A fee gateway handles the authorization and processing of funds between the service provider and the monetary establishments. It ensures safe, environment friendly transactions, integrating straight with programs to facilitate on-line or in-person gross sales.

Choosing a fee gateway is essential to making sure seamless and safe fee processing. For builders and tech-savvy companies, this implies searching for one which aligns along with your technical necessities, gives robust API capabilities, and gives strong safety measures to guard in opposition to fraud.

High fee gateways comparability

The best fee gateway depends upon your online business wants. For this record, I checked out gateways which might be recognized for his or her flexibility and customization choices and I evaluated each primarily based on their pricing, safety features, fee options, and assist.

| Our ranking (out of 5) | Month-to-month charge | Pricing construction | Buyer assist | Uptime (previous 90 days as of writing) | Utility course of | |

|---|---|---|---|---|---|---|

| Stripe | 4.59 | $0 | Flat-rate, interchange upon request | 24/7 cellphone, electronic mail, chat assist | 99.99% | Immediate |

| Braintree | 4.49 | $0 | Flat-rate, interchange upon request | 24/7 emergency assist | 99.99% | Immediate until further docs are wanted |

| Ayden | 4.43 | $0 | Varies | By way of assist ticket | 100.00% | Handbook approval |

| 2Checkout (now Verifone) | 4.39 | $0 | Flat-rate | 24/7 service provider assist | 99.98% | Handbook approval |

| Authorize.web | 4.36 | $25 | Flat-rate | 24/7 cellphone and chat assist | 99.99% | Handbook approval |

