The six finest worldwide service provider accounts are:

A global service provider account permits companies to just accept cashless funds corresponding to bank cards, digital checks, and ACH from clients throughout the globe. It manages a number of currencies via a community of partnerships with native processors in several international locations.

Again within the day, companies with worldwide shoppers had been largely giant B2Bs. Nevertheless, with new enterprise fashions like dropshipping and software program as a service (SaaS), companies of all sizes may have a world service provider account. This information explores the various worldwide service provider account choices available in the market right this moment.

High worldwide service provider account comparability

Beneath is a abstract of our advisable worldwide service provider account suppliers and their key options:

| Stripe | |||||

| Chase | |||||

| Helcim | |||||

| Authorize.web | |||||

| Braintree | |||||

| PayPal |

Stripe: Finest general

Our score: 4.77 out of 5

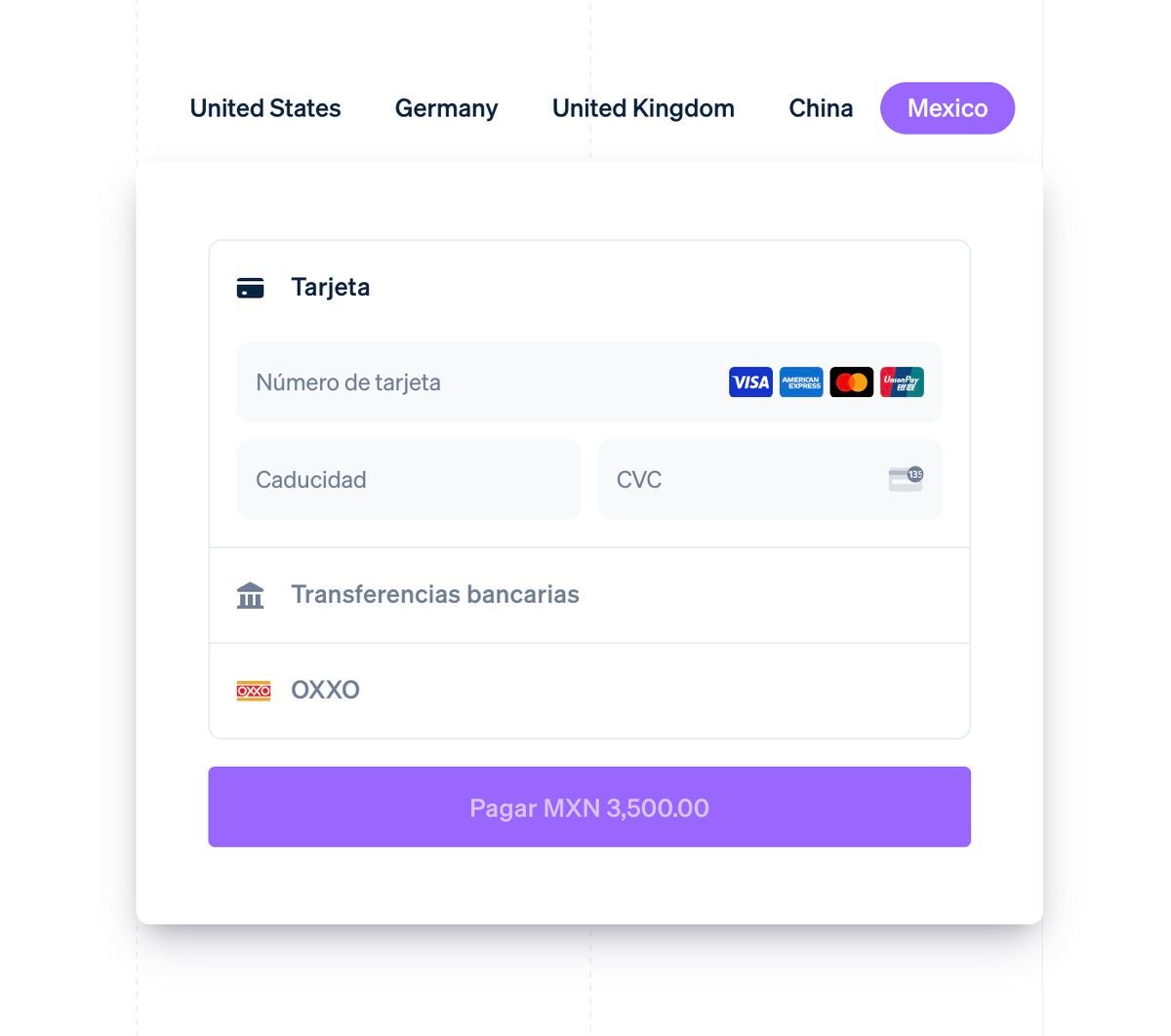

Stripe is a developer-friendly fee processor and service provider service supplier. It’s widespread within the fee business for its extremely customizable on-line fee providers and well-documented open-source APIs.

