in a cellular pockets app. When able to pay, they whip out the app. From there, an individual can faucet their smartphone on a contactless fee terminal or choose their saved card for on-line purchases.

For many smaller purchases, no signatures or safety particulars are needed. Nonetheless, with bank-grade encryption, one-time safety tokens, and different anti-fraud measures, cellular wallets are considered very safe instruments.

Why it’s necessary for small companies

Cell wallets allow a quick, safe, and contactless manner for purchasers to pay. For companies, accepting cellular wallets can scale back the friction of checkout, which can improve buyer satisfaction and gross sales. Moreover, cellular wallets use encryption and tokenization for safety, making them a protected choice for companies and clients alike.

Concerns

Companies should make sure that their point-of-sale (POS) system is NFC-enabled. Whereas most fashionable techniques help cellular wallets, some older terminals might require an improve.

3. Peer-to-peer (P2P) fee apps

Peer-to-peer (P2P) fee apps like Venmo, PayPal, and Money App enable people to ship and obtain cash shortly. Though these apps are designed for person-to-person transactions, many small companies, freelancers, and repair suppliers use them often.

The way it works

Prospects switch cash instantly from their app account to a enterprise’s account. In contrast to tap-to-pay, this methodology normally includes manually wanting up a receiver’s account within the app. In consequence, persons are prompted to create a display screen identify or present their electronic mail tackle.

Why it’s necessary for small companies

P2P fee apps are perfect for companies with low quantity or pop-up retailers, freelancers, and service-based suppliers. They’re simple to arrange, sometimes have minimal charges, and provide quick fee transfers. However they’re meant for extra private situations, therefore the usage of display screen names and transaction notes.

Concerns

Whereas P2P apps are handy, they aren’t designed for high-volume enterprise transactions. Many of those platforms restrict the sum of money that may be despatched or acquired in a given timeframe. Plus, funds are handled like money, that means there are fewer protections towards fraud and errors.

4. Banking apps

Cell banking apps provided by monetary establishments allow clients to switch cash, pay payments, and typically make purchases instantly from their financial institution accounts. These apps can even help funds by providers like Zelle.

The way it works

Prospects use their financial institution’s cellular app to switch cash or full funds. Some banking apps enable companies to arrange a fee hyperlink, letting clients pay instantly by their financial institution.

Why it’s necessary for small companies

Banking apps are an economical manner for small companies to just accept funds. Since transactions occur instantly between banks, they typically have decrease charges than bank card processing.

Concerns

Whereas cellular banking apps are safe and environment friendly, they don’t present the identical comfort as different fee strategies. Not all clients use the identical financial institution, and thus the identical app. Plus, the fee course of will be slower in comparison with different cellular fee applied sciences.

