B2B retailers usually deal with a big quantity of transactions and handbook funds and want an additional layer of safety and safety. Because of this one of the best B2B fee processors supply decrease processing charges, can settle for MOTO (mail order/phone order) funds by way of digital terminals, supply invoicing, settle for different diversified sorts of funds, and may have fraud prevention and chargeback administration instruments.

Prime B2B fee processors comparability

To simply examine my really helpful B2B fee processors, I’ve listed their month-to-month and processing charges beneath, organized in line with their score towards our in-hours rubric. All suppliers supply Stage 2 and three (aka B2B) bank card processing.

| Processing charge (begins at) | |||

|---|---|---|---|

| Interchange plus 0.15% + 15 cents | |||

| 2.9% + 30 cents | |||

| Interchange + 8 cents | |||

| 2.9% + 30 cents | |||

| 2.59% + 49 cents | |||

| 2% – 4.3% |

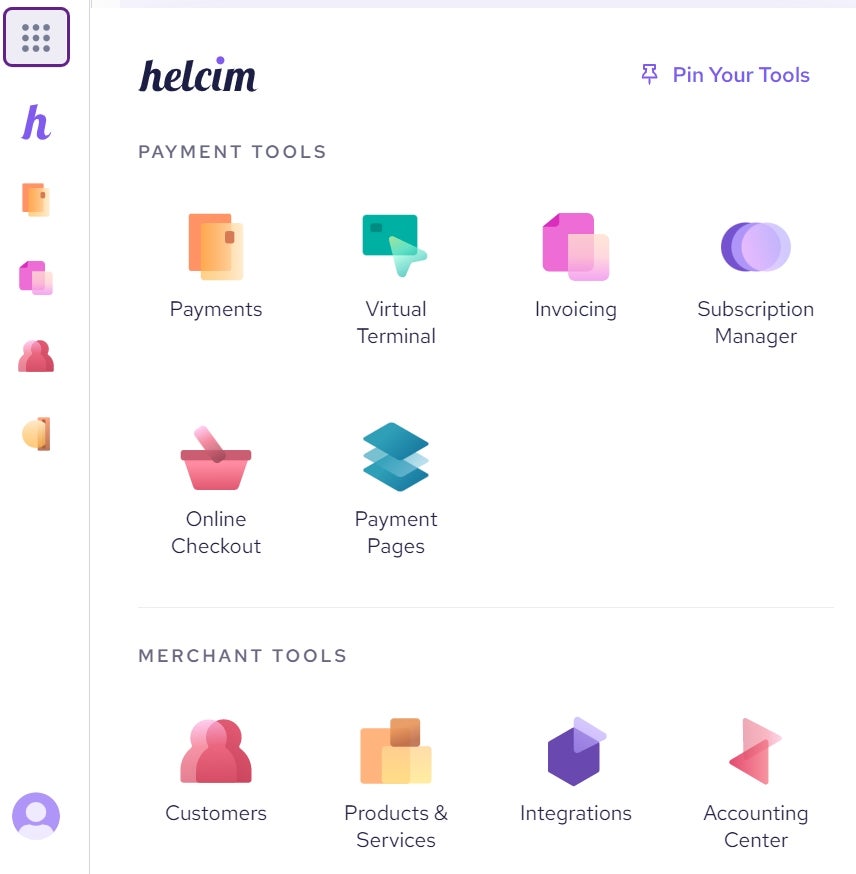

Helcim: Greatest general

Our score: 4.53 out of 5

Helcim is my high decide for a B2B fee processor as a result of its big selection of fee choices (invoicing, recurring billing, and ACH funds) is well-suited for B2Bs. And, not like different suppliers that cost a month-to-month charge or require a paid add-on to make use of a characteristic, Helcim has zero month-to-month charges, zero charges for different fee companies, and provides interchange plus pricing. Furthermore, Helcim’s automated quantity reductions and zero-cost processing make it one of many most cost-effective B2B fee suppliers.