Whereas it provides some no-code customization choices, its back-end flexibility makes Stripe one of the vital scalable fee options available in the market. A lot in order that main on-line platforms corresponding to Shopify use Stripe to energy their fee processing service.

Stripe is for you if you’re tech-savvy and need a extremely personalized on-line fee resolution designed to maximise effectivity.

Why I selected Stripe

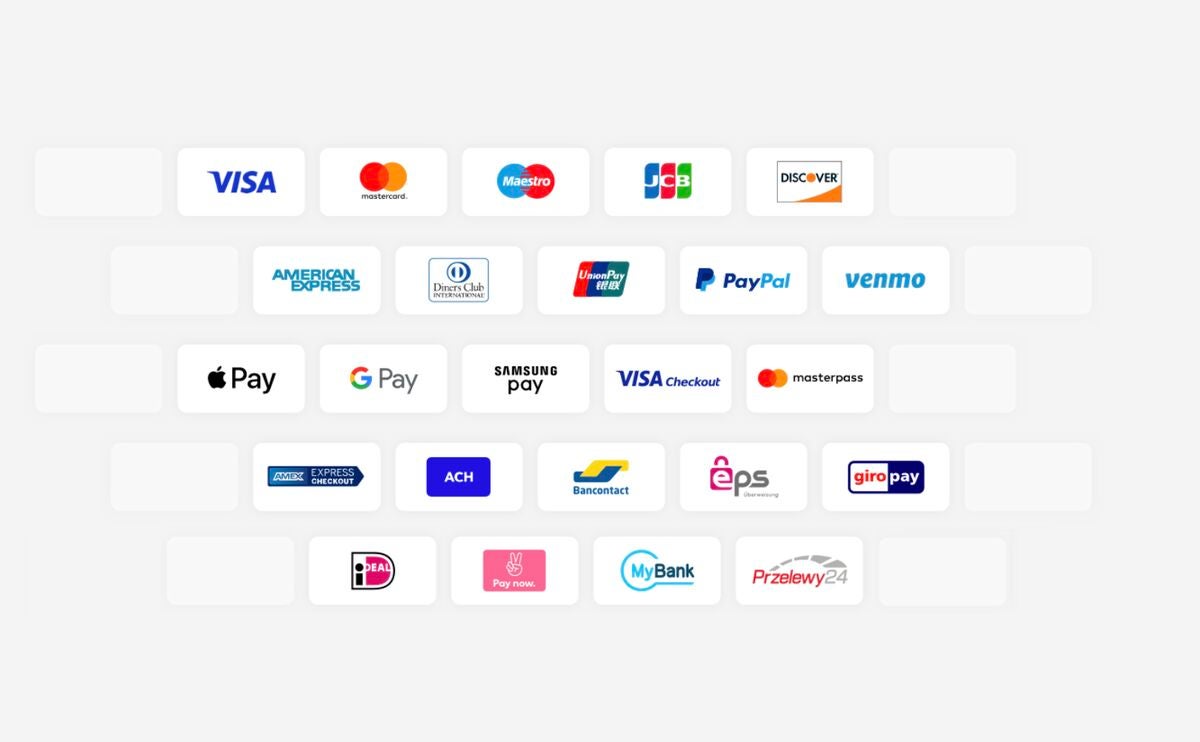

Stripe permits you to settle for bank cards, ACH, and an extended checklist of native fee sorts for over 47 international locations. It helps over 135 currencies and harnesses its highly effective developer instruments to create superior on-line fee options corresponding to adaptive pricing and language customization.

Pricing

- Month-to-month account payment: $0-$10 per thirty days.

- On-line transaction payment: 2.9% + $0.30.

- Keyed-in transaction payment: 3.4% + $0.30.

- Crossborder payment: 1.5%.

- Forex conversion unfold: 1%.

- ACH/Echeck payment: 0.8%, $5 cap (ACH).

- Cost gateway payment: $0.

- Digital terminal payment: $0.

- Similar-day funding: 1.5%.

- Chargeback payment: $15.