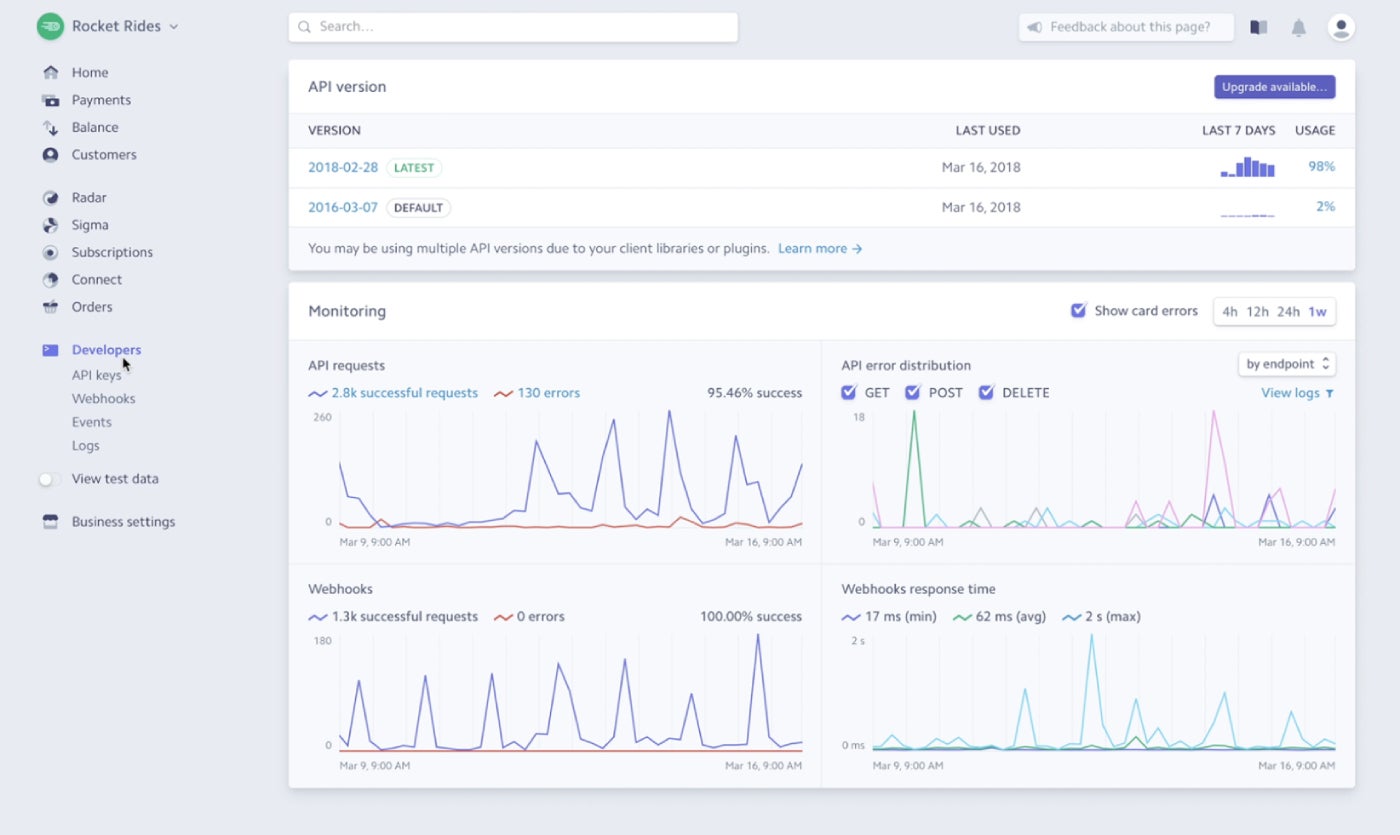

Stripe: Greatest total

Our ranking: 4.59 out of 5

Stripe stands out as the perfect fee gateway for builders and tech-savvy companies due to its highly effective API, intensive developer instruments, and customizable fee options. It excels in dealing with complicated fee flows, international fee assist, and seamless integrations, which permit customers to create tailor-made checkout experiences. Stripe additionally gives zero month-to-month charges, on the spot approval, and 24/7 assist, making it an economical and accessible answer for companies of all sizes.

Why I selected Stripe

In relation to API flexibility, SDK availability, and customizability, Stripe is prime of thoughts amongst tech-savvy companies and builders. It holds up nicely to its developer-friendly repute — it gives probably the most strong and well-documented APIs, SDKs in any language, and really energetic developer communities. Much less tech-savvy companies will nonetheless discover worth in utilizing Stripe as its fee gateway due to its quite a few straightforward third-party integrations that require much less coding than full customizations. It’s also one of many only a few fee gateways that permit companies to right away begin accepting funds with none upfront value or prolonged approval instances.

Pricing

- Month-to-month charge: $0

- Cost processing charges:

- In-person transactions: 2.7% + 5 cents per transaction.

- On-line transactions: 2.9% + 30 cents per transaction.

- Keyed-in transactions: 3.4% + 30 cents per transaction.

- ACH funds: 0.8%, capped at $5 per transaction.

- Add-on charges:

- Invoicing: 0.4% per paid bill.

- Recurring billing/subscription: 0.7% of billing quantity.

- Cross-border charge: 1.5% per transaction.

- Forex conversion: 1% per transaction.

- Customized pricing obtainable for high-volume companies.

Options

- Highly effective API and developer instruments.

- SDKs in Ruby, Python, PHP, Java, Node, Go, .NET, HTML, JavaScript, React, iOS, Android, and React Native.

- 24/7 buyer assist.

- Superior fraud detection and safety instruments.

- PCI-SSS Stage 1 compliant.

- Accepts most fee strategies.

- Helps 40+ nations and 130+ currencies.

Execs and cons

| Execs | Cons |

|---|---|

| Extremely customizable with highly effective APIs and developer instruments. | Add-on charges for billing and invoicing. |

| No month-to-month charges. | Account stability points (sudden holds). |

| Broad country- and currency-support. | Flat-rate processing charges will be costly for low-volume companies. |

| Superior fraud detection and safety features. | Doesn’t work with different service provider accounts. |