Why I selected Helcim

I like Helcim’s pricing transparency — zero value processing, zero month-to-month charges, and automatic quantity reductions — it’s simply the most affordable B2B fee processor. It additionally has a free invoicing device and buyer portal that could be very helpful for B2B firms and their shoppers.

And in contrast to different B2B fee platforms like Stripe, Helcim has native Stage 2 and three knowledge processing and, with the assistance of AI, optimizes the interchange to mechanically retrieve transaction info wanted to qualify for Stage 2 and three reductions.

Pricing

- Month-to-month charge: $0.

- Cost processing charges:

- On-line: Interchange plus 0.15% + 15 cents to 0.50% + 25 cents.

- Keyed-in: Interchange plus 0.15% + 15 cents to 0.50% + 25 cents.

- Home ACH/Wire transfers: 0.5% + 25 cents

- Extra 0.10% + 10 cents for all AMEX transactions.

- Cost service charges:

- $0 for invoicing, recurring billing, worldwide funds, and digital terminal.

Options

- Interchange-plus pricing with automated quantity reductions.

- Free worldwide bank card fee processing – a world service charge (1%-3%) could also be charged by your financial institution.

- All-in-one dashboard for managing fee processing instruments.

- Buyer self-service portal.

- Cellular fee app.

- Digital terminal for all fee and transaction varieties.

- Invoicing for estimates, quotes, and account receivables.

- Recurring billing for subscription administration.

- Guided chargeback dispute decision.

- Credit score Card Vault – retailer and shield prospects’ bank cards on file.

- Fraud Defender – threat estimation achieved for every transaction for fraud and chargeback discount.

- Price Saver Program – a zero-cost processing program that helps on-line, bill, and in-person funds. Helcim mechanically detects the free bank card processing program accessible to make use of based mostly on the cardboard sort/community and enterprise location.