- Quantity low cost: Greater than $250,000/12 months in card gross sales.

Options

- Helps greater than 135 currencies.

- Integrates with quite a lot of native fee strategies in 47 international locations.

- Supplies 660 third occasion integrations and 450 platform extensions.

- Machine-learning safety and fraud administration instruments.

Professionals and cons

|

|

Chase Cost Options: Finest for multicurrency administration

Our score: 4.66 out of 5

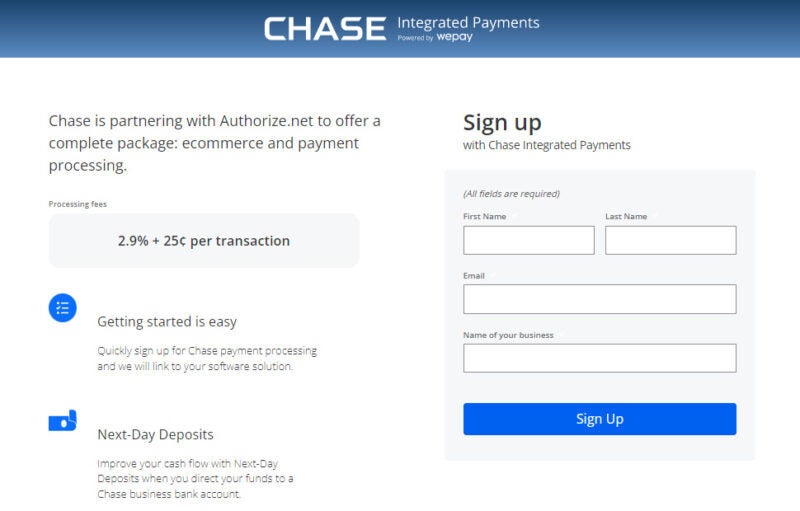

Chase Cost Options is the service provider providers arm of banking big Chase. Not like many bigger monetary establishments, Chase supplies service provider accounts on to small, mid-size, and enterprise-level companies.

If you need seamless multicurrency conversion to avoid wasting on charges, Chase is a good possibility. Your clients pays of their native forex, and also you obtain the proceeds in your personal forex via an area Chase financial institution, avoiding double forex conversion prices.

Why I selected Chase

Only a few main banking establishments would supply their service provider providers on to companies like Chase does. With long-standing banking companions world wide, Chase is in a singular place to supply worldwide retailers with seamless multicurrency administration options, larger cross-border authorization charges, decrease charges, and quicker funding at no further price.

Pricing

- Month-to-month account payment: $0-$15.

- On-line transaction payment: 2.9% + 25 cents.

- Keyed-in transaction payment: 3.5% + 10 cents.

- Crossborder payment: Interchange charges.

- Forex conversion unfold: varies.

- ACH/Echeck payment: $2.50 for the primary 10 transactions, 15 cents for added (ACH).

- Cost gateway payment: $0-$9.95.

- Digital terminal payment: $0.

- Similar-day funding: Free for Chase enterprise financial institution holders.

- Chargeback payment: $25-$100.

- Quantity low cost: Customized interchange plus charges.

Options

- Direct processor providing conventional worldwide service provider account.

- Favorable change charges and decrease conversion price.

- Finish-to-end multicurrency administration options.

- Customizable fee providers and charges for large-volume companies.

Professionals and cons

|

|

Helcim: Finest for minimizing fee processing price

Our score: 4.61 out of 5

Helcim is a conventional service provider account providers supplier and fee processor. It provides interchange plus charges with automated quantity reductions and free entry to all of Helcim’s fee providers — fee gateway, digital terminal, invoicing, subscription administration, ecommerce, and cellular app.

Whereas it doesn’t present a listing of supported currencies, Helcim claims to have the ability to settle for bank cards from “almost anywhere in the world.” There are not any crossborder charges besides interchange imposed by the cardboard community, and clients are charged based mostly on the service provider’s native forex.

Why I selected Helcim

Helcim’s multicurrency administration function is proscribed, however it’s the only option for these seeking to maintain their transaction prices low. All of Helcim’s payment administration applications are automated, from quantity reductions, stage 2 and three knowledge optimization for B2Bs, to its payment saver service (surcharging and comfort charges).

Pricing

- Month-to-month account payment: $0.

- Card-not-present payment: Interchange plus 0.15% + 15 cents to 0.50% + 25 cents.

- Crossborder payment: Interchange imposed by card community.