| 24/7 buyer assist. |

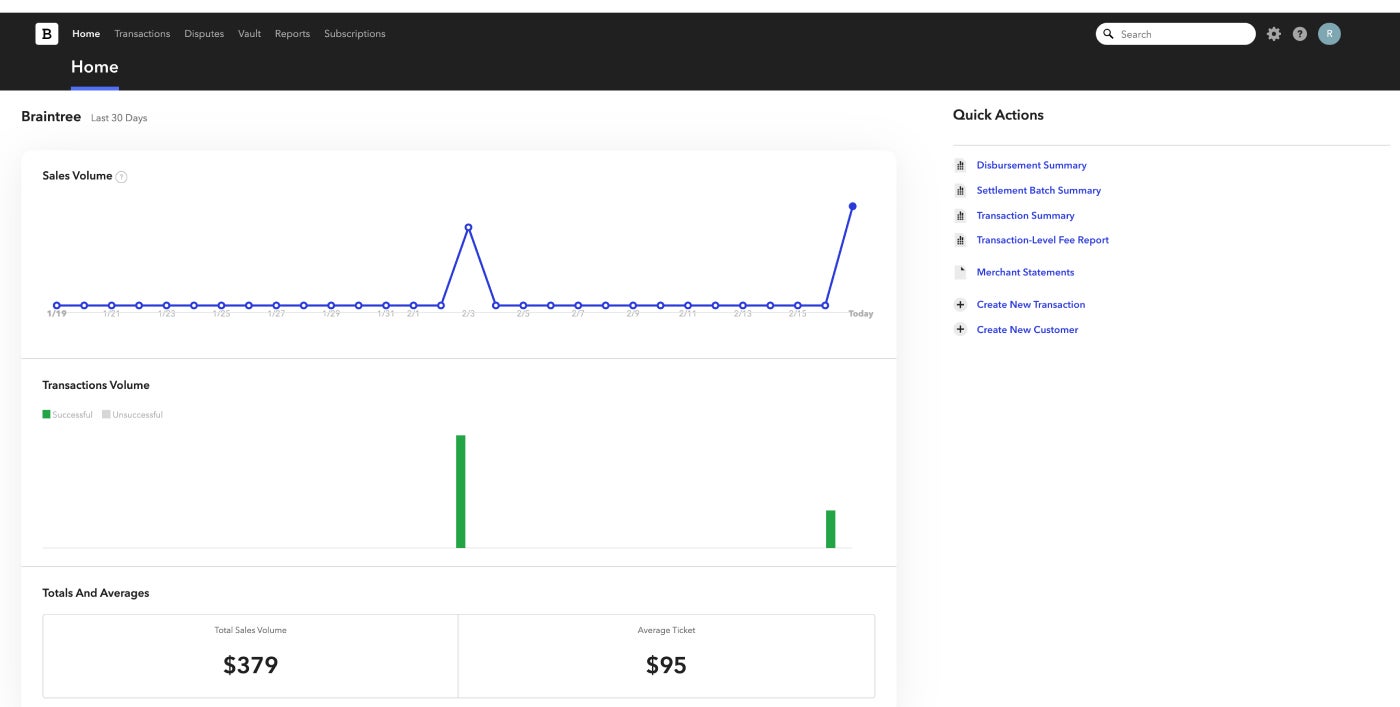

Braintree: Greatest for subscription and recurring billing

Our ranking: 4.49 out of 5

Braintree, a PayPal firm, is a fee gateway that provides versatile fee choices, customizable instruments, and seamless integration with main platforms. Its strong subscription and billing capabilities make it a wonderful selection for companies centered on these fee choices, particularly with Braintree’s assist for a number of currencies and fee strategies.

Why I selected Braintree

Braintree stands out for its devoted concentrate on subscription and recurring billing, offering a variety of instruments designed to simplify the administration of those complicated fee flows. Its clear pricing mannequin and superior options, resembling dynamic management over billing intervals, buyer administration, and simple integration with digital wallets, make it superb for subscription-based companies.

Braintree’s fraud safety and detailed analytics give companies the insights they should optimize their billing processes and improve buyer expertise, setting it aside from different gateways which will require extra complicated configurations for related capabilities.

Pricing

- Month-to-month charge: $0

- Processing charges:

- Playing cards and digital wallets: 2.59% + 49 cents per transaction.

- Venmo: 3.49% + 49 cents per transaction.