Professionals and Cons

| Cons | |

|---|---|

|

|

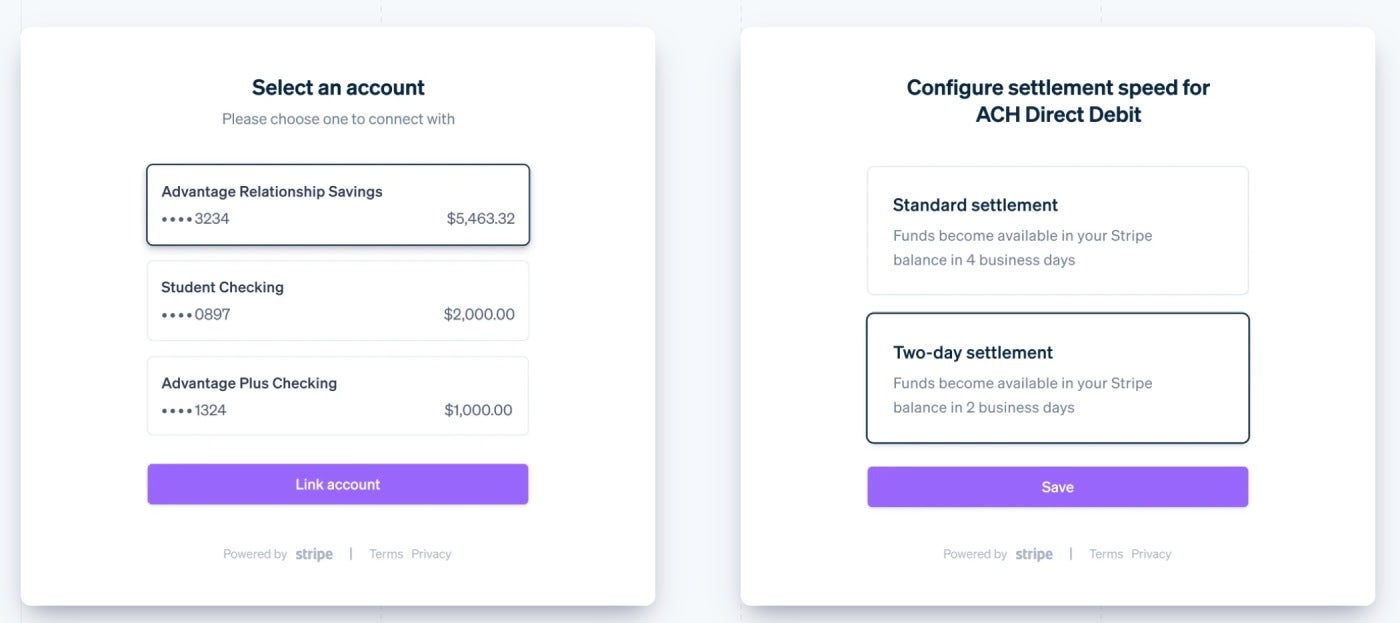

Stripe: Greatest for worldwide B2B funds

Our score: 4.41 out of 5

Stripe can assist greater than 135 currencies and course of funds as much as $999,999.99, making it one of the best B2B fee resolution for companies that take worldwide funds. It additionally helps the widest vary of funds amongst all suppliers in my record, offering in-person and on-line/distant funds, wire transfers, ACH/e-checks, and playing cards — each home and worldwide, because it has direct integrations with world card networks and issuers.

Why I selected Stripe

I like Stripe’s secure assist for world funds — it at the moment has a presence in 46 nations, enabling you to just accept funds in-person or remotely by way of a POS system or a webpage with real-time authorization. However its biggest power is its customization choices, the place you may must pay a little bit extra for some options, equivalent to constructing your individual checkout resolution.

B2B companies can even profit from Stripe’s invoicing device and cheap ACH transaction charges — the bottom among the many software program on this record (0.8%, $5 cap), even Helcim (0.5% + 25 cents), as a result of it has no cap restrict. Stripe additionally provides {custom} interchange-plus charges for large-volume and enterprise-level firms, though it provides flat-rate processing charges for the remaining.

Pricing

- Month-to-month charge: $0.

- Cost processing charges:

- On-line: 2.9% + 30 cents.

- Keyed-in: 3.4% + 30 cents .

- Home ACH debit: 0.8%, $5 cap.

- Customized charges accessible

- Cost service charges:

- Invoicing: Extra 0.4% to 0.5% per transaction.

- Recurring billing: 0.5% to 0.8% per transaction.

- Worldwide funds: 1.5%.

- Digital terminal: Third celebration.

Options

- Assist for native and worldwide funds.

- Unified dashboard to handle enterprise operations.

- Actual-time and unified reporting instruments, together with deposit monitoring.

- A whole lot of purposes and {custom} APIs and SDKs for straightforward integration.

- Instruments that may assist create diversified sorts of id verification strategies (KYC).

- Fraud prevention device that has superior fee, {hardware} and account safety instruments, and safe knowledge migration (Stripe Radar).

- One to 2 days deposit velocity.

- 24/7 buyer assist, together with technical assist on Discord platform and for over 25 nations.