- Forex conversion unfold: 1%.

- ACH/Echeck payment: 0.5% + 25 cents (ACH).

- Cost gateway payment: $0.

- Digital terminal payment: $0.

- Similar-day funding: N/A.

- Chargeback payment: $15 refundable.

- Quantity low cost: Automated quantity reductions.

Options

- Supplies varied free cost-saving options.

- Free service provider account and entry to all of Helcim’s fee providers.

- Worldwide funds for each card-present and card-not-present transactions.

- Supplies companies with steady, conventional service provider accounts.

Professionals and cons

|

|

Authorize.web: Finest for fee gateway integration

Our score: 4.61 out of 5

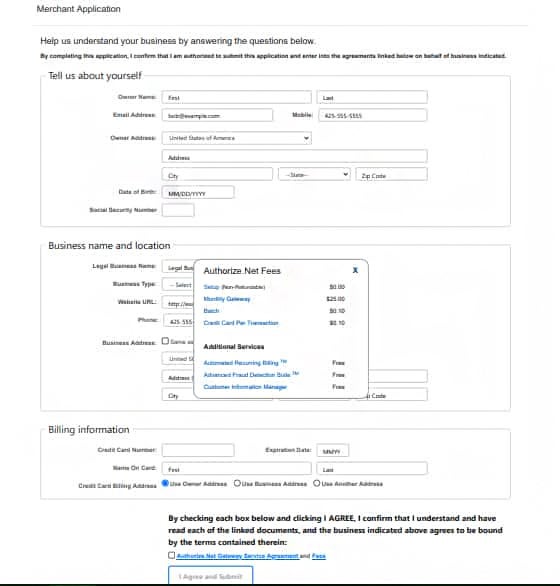

Authorize.web is a well-established fee gateway supplier within the business and is widespread for its on-line fee options. Owned by Visa, Authorize.web boasts of an extended checklist of service provider service partnerships (together with worldwide service provider account suppliers like TSYS, WorldPay, and Chase) that may readily combine Authorize.web’s platform into their system.

Authorize.web securely captures and transmits buyer fee knowledge via fee kinds for various transaction sorts corresponding to invoicing, ecommerce, and stage 2 and three optimization for B2Bs.

Why I selected Authorize.web

Authorize.web provides distinctive assist for worldwide service provider accounts with its lengthy checklist of service provider service partnerships. You possibly can maintain utilizing your Authorize.web account even should you migrate to a distinct service provider service supplier to get higher charges. Don’t have a world service provider account but? Authorize.web will select one among its companions to set you up with a service provider account software.

Pricing

- Month-to-month account payment: $25 (could be decrease should you enroll via a service provider account supplier).

- On-line transaction payment: 2.9% + 30 cents.

- Keyed-in transaction payment: 2.9% + 30 cents.

- Crossborder payment: 1.5%.

- Forex conversion unfold: varies.

- ACH/Echeck payment: 0.75% per transaction.

- Cost gateway payment: $0.

- Digital terminal payment: $0.

- Similar-day funding: Free (inside 24 hours).

- Chargeback payment: $25.

- Quantity low cost: Will depend on service provider account supplier.

Options

- Integrates with many service provider account service suppliers.

- Customizable safe on-line fee kinds.

- Helps stage 2 and three knowledge optimization for B2B companies.

- Funding obtainable inside 24 hours at no further price.

Professionals and cons

|

|

Braintree: Finest for nonprofits

Our score: 4.53 out of 5

Braintree is a web-based fee processor acquired by PayPal in 2013. Like Helcim, it supplies companies with a conventional service provider account that provides extra stability because it’s much less liable to account holds. However when it comes to options, Braintree is extra just like Stripe, as there are lots of customization potentialities obtainable to customers via developer-based integrations designs.

Braintree provides discounted charges to nonprofits and whereas this isn’t distinctive, it must also be identified that Braintree’s on-line flat fee payment is among the many most cost-effective available in the market.

Why I selected Braintree

Braintree isn’t any slouch in terms of multicurrency funds. It could actually course of greater than 130 currencies from 45 international locations world wide and works with native banks to make sure the bottom crossborder charges. So paired with discounted charges for certified Nonprofit 501(c)(3) transactions and low flat fee on-line charges for easy donations, Braintree is a top quality selection for on-line nonprofits with world donors.

Pricing

- Month-to-month account payment: $0.

- On-line transaction payment: 2.59% + 49 cents.

- Keyed-in transaction payment: 2.59% + 49 cents.