- ACH funds: 0.75%, capped at $5 per transaction.

- Add-on charges:

- Cross-border charge: 1% per transaction.

- Forex conversion: 1% per transaction.

- Customized pricing obtainable for high-volume companies.

Options

- Sturdy subscription and billing instruments.

- Accepts PayPal and Venmo.

- SDKs in Ruby, Python, PHP, Java, Node, Go, .NET, JavaScript, iOS, Android, and React Native.

- Broad number of straightforward third-party integrations.

- Superior fraud safety.

- Helps 40+ nations and 130+ currencies.

- Information portability for these switching from different gateways.

- Sandbox atmosphere for testing.

Execs and cons

| Execs | Cons |

|---|---|

| Accepts PayPal and Venmo. | Increased normal flat-rate charges. |

| Sturdy subscription and billing instruments. | Restricted assist for normal customer support. |

| White-glove assist for enterprise companies. | Account approval could also be extra stringent and prolonged. |

| Works with different service provider accounts. |

Adyen: Greatest for big enterprises

Our ranking: 4.43 out of 5

Adyen is extremely appropriate for big enterprises that want a scalable answer with its wide selection of fee strategies and currencies. It’s recognized for its strong, all-in-one platform, massive worldwide presence, superior fraud safety, and real-time reporting. It makes use of an interchange plus processing charge construction the place every transaction is charged the fee technique charge plus a set add-on Adyen processing charge.

Why I selected Adyen

With its availability in 100+ nations and assist for 180+ currencies, Adyen is understood for its capacity to deal with the complicated wants of huge enterprises, notably these with a worldwide footprint. It permits retailers working throughout a number of areas to supply their clients numerous fee strategies inside a single streamlined answer. Adyen’s superior fraud safety and real-time analytics additionally present enterprises with essential insights and safety, enhancing total effectivity.

Moreover, additionally it is the one fee gateway on this record that provides normal interchange-plus pricing–the opposite suppliers, like Stripe and Braintree, could supply interchange-plus pricing however solely upon request.

Pricing

- Month-to-month charge: $0

- Cost processing charges: Cost technique charge + 13 cents per transaction.

- Could require reserves.

Options

- International fee processing.

- SDKs in C#, Go, Java, Node, PHP, Ruby, Python, .NET, HTML, React, iOS, Android, and React Native.

- Helps 100+ nations and 180+ currencies.

- A unified platform that integrates buying, processing, and settlement.

- Actual-time analytics and reporting.

- Scalable infrastructure.

- Superior fraud safety instruments.

- Sandbox atmosphere for testing.

Execs and cons

| Execs | Cons |

|---|---|

| Simply scalable for big enterprises. | Could require reserves. |

| Intensive international fee choices. | Much less appropriate for small companies. |

| Interchange-plus pricing. | Doesn’t work with different service provider accounts. |

