Quick details about FreshBooksBeginning value: $19/month. Key options:

|

Our star score: 4.1 out of 5

FreshBooks is an accounting, invoicing and billing software program program designed for small companies. All pricing plans assist limitless invoices, estimates and expense monitoring, not like some opponents that cap the variety of invoices. The software program does provide fundamental accounting options like receipt scanning and fundamental experiences, however invoicing and billing are the place it actually shines. Companies with extra advanced accounting wants may have to have a look at FreshBooks opponents corresponding to QuickBooks.

On this article, I evaluation FreshBooks’ execs and cons, discover its most necessary options and advocate comparable accounting software program merchandise that might be just right for you if FreshBooks doesn’t.

FreshBooks’ pricing

FreshBooks gives 4 pricing plans. The primary three plans have clear pricing and are designed to satisfy the wants of freelancers and small and midsize companies. FreshBooks has an enterprise-level plan with customizable pricing and options, so that you’ll must contact the gross sales group for a pricing quote.

All FreshBooks plans include a 30-day free trial, which doesn’t require a bank card. FreshBooks runs frequent gross sales that lock in deep reductions on your first six months; nevertheless, you need to select between the introductory low cost and the free trial — you possibly can’t have each. That being mentioned, FreshBooks’ 30-day money-back assure ensures you gained’t must pay for the total six months in the event you resolve FreshBooks doesn’t be just right for you inside that first month.

| Plan particulars are updated as of 6/14/2024. | ||||

FreshBooks Lite

Value: Begins at $19 per thirty days

True to its identify, the FreshBooks Lite plan gives fundamental options which can be centered on invoicing. With this plan, you possibly can ship limitless invoices and estimates to as much as 5 shoppers. You possibly can observe limitless estimates, however this plan doesn’t assist cell receipt seize. You will get paid through credit score and ACH financial institution transfers and run experiences at tax time, however that’s about it. In case you want extra options or need to invoice extra shoppers, you’ll must improve to the Plus plan.

FreshBooks Plus

Value: Begins at $33 per thirty days

The FreshBooks Plus plan allows you to bill as much as 50 shoppers per thirty days. This plan consists of the whole lot in Lite, plus the power to arrange recurring invoices and shoppers, mechanically seize receipts and run monetary and accounting experiences. With this plan, it is possible for you to to ask your accountant to the platform, which might be an enormous assist come tax time.

FreshBooks Premium

Value: Begins at $60 per thirty days

The FreshBooks Premium plan permits you to ship limitless invoices to limitless shoppers, making it an appropriate alternative for midsize companies. This plan consists of the whole lot in Plus, along with automated invoice seize, customizable electronic mail templates with dynamic fields and challenge profitability monitoring.

FreshBooks Choose

Value: Customized pricing solely

FreshBooks Choose is designed for bigger companies and enterprises. You could contact the gross sales group for a customized pricing quote. This plan consists of the whole lot in Premium, plus entry to decrease transaction charges, the power to take away FreshBooks branding from emails and a devoted quantity for unique assist. This plan consists of two group seats as an alternative of only one.

Extra charges

FreshBooks customers can add the next options for a payment:

- Additional customers for $11 per particular person per thirty days.

- Superior fee acceptance for $20 per thirty days (included with Choose plan).