- Crossborder payment: 1%.

- Forex conversion unfold: 1%.

- ACH/Echeck payment: 0.75%, $5 cap (ACH).

- Cost gateway payment: $0.

- Digital terminal payment: $0.

- Similar-day funding: PayPal Hyperwallet.

- Chargeback payment: $15.

- Quantity low cost: Interchange plus fee for large-volume companies.

Options

- A number of forex settlement choices for worldwide funds.

- Supplies a steady devoted service provider account.

- Among the many lowest flat fee on-line transaction charges.

- Contains free on-line fee gateway and digital terminal instruments.

Professionals and cons

|

|

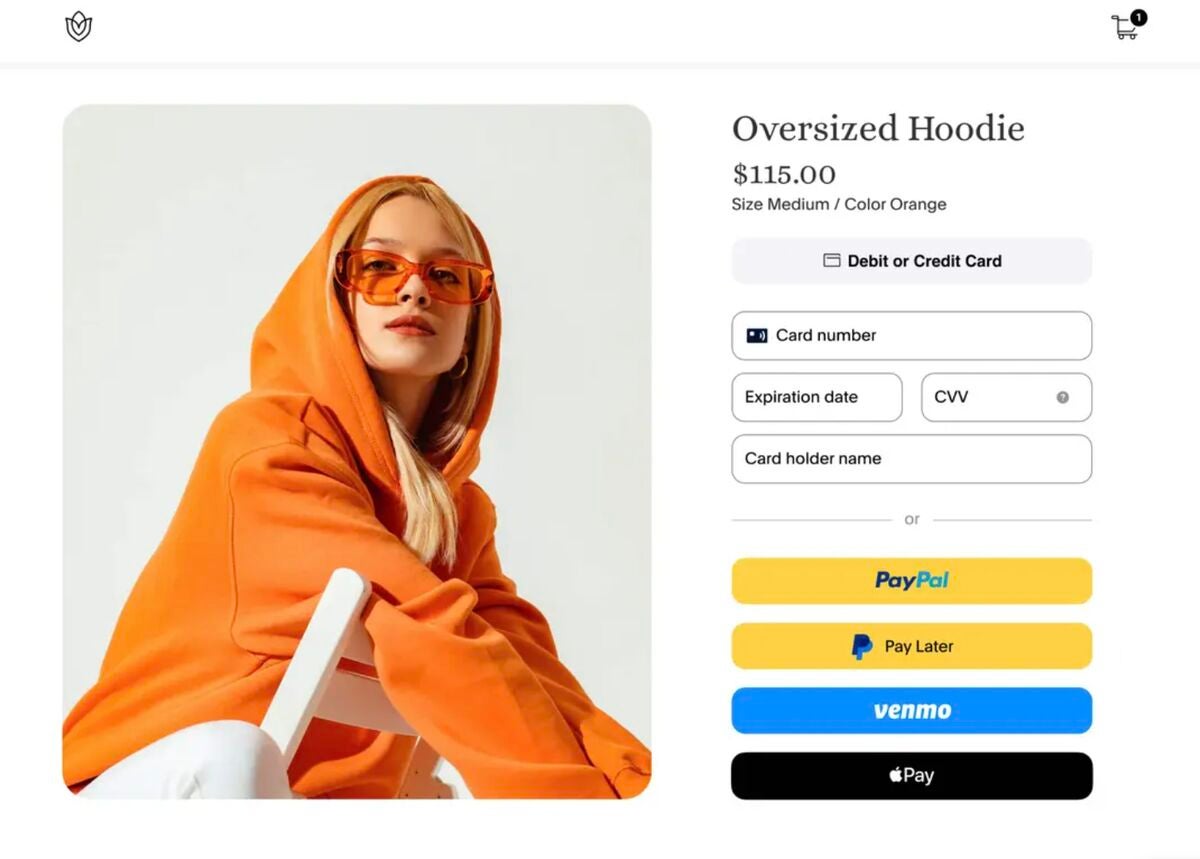

PayPal: Finest for accepting PayPal funds

Our score: 4.4 out of 5

PayPal helped launch the ecommerce market when it first got here out with its shopper digital pockets within the Nineties. This made it doable for customers to ship and obtain cash anyplace on this planet via the PayPal app.

Ultimately PayPal opened its providers to companies, permitting retailers to just accept funds from anybody, anyplace so long as they’ve a PayPal account. This interprets to over 100 currencies obtainable to greater than 400 million shopper and service provider accounts being served by the platform. PayPal has constructed partnerships with quite a lot of native banks and digital wallets.