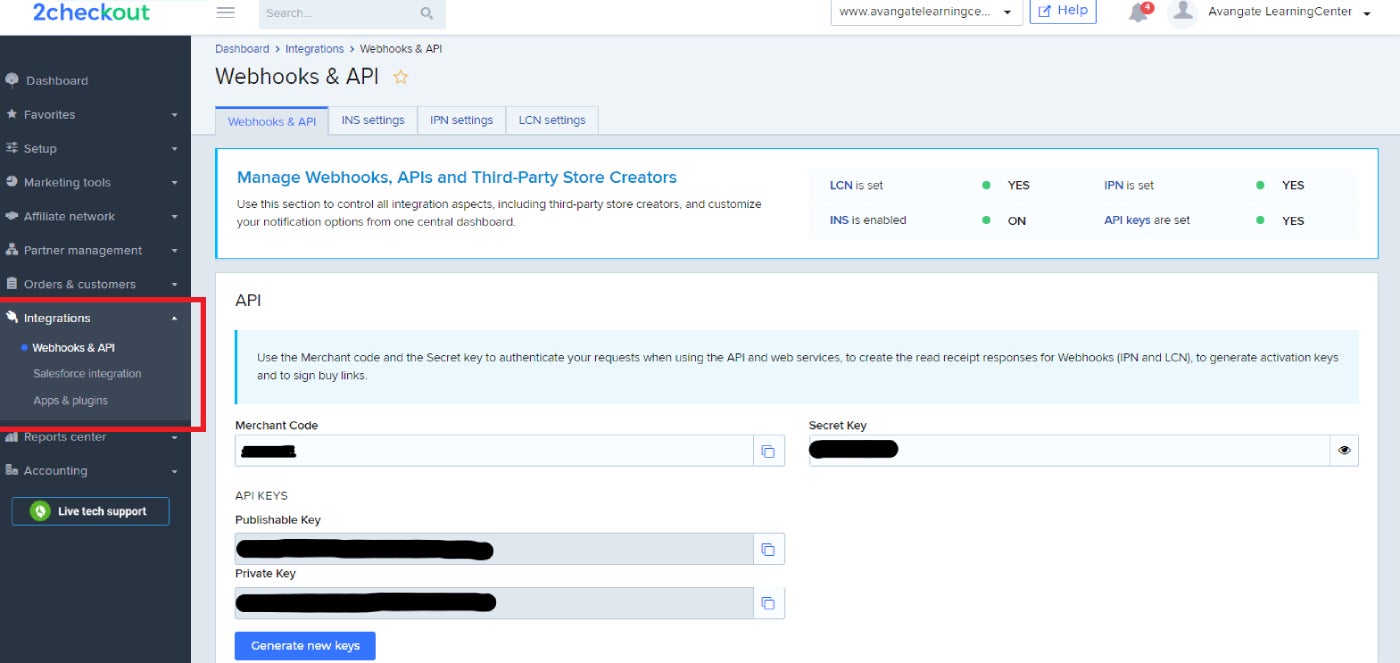

2Checkout (now Verifone): Greatest for worldwide commerce

Our ranking: 4.39 out of 5

2Checkout, now rebranded as Verifone, is a wonderful fee gateway for companies centered on worldwide commerce due to its intensive international attain and assist for a number of currencies and fee strategies. It gives customizable checkout choices, built-in tax and compliance administration, strong fraud safety, and service provider of document companies.

Why I selected 2Checkout

2Checkout stands out for its capacity to assist international companies with localized fee choices. It helps 230+ nations, 30+ languages, and 100+ currencies — greater than some other fee gateways on this record — and has built-in tax and compliance administration instruments that simplify cross-border transactions.

Not like different gateways, 2Checkout additionally acts because the service provider of document, which suggests it takes on the liabilities to the purchasers, handles compliance, and handles taxes, refunds, and chargebacks. This, together with its strong fraud safety and customizable checkout choices, makes it a powerful selection for companies trying to develop internationally with minimal trouble.

Pricing

- Month-to-month charge: $0

- Processing charges:

- 2Sell Plan: 3.5% + 35 cents per transaction.

- 2Subscribe Plan: 4.5% + 45 cents per transaction.

- 2Monetize Plan: Tailor-made pricing.

Options

- Helps 230+ nations, 30+ languages, and 100+ currencies.

- Service provider of document companies.

- Superior fraud safety.

- Built-in tax administration.

- Detailed reporting and analytics.

Execs and cons

| Execs | Cons |

|---|---|

| Intensive international attain and assist. | Excessive transaction charges. |

| Service provider of document companies. | Account holds with out prior discover. |

| Localized checkout expertise. | Subscription administration has add-on charges within the lowest plan. |