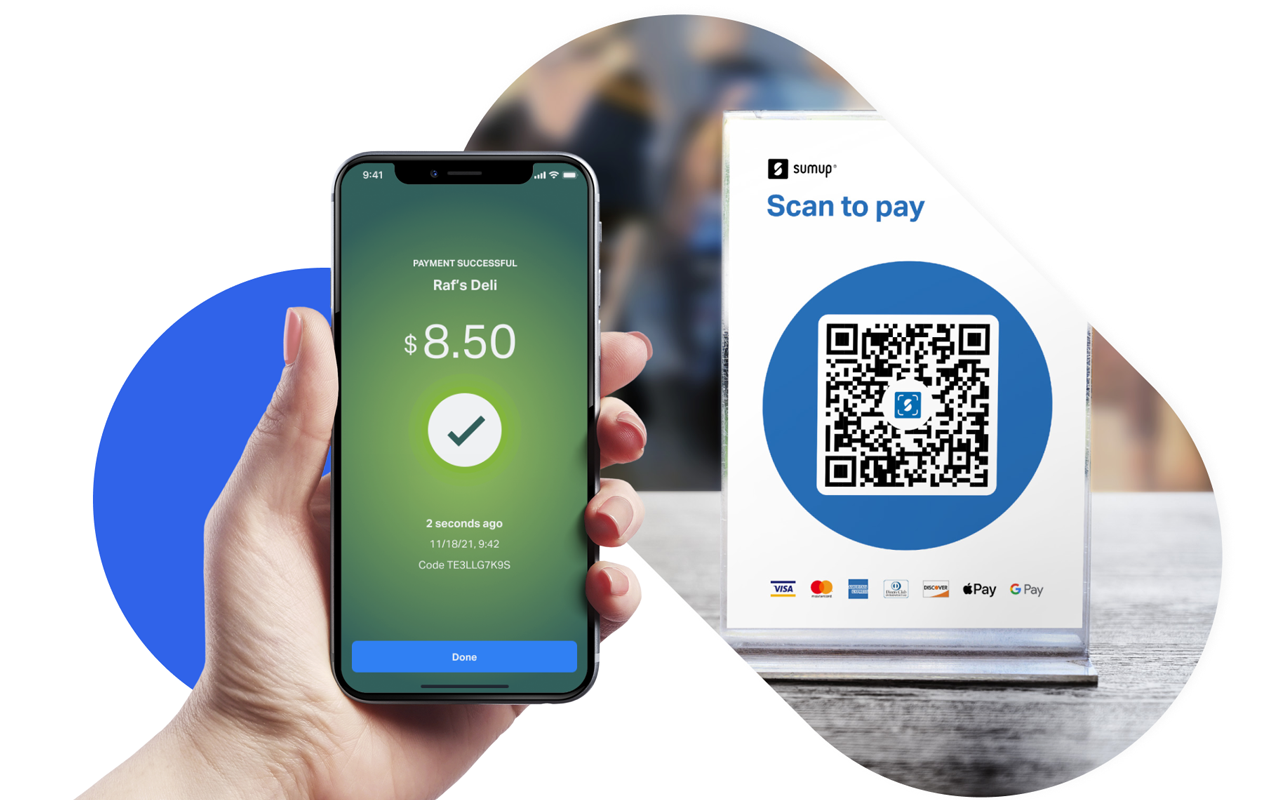

5. QR code funds

QR code funds are prized for his or her simplicity and low-cost implementation. They’re a terrific mix of comfort and safety. However they rely closely on a buyer’s tech abilities and Web connection.

The way it works

A enterprise generates a QR code that hyperlinks to a fee gateway. The shopper scans the code with their smartphone, which opens a fee interface. From there, the shopper completes the transaction by deciding on their fee methodology.

Why it’s necessary for small companies

This fee methodology is simple to arrange. You possibly can mission the QR code on something, from a serviette to a pc display screen. This simplicity is nice for every kind of conditions, from pop-up occasions to tableside funds in a restaurant.

Concerns

QR code funds require an Web connection and a more recent mannequin smartphone. So, if cell reception is spotty or a buyer nonetheless makes use of a flip cellphone, this methodology can hit a snag. And even with the suitable gear, the cryptic look of a code means some individuals might really feel mystified about tips on how to pay.

You’ll even have to make sure your QR code results in the right place. A lifeless hyperlink is a transaction killer.

6. NFC contactless funds

NFC (near-field communication) expertise allows contactless funds. This idea permits clients to faucet their cellular gadget or card on a terminal to pay. This methodology is mostly used with cellular wallets. But it surely’s additionally the expertise behind faucet to pay credit score or debit playing cards.

The way it works

Prospects carry their NFC-enabled gadget (equivalent to a cellphone or wearable) near a fee terminal geared up to help this expertise. The transaction is accomplished wirelessly inside a few seconds. There’s usually no want for signatures or different hands-on steps.

Why it’s necessary for small companies

NFC contactless funds are championed for his or her comfort, pace, and safety. For companies with excessive transaction volumes, this methodology cuts transaction occasions dramatically. It additionally affords a hygienic, touch-free fee choice.

Concerns

Companies will want a POS system that helps NFC expertise. Whereas this buy includes budgeting, the advantages of quicker, safer transactions can quickly recoup prices.

FAQs

What are the advantages of cellular funds for small companies?

Cell funds provide small companies quicker checkout processes, diminished reliance on money, decrease transaction prices, and the power to just accept funds remotely or on the go. All of those elements can increase income and enhance buyer satisfaction. Additionally they mission a extra tech-savvy picture of what you are promoting, which boosts public notion.

How do cellular fee strategies differ from conventional fee strategies?

Cell fee strategies depend on smartphones and apps like Google Pay and Apple Pay. These instruments transfer cash by way of near-field communication, QR codes, or textual content messages. This dependence on expertise separates it from conventional, tangible types of fee, like money. Plus, cellular funds are usually quicker, extra handy, and safe on account of options like tokenization and biometric authentication.

How do I test if my cellphone is appropriate with cellular funds?

To make sure compatibility, test that your gadget helps near-field communication (NFC) or Bluetooth for contactless funds. Most fashionable smartphones have this expertise built-in. Some cellular funds contain a QR code, which solely requires your cellphone’s digicam app.