Professionals and cons

| Cons | |

|---|---|

|

|

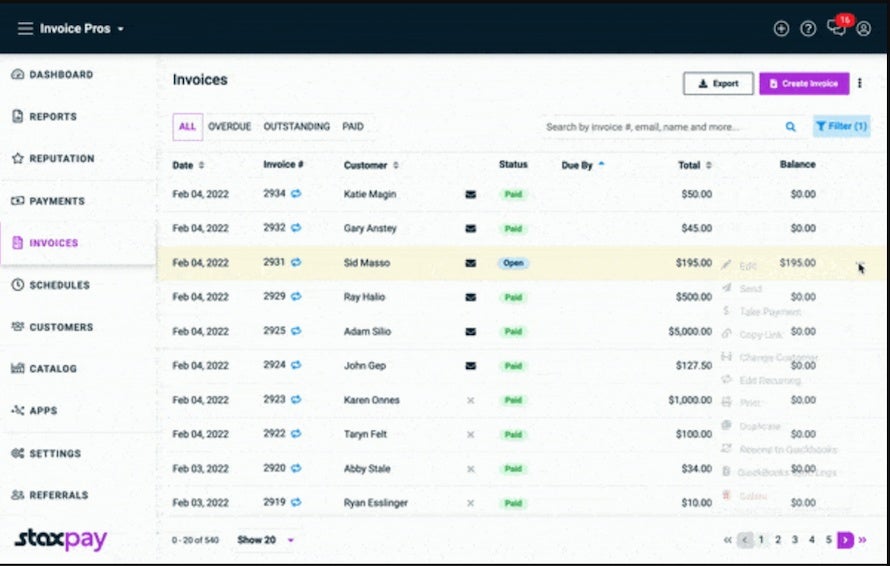

Stax: Greatest for high-volume B2B companies

Our score: 4.41 out of 5

Stax is well-suited for B2B firms that recurrently course of a big quantity of transactions as a result of it provides interchange optimization, like Helcim, however combines it with wholesale charges as a substitute of interchange plus charges. This leads to larger financial savings.

Why I selected Stax

Even with its greater month-to-month charge in comparison with others on this record, Stax scored second to Helcim in my analysis on the subject of pricing. Month-to-month plans generally is a bit expensive upfront. Nevertheless, there aren’t any long-term contracts with cancellation charges, and also you’ll really save due to the interchange and wholesale charges—however provided that you steadily course of giant funds or a excessive quantity of transactions every month.

I additionally like that Stax can work with most POS techniques with integrations, not like Helcim. Its subscription instruments rival Braintree, my really helpful resolution for B2B subscription billing.

Pricing

- Month-to-month charge: $99–$199.

- Cost processing charges: Begins at Interchange + 18 cents.

- Quantity low cost: Wholesale subscription.

- Cost service charges: $0 for Stage 2 interchange optimization; contact Stax for Stage 3 knowledge processing charges (if any).

Options

- Quantity-based wholesale subscription charges.

- Compliant surcharging by way of CardX, Stax’s sister firm.

- Automated recurring billing schedule for subscriptions and invoicing (Stax Invoice).

- Buyer self-service portal to observe subscriptions.

- Buyer relationship administration (CRM).

- A number of foreign money assist through a number of gateways.

- Dispute administration (Stax Join).