| Doesn’t work with different service provider accounts. |

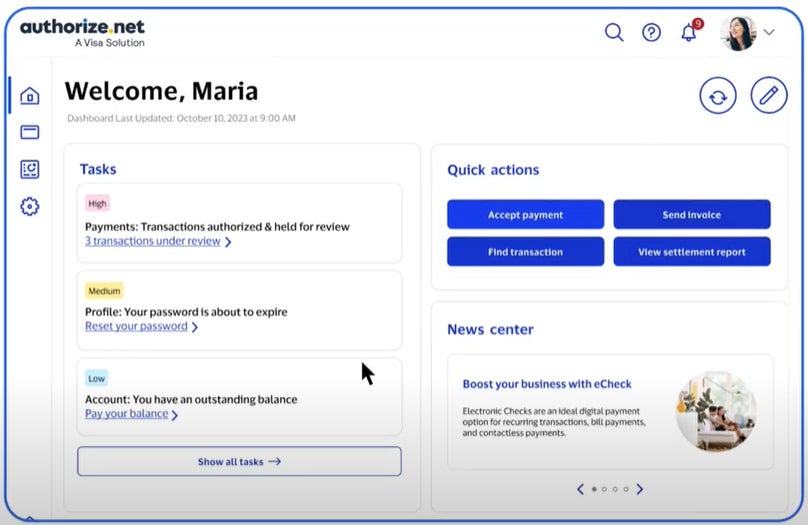

Authorize.web: Greatest for intensive fraud safety

Our ranking: 4.36 out of 5

Authorize.web is among the hottest fee gateways that’s superb for companies that prioritize intensive safety and fraud prevention. It has a user-friendly interface, a variety of integrations, and a number of fee choices. That is the one fee gateway on this record that enables retailers to make use of their current service provider account, in the event that they have already got one.

Why I selected Authorize.web

Its distinctive concentrate on safety makes Authorize.web a prime decide for retailers searching for a extremely respected, dependable, and safe platform. Its Superior Fraud Detection Suite gives over a dozen customizable fraud filters, which assist shield from suspicious transactions. Moreover, Authorize.web’s flexibility in permitting companies to make use of their current service provider accounts makes it an acceptable selection for high-risk retailers or different retailers with distinctive enterprise fashions.

Pricing

- Month-to-month charge: $25.

- Processing charge:

- All-in-one plan: 2.9% + 30 cents per transaction.

- Cost gateway+eCheck plan:

- Bank card transactions: 10 cents per transaction + 10 cents day by day batch charge.

- eCheck: 0.75%.

- Cost gateway plan: 10 cents per transaction + 10 cents day by day batch charge.

Options

- Complete fraud safety.

- Buyer info supervisor.

- Invoicing and recurring funds.

- Permits use of your personal service provider account.

- Detailed reporting instruments.

- 24/7 buyer assist.

Execs and cons

| Execs | Cons |

|---|---|

| Works with current service provider accounts. | Month-to-month charges make it costly for small companies. |

| Sturdy fraud prevention instruments with customizable filters. | Solely obtainable for retailers within the US and Canada. |

| 24/7 buyer assist. |

How do I select the perfect fee gateway for my enterprise?

Selecting the perfect fee gateway depends upon your distinctive enterprise wants, business, and plans for development. For tech-savvy retailers or builders searching for a fee gateway for his or her tasks, search for fee gateways with strong API capabilities, vast SDK language availability, and complete developer documentation.

If your online business values customization and integration flexibility, Stripe’s highly effective API and developer instruments make it a best choice. For giant enterprises with international attain, Adyen stands out with its intensive worldwide assist and interchange-plus pricing mannequin. In the meantime, 2Checkout is right for firms focusing on worldwide markets, due to its complete international attain and built-in compliance administration.

For companies centered on subscriptions or recurring billing, Braintree gives strong instruments that make managing complicated fee fashions easy and environment friendly. If safety is your prime precedence, Authorize.web gives superior fraud prevention instruments that present peace of thoughts, together with the flexibleness to make use of your current service provider account.

Finally, the suitable fee gateway will align with your online business mannequin, business necessities, and development ambitions — prioritize one that provides the particular options, pricing, and assist your online business must thrive.

Methodology

I evaluated a number of fee gateways that provide APIs and developer instruments primarily based on a number of standards: safety and compliance, integration and API capabilities, fee options and international attain, efficiency and reliability, pricing and contract, and person expertise and assist. My analysis for this text concerned in-depth evaluation of product pages and documentation, overview of person suggestions, and creation of take a look at accounts, if obtainable.

This text and methodology had been reviewed by our retail professional, Meaghan Brophy.