FreshBooks’s key options

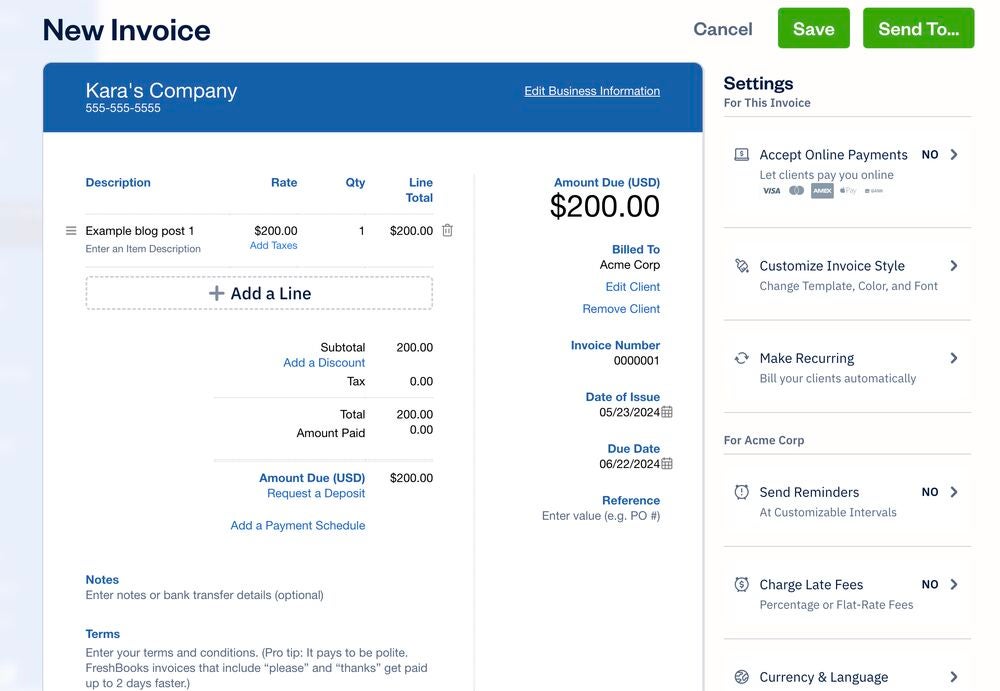

Limitless invoicing and estimates

Each FreshBooks plan consists of limitless invoices — this units it other than Xero’s most cost-effective plan, which limits customers to sending solely 20 invoices a month. There are two templates to select from, two fonts and a handful of colours. Personally, I might like to see extra choices than this restricted choice to permit for better customization, however it should suffice for many small companies.

The method to create and ship an estimate is equally easy, and you’ll convert it to an bill with a single click on after the shopper approves it. Extra invoicing options embrace automated recurring invoices, automated late charges for overdue invoices and automatic upcoming-payment reminders.

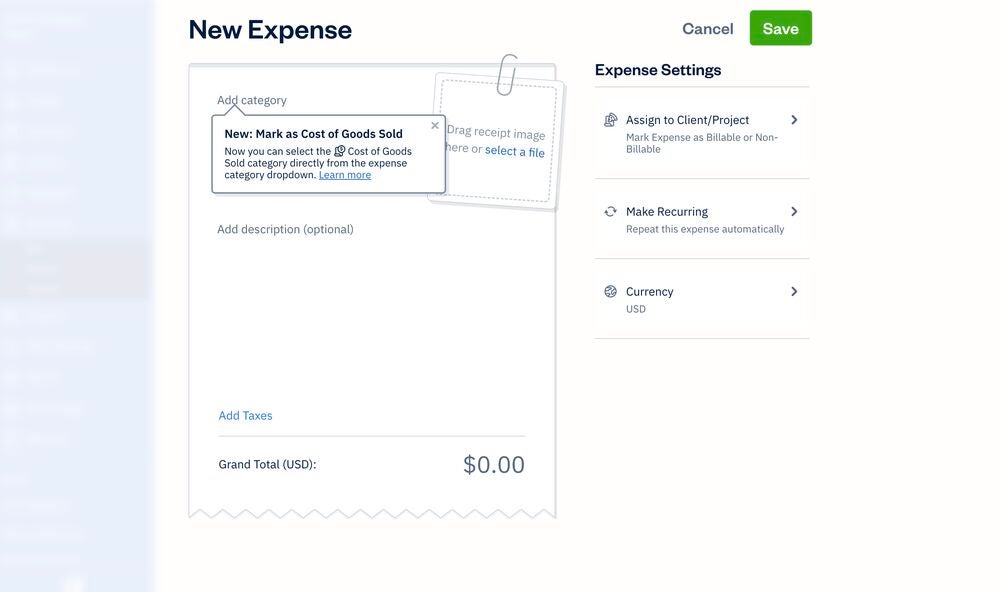

Expense monitoring and categorization

FreshBooks syncs with greater than 14,000 monetary establishments and mechanically imports your knowledge by way of a safe 128-bit SSL encryption. You add your bills or seize them utilizing the cell app, then assign them to shoppers and fix them to invoices for reimbursement. The software program will mechanically categorize bills to easily tax write-offs.

FreshBooks not too long ago launched a brand new function referred to as Journal Entries, which lets you observe transactions outdoors of Invoices and Bills, corresponding to depreciation or loans. You could allow Superior Accounting so as to have the ability to entry the Journal Entries function, so I solely advocate utilizing it in the event you’re conversant in barely extra advanced accounting options.