Professionals and cons

| Cons | |

|---|---|

|

|

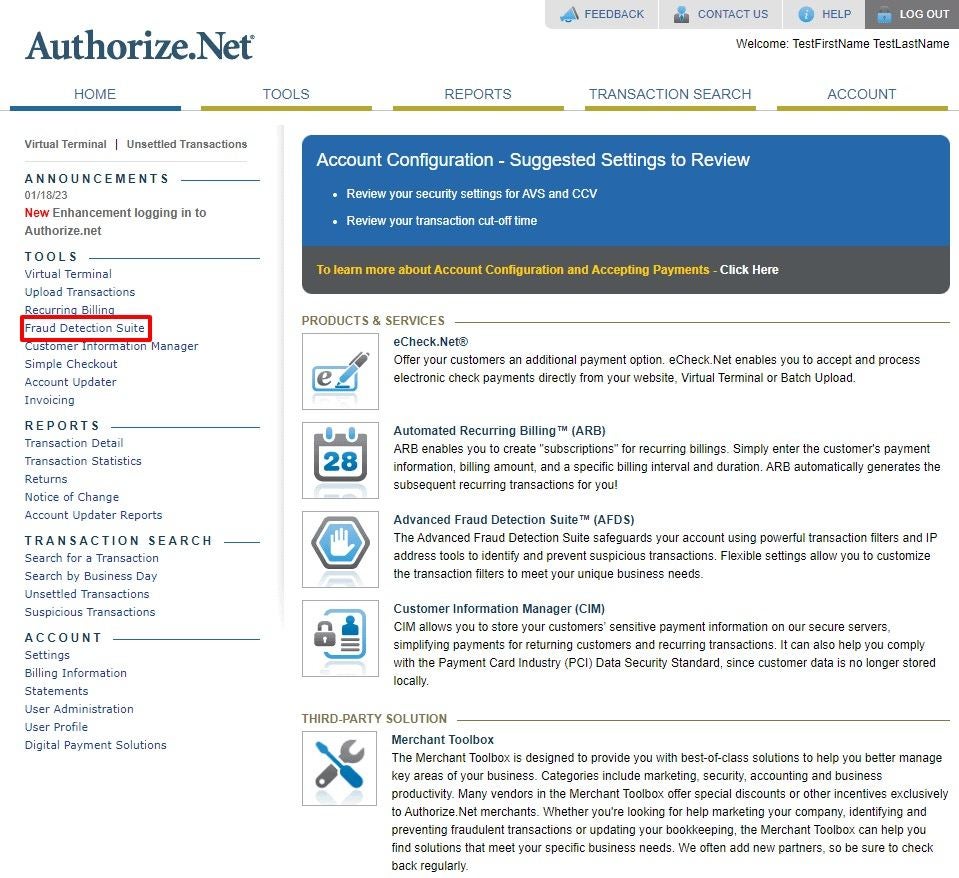

Authorize.internet: Greatest for integrations

Our score: 4.29 out of 5

As one of many oldest, most trusted, and hottest platforms, Authorize.internet is certainly one of our high picks for finest fee gateways. Its in depth integrations vary from procuring carts and POS {hardware} to accounting and B2B platforms. It’s ideally suited for custom-built integrations because it comes with an open API for larger flexibility. You additionally received’t want as a lot coding or developer assist with the customization, not like Stripe, which additionally provides in depth integrations however requires coding data and technical know-how.

Why I selected Authorize.internet

Flexibility is certainly one of Authorize.internet’s biggest strengths. You should utilize the platform as a full fee processor or simply as a fee gateway and go together with a unique service provider account. As a full fee processor, you’ll be able to course of cross-border, B2B funds, invoicing, and recurring transactions. The platform additionally seamlessly integrates with 900 platforms and works with 160 software program developer platforms and greater than 400 licensed know-how companions — probably the most in depth on my record.

Safety is one other space the place Authorize.internet shines. Its top-notch safety and anti-fraud options could be additional personalized to your online business wants — geographic limitations, fee velocity settings, minimal thresholds, and extra. This degree of safety is taken into account premium and requires a paid improve for some suppliers, whereas Authorize.internet supplies its retailers this characteristic without spending a dime.

Moreover, Authorize.internet supplies assist for high-risk retailers, just like PaymentCloud. The remainder of the suppliers on this record don’t settle for companies in high-risk industries.

Pricing

- Month-to-month charge: $25.

- Cost processing charges: 2.9% + 30 cents;

- International funds: 1.5% per transaction.

- ACH: 0.75% per transaction.

- Verbal authorization: $1.20 per transaction.

- Cost service charges: $0 for recurring billing service, fraud detection, buyer administration.

Options

- Full Stage 2 and Stage 3 fee processing.

- Open API for extra {custom} integrations or select from 145 techniques (from POS {hardware} to accounting techniques).

- Partnered with 160 software program growth platforms.

- Worldwide fee processing with assist for 13 currencies.

- Can subscribe to a fee gateway-only plan or an all-in-one plan that comes with a service provider account.

- Superior Fraud Detection Suite (AFDS) device composed on 13-rules based mostly filters to determine, handle, and forestall suspicious and probably fraudulent transactions.

- Buyer Info Administration (CIM) device able to saving playing cards on file and as much as 10 funds and 100 transport particulars.

- Can assist high-risk retailers by way of its companions.

- Payout inside 24 hours (no charges).

