A flawed report by Goldman Sachs analyst Peter Oppenheimer might have been behind the numerous unfavourable sentiment for AI shares over the previous few days.

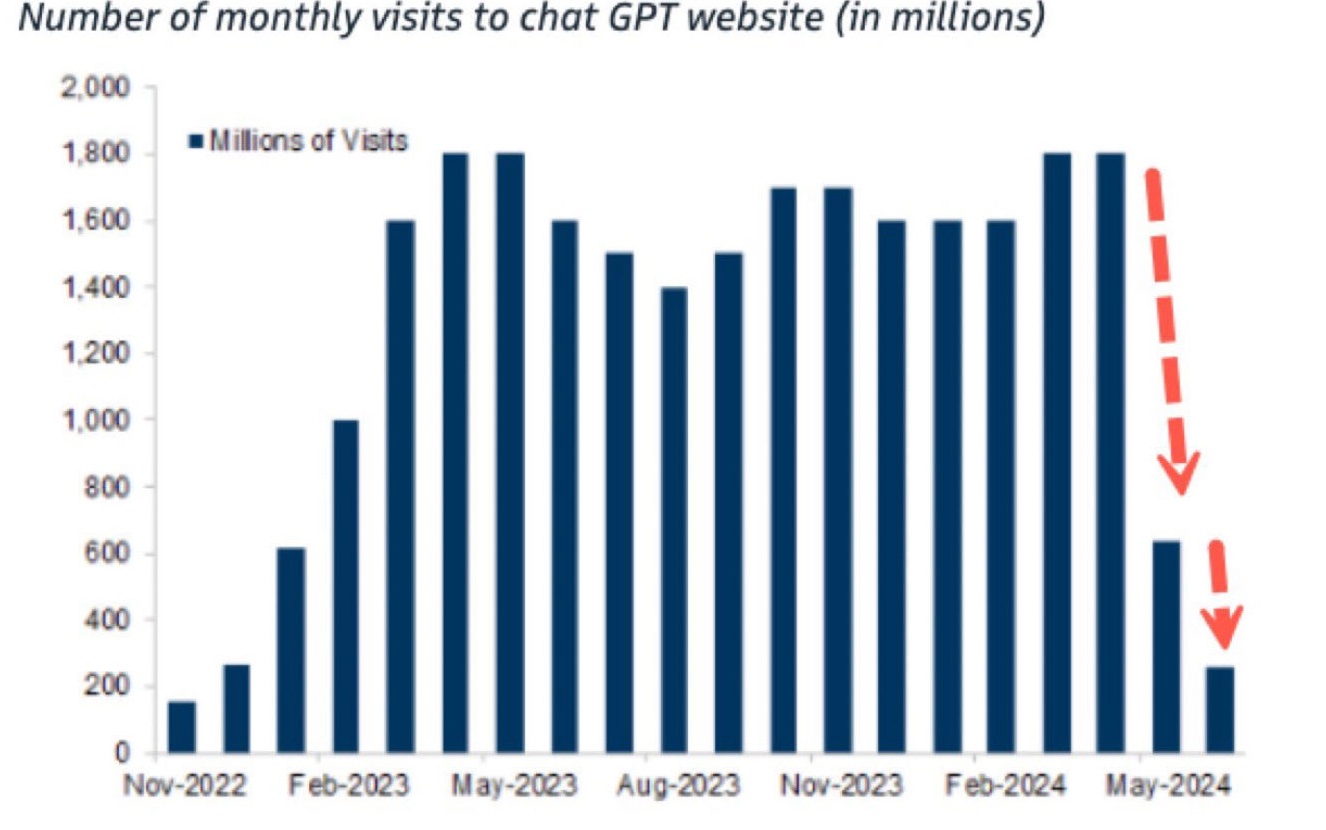

There have been rumors of a possible AI bubble as tech costs proceed to rise and Oppenheimer’s reviews indicated that the tide was about to show. Oppenheimer’s report relied on a graph that appeared to point that the variety of customers of OpenAI’s ChatGPT was declining.

Right here’s the graph that made Oppenheimer consider that ChatGPT was shedding customers.

In his evaluation of the graph, Oppenheimer mentioned, “Furthermore, the original ‘excitement’ about chat-GPT is fading in terms of monthly users (Exhibit 11). This does not mean, of course, that the growth rates in the industry will not be strong, but it does suggest that the next wave of beneficiaries may come from the new products and services that can be created on the back of these foundation models.”

Buyers questioning if it was time to take earnings or delay investing in OpenAI and associated shares have been spooked once they learn the report featured within the Monetary Instances. NVIDIA, which is closely depending on the way forward for AI, noticed its shares fall 4% on Friday, hitting their lowest level in weeks.

The issue although is that the graph Oppenheimer utilized in his report didn’t seize the truth of what was occurring. The decline in guests to speak.openai.com was not as a result of customers have been leaving ChatGPT. It was as a result of OpenAI was migrating the service to its new URL at chatgpt.com.

Similarweb, which tracks web site site visitors, famous that though there was a slight dip in ChatGPT site visitors in July, the pattern in ChatGPT customers continues to develop.

For the primary time since December 2023, ChatGPT confirmed a drop in month-over-month site visitors throughout July 2024. Nevertheless, as a testomony to the numerous progress of the OpenAI instrument, July’s site visitors nonetheless elevated by 74% year-over-year.https://t.co/dL9iz4jLT6 pic.twitter.com/ODcXb1BF6w

— Similarweb (@Similarweb) August 11, 2024

Not realizing that OpenAI was utilizing a brand new area for ChatGPT, Oppenheimer assumed that the nice instances may very well be over and his report’s impact on share costs was evident.

It’s an instance of how unstable the AI investor market is and the way inclined it’s to bulletins, rumors, and disinformation, albeit unintentional on this case.

OpenAI is eyeing new buyers with a $100B valuation in its sights and expects income of between $3.5 to $4.5 billion this 12 months. If it releases Strawberry within the fall, it might see a continuation of optimistic AI sentiment which may very well be excellent news for tech shares like NVIDIA.

California’s proposed SB 1047 AI security invoice is on Governor Newsom’s desk ready for him to both signal it into regulation or veto it. Workers at OpenAI, Anthropic, Google, Meta, and others got here out in help of the invoice in an open letter revealed yesterday.

Newsom’s choice might have an excellent larger impact on tech inventory costs than a misinterpret ChatGPT person graph.