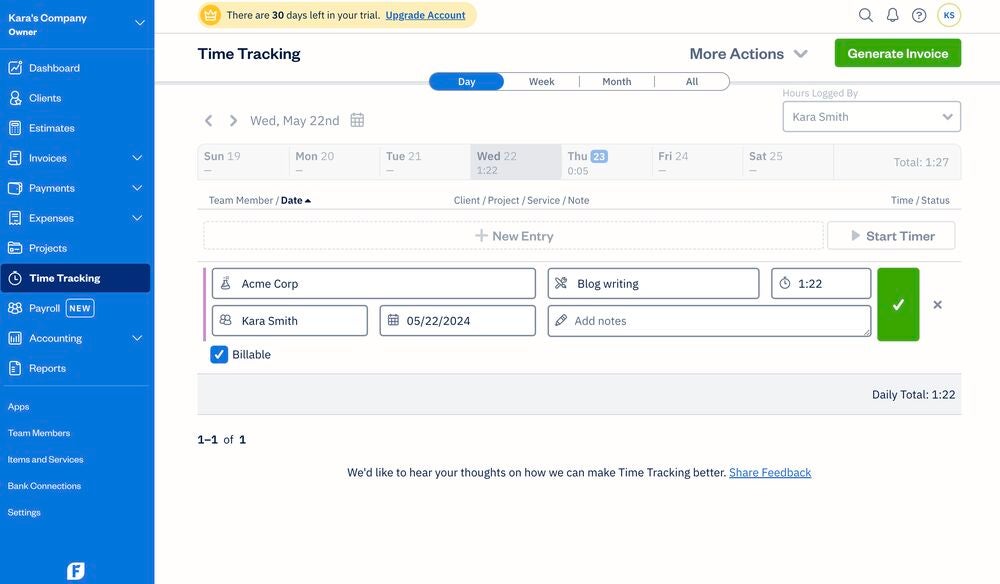

Time monitoring

FreshBooks gives a local time-tracking function so you possibly can observe billable hours and add line objects to invoices. I discovered the timer very straightforward and intuitive to function, and including a time entry after the actual fact was tremendous fast. All I needed to do was select the shopper, decide the date and add the service I used to be engaged on and the date I carried out the work.

While you’re able to invoice your shopper, hit the large inexperienced Generate Bill, and FreshBooks will stroll you thru the method. You possibly can add time entries as line objects proper from the invoicing instrument. As an employer, you possibly can type hours labored by shopper, group member, date and challenge to see how work time is being spent.

I really like that FreshBooks gives this native time-tracking function, not like many opponents that depend on third-party integrations. Nonetheless, the timer is fairly easy and doesn’t assist superior time monitoring like getting into specific billing codes for particular person jobs.

Fee acceptance

When you’ve despatched the bill, shoppers pays you one in all 3 ways: FreshBooks funds, Stripe and PayPal. All of those strategies cost a typical payment of two.9% + $0.30 per transaction for many playing cards and 1% for direct financial institution ACH transfers. Subscribers to the FreshBooks Choose plan will get even decrease transaction charges, however FreshBooks doesn’t disclose what that lowered price is.

The non-obligatory Superior Funds add-ons let your enterprise settle for bank card funds over the telephone. It prices $20 per thirty days for the three most cost-effective plans and is included on the Choose plan. This function additionally allows you to arrange recurring billing profiles for shoppers you’re employed with commonly.

FreshBooks execs

- Constructed-in time and challenge monitoring: All FreshBooks plans include native time and challenge monitoring, so you possibly can sync the information straight to your invoices.

- Extremely rated cell accounting apps: With FreshBooks’ iOS and Android apps, customers can create invoices, scan receipts and observe mileage on the go. The iOS app scores 4.7/5 on the App Retailer, whereas the Android app charges 4.5/5 on Google Play.

- Consumer-friendly interface: Each the cell and net apps are user-friendly and intuitive, with setup solely taking a couple of minutes.

- Payroll integration: FreshBooks gives an non-obligatory payroll add-on that’s powered by Gusto, one of the widespread software program choices on the market. You could contact the gross sales group for pricing data.

FreshBooks cons

- Least expensive plan limitations: FreshBooks Lite doesn’t embrace free accountant entry, double-entry accounting or financial institution reconciliation, not like many shut opponents.

- Price for extra customers: Extra customers for FreshBooks price an additional $11 per particular person per thirty days. For context, Zoho Books prices simply $3 per further person per thirty days.