Why I selected PayPal

What makes PayPal distinctive is its means to work alongside different fee processors. PayPal integrates with any ecommerce checkout platforms as an add-on fee methodology. And with 400 million PayPal customers world wide, it gained’t harm having a PayPal checkout possibility in your web site to develop your worldwide shoppers.

Pricing

- Month-to-month account payment: $0.

- On-line transaction payment: 2.59% + $0.49.

- Keyed-in transaction payment: 3.49% + $0.49.

- Crossborder payment: 1.5%.

- Forex conversion unfold: 4%.

- ACH/Echeck payment: 3.49% + 49 cents, $300 cap (E-check).

- Cost gateway payment: $0-$25 per thirty days.

- Digital terminal payment: $$30 per thirty days.

- Similar-day funding: 1.5%.

- Chargeback payment: $20 (for visitor checkouts).

- Quantity low cost: Customized interchange plus charges for enterprise accounts.

Options

- Extensive number of fee strategies together with distinctive PayPal checkout.

- Easy and superior fee gateway customization instruments.

- Quite a few partnerships with native banks and widespread on-line fee strategies.

- Pre-built integration with widespread ecommerce platforms.

Professionals and cons

|

|

How do I select the most effective worldwide service provider account for my enterprise?

Selecting the best worldwide service provider account supplier ought to focus on discovering the choice that helps your present enterprise objectives. So whereas each supplier in our checklist provides a variety of fee strategies and stage 1 PCI compliance, the important thing options under present the place every system stands out essentially the most.

Finest value-for-money

Whereas it’s straightforward to be impressed with a supplier that carries all of the bells and whistles, it might not be smart to be paying for a service that your corporation doesn’t at the moment want. On the identical time, the supplier with the most cost effective charges might not be the only option if you need to pay add-on charges to entry key fee options for your corporation.

Helcim is a transparent selection if you wish to have entry to many fee service options whereas retaining your charges low. Braintree’s low transaction charges, zero add-on price, and versatile on-line fee gateway instruments can also be an incredible possibility.

Multicurrency administration

With the ability to course of a number of currencies must be a core function (not an add-on) when selecting a world service provider account service. Contemplate the areas the place your goal clients are situated and ensure these are included within the supplier’s checklist of supported international locations and currencies. Suppliers that assist native fee strategies will even provide help to decrease cross border charges.

Stripe, Chase, and PayPal lead our checklist of suggestions for managing multicurrency transactions with their many banking partnerships world wide.

Customizability and scalability

Once you join a worldwide service provider account, the aim must be that it may well tailor their fee providers to match your corporation wants. This implies with the ability to customise your checkout pages with a number of languages, combine essential instruments corresponding to delivery administration into the checkout course of, and extra.

Stripe and Braintree are clear standouts for customizability in our checklist. Select Authorize.web should you want a world fee gateway that you may proceed to make use of even should you resolve to alter service provider account suppliers.

Safety and fraud prevention

Among the riskiest sorts of non-cash transactions contain accepting on-line and cross-border funds. That’s why, except for guaranteeing that the supplier is PCI compliant, you’ll want to customise your fraud prevention instruments and have a option to monitor and reply to chargebacks on the identical platform.

All of our advisable worldwide fee processing corporations are PCI compliant, however Stripe stands out for its extremely customizable fraud prevention instruments.

Methodology

To construct this information, I put collectively an preliminary checklist of 14 widespread worldwide service provider account suppliers within the business, together with:

- PayPal.

- Stripe.

- Helcim.

- PaymentCloud.

- Chase Cost Options.

- Authorize.web.

- Braintree.

- Durango Service provider Companies.

- Amazon Pay.

- 2Checkout.

- WorldPay.

- Adyen.

- Smart.

- Clearly Funds.

From there, I evaluated every service in opposition to 4 standards and 21 knowledge factors, specializing in pricing, fee providers, and account options.

The scores had been based mostly on my private expertise exploring and testing every platform (when doable), plus suggestions from real-life customers that I gathered from respected assessment websites. I additionally requested our fee and know-how specialists to weigh in on their data of every supplier’s benefits and downsides.

After cautious analysis, I narrowed down my decisions to the highest 6 that stood out as the most effective suggestions for quite a lot of enterprise wants.

This text and methodology had been reviewed by our retail knowledgeable, Meaghan Brophy