Picture: Authorize.internet

Professionals and cons

| Cons | |

|---|---|

|

|

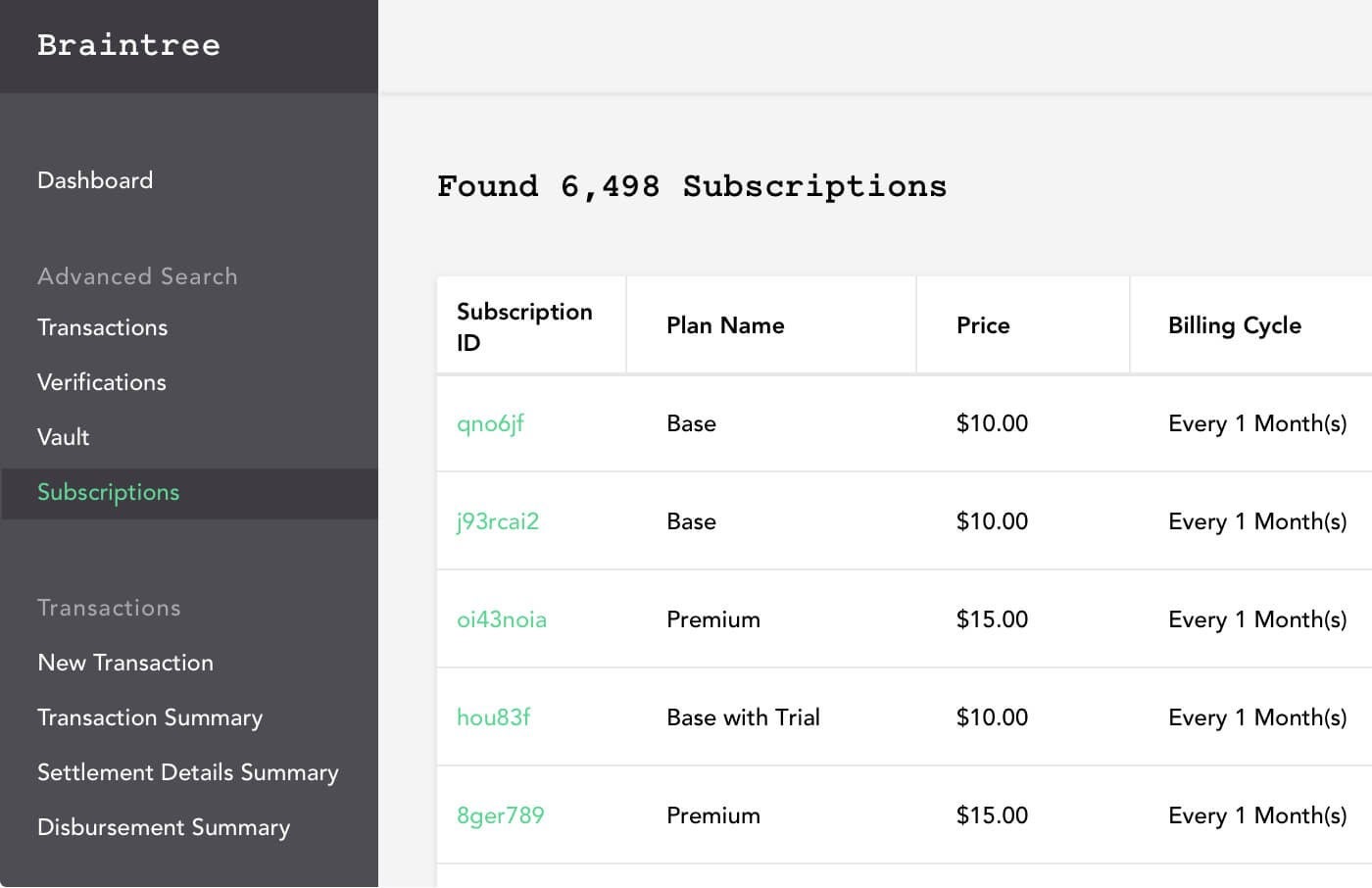

Braintree: Greatest for subscription B2B billing

Our score: 4.20 out of 5

Braintree’s strong recurring billing device is well-suited for B2B retailers that rely closely on subscription fashions, equivalent to these with common provide orders. You’ll be able to create {custom} subscription plans and arrange reductions, rewards, add-ons, and promotional durations. It’s also possible to set automated prorated billing for many who change subscriptions mid-month and settle for a number of currencies and diversified fee strategies.