- Primary stock monitoring solely: FreshBooks has solely fundamental built-in stock administration options, although you possibly can combine it with some third-party integration monitoring software program.

- Restricted scalability: Though FreshBooks gives a customizable plan for greater companies, its streamlined options work a lot better for small and midsize companies. Its comparatively restricted choice of third-party integrations gives much less flexibility for greater firms.

Options to FreshBooks

Xero: Greatest for product-based companies

Our star score: 4.4 out of 5

Beginning value: $15 per thirty days

Xero’s key options

Xero accounting software program is designed for freelancers and small and midsize enterprise house owners. It gives easy instruments for sending invoices, accepting funds and monitoring funds. It really works with Hubdoc, so you possibly can add payments and receipts for simpler monetary administration.

Not like FreshBooks, Xero consists of stock monitoring with each plan. It allows you to add as many customers as you need at no extra price, although every subscription is proscribed to at least one group, so it’s not the only option for enterprise house owners with a number of firms.

Xero’s execs

- Integration with greater than 1,000 third-party apps.

- Consumer-friendly software program interface and cell app.

- Automated recurring invoicing.

- Financial institution reconciliation, accountant entry and limitless shoppers in all plans.

Xero’s cons

- Least expensive plan limits you to twenty invoices and 5 payments per thirty days.

- Expense and challenge monitoring solely obtainable in the costliest plan.

- 24/7 assist solely obtainable through dwell chat — no phone quantity.

Study extra about how FreshBooks and Xero examine in our complete evaluation of FreshBooks vs. Xero, and skim our Xero evaluation.

QuickBooks On-line: Greatest for rising companies

Our star score: 4.6 out of 5

Beginning value: $30 per thirty days

QuickBooks On-line’s key options

Intuit QuickBooks On-line is without doubt one of the hottest accounting software program of all time. Its plans assist companies of all sizes, from self-employed freelancers and contractors to enterprises. With QuickBooks, you possibly can observe bills, ship a vast variety of invoices per thirty days, settle for funds on-line and generate estimates.

QuickBooks On-line has extra bookkeeping and accounting options than FreshBooks, particularly on the upper tier plans. In case you’re keen to pay for them, QuickBooks’ costlier plans provide superior options like invoice administration, challenge profitability monitoring and stock administration.

QuickBooks On-line’s execs

- Accountant entry, financial institution reconciliation and double-entry accounting.

- Mileage monitoring, revenue monitoring and tax categorization.

- Extraordinarily scalable plans.

- Superior accounting options obtainable.

QuickBooks On-line’s cons

- A lot increased beginning value than most opponents.

- Variety of customers restricted on every plan.

- Poor customer support repute.

Study extra about how QuickBooks On-line and FreshBooks examine in our complete evaluation of QuickBooks vs. FreshBooks, and skim our QuickBooks On-line evaluation.

Wave Accounting: Greatest free accounting software program

Our star score: 4 out of 5

Beginning value: $0 per thirty days

Wave’s key options

Wave Accounting is without doubt one of the solely accounting software program that provides a totally free plan. Nonetheless, a number of the most useful options, corresponding to automated financial institution transaction import and cell receipt seize, are restricted to the Professional paid plan, which prices $16 a month.

A lot of Wave’s options overlap with FreshBooks’, together with its customizable invoicing instrument, expense monitoring and on-line fee bills. Not like FreshBooks, Wave makes use of double-entry accounting. With Wave’s paid plan, you possibly can add a vast variety of customers and extra totally automate your revenue monitoring.

Wave’s execs

- Free endlessly plan obtainable.

- Useful accounting app for each iOS and Android.

- Seamless integration with Wave Payroll.

Wave’s cons

- No stock administration, time monitoring or challenge monitoring.

- Restricted third-party integrations.

- Much less scalable than opponents.

Study extra about how Wave Accounting and FreshBooks examine in our complete evaluation of Wave Accounting vs. FreshBooks and take a look at our Wave Accounting evaluation.

Overview methodology

To guage FreshBooks, I arrange a free account, considered a demo and created invoices throughout the software program as a part of our hands-on check challenge. I rigorously thought-about person opinions from trusted third-party websites. Options that I prioritized included invoicing, billing, costly monitoring, time monitoring and fee acceptance. I thought-about pricing, ease of use and customer support in the course of the writing of this evaluation.