Why I selected Braintree

As a PayPal-owned firm, Braintree focuses on on-line funds and provides full PayPal integration at no additional value. I like its all-in-one resolution — gateway, processor, and service provider account. You’ll be able to course of a number of funds in additional than 130 currencies and 45 nations.

Much like Helcim and Stripe, Braintree expenses zero month-to-month charges, and its flat-rate processing charges are very aggressive — the bottom among the many suppliers on my record.

I like Braintree’s subscription or recurring billing options as a result of it simplifies the administration of complicated fee workflows. Dunning administration, automated prorated billing, reductions, promos, and rewards are only a few of the options you get with recurring billing. Stax provides dunning administration, however Braintree covers extra fee strategies.

Pricing

- Month-to-month charge: $0.

- Cost processing charges:

-

- On-line: 2.59% + 49 cents.

- Keyed-in: PayPal charges.

- ACH direct debit: 0.75% capped at $5.

- Worldwide funds: 1%.

- Cost service charges: $0 for invoicing, recurring billing, and digital terminal.

Options

- Devoted service provider account.

- Free and seamless PayPal integration.

- Accepts Venmo funds.

- Recurring billing device to create {custom} subscription plans.

- Safe platform with fraud prevention instruments, could be upgraded to premium for a charge to get extra flexibility and management over fraud prevention technique.

- Account updater that updates prospects’ Visa, Mastercard, or Uncover Card particulars — equivalent to numbers, expiration dates, and account standing modifications (paid add-on).

- Payouts in two to 3 enterprise days.

Professionals and cons

| Cons | |

|---|---|

|

|

PaymentCloud: Greatest for high-risk B2B retailers

Our score: 4.11 out of 5

PaymentCloud focuses on offering service provider companies to companies belonging to high-risk industries. If you happen to discover it arduous to get accepted with fee processors or service provider companies, PaymentCloud will likely be match for you. Massive-volume and card-not-present (equivalent to MOTO (mail order/phone order) and handbook/keyed-in) transactions are regular on the subject of B2B and high-risk retailers, and PaymentCloud supplies these companies with a variety of accepted fee strategies.

Why I selected PaymentCloud

I selected PaymentCloud due to its glorious customer support; it’s the one one with good scores for person evaluations, together with Stax. Like Authorize.internet, it helps a variety of high-risk retailers, however not like the previous, PaymentCloud focuses on servicing high-risk industries — with a same-day setup upon approval and a reported 98% approval price.

I additionally like that PaymentCloud can work with any fee gateway. It could additionally present a fee gateway with Stage 2 and three knowledge processing wanted by most B2B retailers.

Whereas PaymentCloud doesn’t publish its precise pricing, that is anticipated due to its {custom} pricing for high-risk retailers. It supplies added charges for ordinary service charges equivalent to invoicing and digital terminals which are usually free for different suppliers, however because it companies high-risk retailers, that is additionally to be anticipated.

Pricing

- Month-to-month charge: $10 to $45.

- Cost processing charges:

- On-line/Bill: 2% to 4.3%.

- Keyed-in: 2% to 4.3%.

- Worldwide funds: 1% to 2%.

- ACH and echeck: Contact PaymentCloud.

- Cost service charges:

- Invoicing and recurring billing: $0.

- Digital terminal: $15 to $45.

- Cost gateway: $15 monthly.

Options

- Focuses on high-risk retailers with a 98% approval score with its greater than 10 banking companions.

- Customized pricing.

- Helps cryptocurrency funds.

- Chargeback safety – partnership with Chargeback Gurus to detect, observe, and resolve disputes on behalf of retailers.

- Sturdy fraud prevention – AVS know-how, tokenization, P2PE knowledge encryption, and 3D Safe know-how.

- Subsequent-day funding.

Professionals and cons

| Cons | |

|---|---|

|

|

How do I select one of the best B2B fee processor for my enterprise?

To decide on the fitting B2B fee resolution to your companies, it’s crucial that you just study extra about your online business operations first.

- Check out your online business’s transaction quantity and common transaction worth.

- Know the assorted software program your online business is at the moment utilizing.

- Listing down all of the fee strategies you at the moment settle for and which channels they normally undergo (on-line, in-person, ACH, and extra).

From there, collect an inventory of B2B processing firms. Consider the pricing construction of every B2B fee gateway. Contemplate the overall value — transaction charges, month-to-month charges, and any extra expenses. If your online business has a excessive quantity of transactions, select B2B fee processing firms that provide interchange-plus pricing fashions (equivalent to my high decide, Helcim). They’ll supply important financial savings.

Then, check out B2B fee platforms which have integrations along with your present enterprise techniques (accounting, CRM, for instance) to make sure a seamless integration with your online business operations. B2B fee suppliers like Stripe and Authorize.internet are famend for his or her in depth integration capabilities.

Contemplate additionally the fee strategies these platforms assist, and whether or not they supply invoicing and recurring billing, or subscription companies. If in case you have a world enterprise and take funds in numerous currencies, go together with a fee processor that helps a number of currencies and provides favorable alternate charges. Stripe is understood for its worldwide fee functionalities, whereas Braintree has strong B2B subscription fashions.

Lastly, learn every supplier’s person evaluations. The flexibility to ship 24/7 assist is crucial to resolving points rapidly, however the high quality of assist must also be regarded into.

As a B2B firm, you’ll profit from a supplier that gives scalability and adaptability as your online business wants change and develop. Helcim, my high really helpful B2B fee processor, is ready to present assist with its complete options to scale your online business.

Methodology

Leveraging my expertise serving to retail companies construct their ecommerce shops and offering assist to B2B companies that want to just accept B2B funds, significantly a number of currencies, I checked out standard and equally highly-rated fee processors that provide Stage 2 or Stage 3 processing.

From my preliminary record, I graded them utilizing an in-house rubric of 26 knowledge factors based mostly on pricing and contract phrases, fee varieties, account options, safety and person expertise, and real-world person and professional evaluations.

This text and methodology had been reviewed by our retail professional, Meaghan Brophy.

Regularly Requested Questions (FAQs)

What are B2B options?

Enterprise-to-business (B2B) options are particularly created to assist different companies enhance and streamline their operations, scale back prices, and, extra importantly, generate and enhance income. Typical examples embrace software program platforms, advertising instruments, and provide chain administration techniques.

What’s the typical B2B fee course of?

A B2B transaction happens between two companies, so the fee course of is a bit totally different from that of a B2C (enterprise to shopper) fee. The B2B fee course of normally begins with the vendor issuing an bill for the client. The bill then must get authorized from the client’s (different enterprise) aspect, and as soon as authorized, fee is ready — by wire switch, ACH, or different technique.

As soon as fee is distributed, it’s validated and licensed. And as soon as it’s obtained within the vendor’s checking account, the vendor reconciles the fee and updates the client’s information.

What’s the distinction between P2P and B2B funds?

The principle distinction between B2B (enterprise to enterprise) and P2P (peer-to-peer) funds is the velocity of transaction — from issuing and receiving funds. Not like P2P funds the place transactions are usually smaller, funds are immediate, and receivers normally get the funds of their account instantly.

B2B funds are extra complicated than B2C (enterprise to shopper) and P2P funds, as they normally endure lots of steps. The transactions are usually bigger and are normally obtained after the transaction (alternate of services or products) has occurred. B2B funds undergo invoicing, approval, preparation, issuing, validation, and receiving earlier than they’re lastly acknowledged and recorded on the client’s finish.

How a lot do B2B funds value?

B2B funds usually value greater than B2C funds due to the quantity transaction, however fee service suppliers supply quantity reductions to B2B firms. So, whereas the general value is greater, the share that processors cost for B2B funds is commonly decrease.