Service provider providers are just like fee processors, however their largest benefit is the supply of a devoted service provider account, not like processors, which often supply combination providers.

A devoted service provider account affords larger account stability, that means you gained’t expertise frozen funds or accounts on account of modifications in fee and processing volumes.

Furthermore, the most effective service provider account suppliers supply aggressive charges and versatile options for processing in-person and on-line funds.

Prime service provider providers comparability

Processing charges are a key deciding issue when selecting the most effective service provider service for your online business. The desk under illustrates the month-to-month charges, per-transaction charges, and price construction for every of our advisable service provider providers.

Don’t want a devoted service provider account? See our roundup of the finest fee processors, which incorporates combination processors like Sq..

Pricing buildings defined

- Interchange plus: The processor passes alongside the precise charges from the bank card networks, including a small markup on high. This ends in extra variable charges for the reason that charges from the networks differ relying on card sort and transaction sort. Nevertheless, the result’s often decrease charges general.

- Fats-rate: The processor fees the identical pre-set price for each transaction. This mannequin is easy and predictable, ultimate for brand new companies. Nevertheless, it’d lead to barely larger charges, particularly for bigger companies.

- Subscription: Just like an interchange-plus mannequin, however the processor fees a month-to-month price and decrease per-transaction charges. This mannequin, whereas cost-prohibitive for small companies, usually affords a whole lot of financial savings for giant companies.

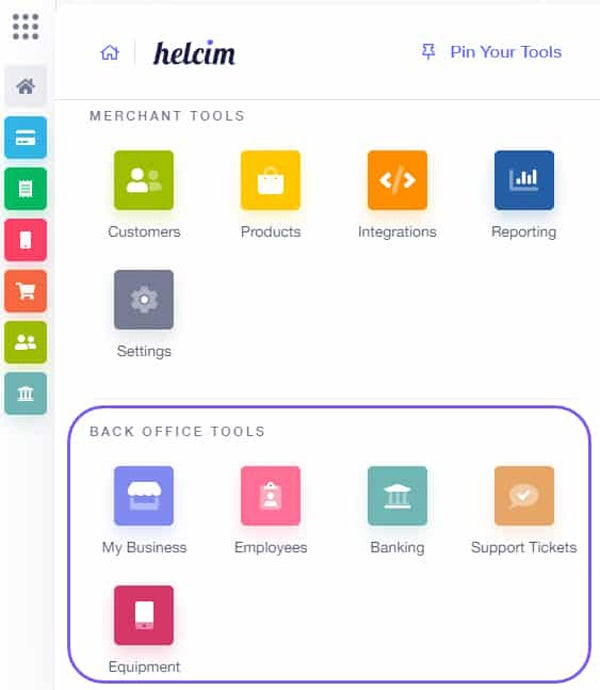

Helcim: Finest general

Our ranking: 4.61 out of 5

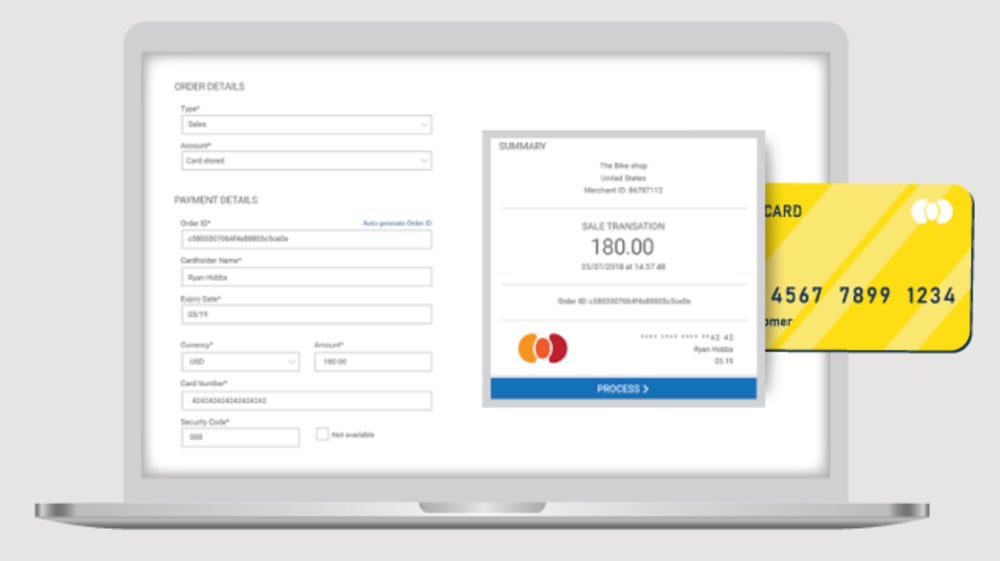

Helcim has an automatic quantity low cost and interchange-plus pricing mannequin with no month-to-month charges, which is a uncommon discover for a devoted service provider account. You may take into account it an all-in-one service provider account supplier. Along with inexpensive charges, it helps a variety of fee choices, together with Degree 2 and three bank card knowledge processing for B2B funds.

Why I selected Helcim

Companies of all sizes will discover Helcim’s interchange-plus pricing, automated quantity reductions, and zero-cost processing a really inexpensive choice. I’ve evaluated dozens of service provider service suppliers, and Helcim’s number of fee strategies is among the many finest out there. It will probably help a variety of industries, too. Actual-world consumer suggestions additionally praises its high-quality buyer help.

Pricing

- Month-to-month price: $0

- Cost processing charges:

- Interchange plus 0.15-0.4% and 6-8 cents per card-present transactions.

- Interchange plus 0.15%-0.50% and 15-25 cents per card-not-present transactions.

- 0.10% + 10 cents per transaction American Categorical surcharge charges.

- 0.5% plus 25 cents, capped at $6/transaction, $5 return price for ACH funds.

Options

- Interchange-plus pricing with automated quantity reductions.

- Hosted fee pages.

- Cell fee app.

- Digital terminal.

- Guided chargeback dispute decision.

- Price Saver Program – a zero-cost processing program that helps on-line, bill, and in-person funds. Helcim routinely detects the free bank card processing program accessible to make use of based mostly on the cardboard sort/community and enterprise location.

Execs and cons

| Execs | Cons |

|---|---|

|

|

PaymentCloud: Finest for high-risk companies

Our ranking: 4.56 out of 5

PaymentCloud offers conventional service provider providers along with high-risk service provider account providers. Nevertheless, it’s best recognized for high-risk fee processing as a result of it has a superb fame for getting companies permitted. PaymentCloud integrates with all fee gateways, so you should use your most popular gateway, or it will possibly assist you discover a extra suitable gateway answer for your online business.

Why I selected PaymentCloud

What I like about PaymentCloud is that it takes a really hands-on method to getting you permitted with associate banks and works with a number of fee processors to get you the bottom charges. The corporate companions with ten banks and has a 98% approval fee.

PaymentCloud can seemingly approve you even when different service provider account suppliers have rejected your utility. After approval, it helps with onboarding, resembling establishing superior fraud/filtering in your fee gateway.

Pricing

- Month-to-month charges: $10-$45

- Transaction charges:

- 2%-3.1% for low-risk transactions

- 2.3%-3.4% for medium-risk transactions

- 2.7%-4.3% for high-risk transactions

- Different charges:

- $25 chargeback price

- Common $15/month for fee gateway

- $15-$45/month for digital terminal

- 1%-2% cross-border charges

Options

- Helps medium- to high-risk companies — tobacco, e-cigarettes, topical CBD, electronics, dropshipping, bail bonds, firearms, and extra.

- Accepts cryptocurrencies.

- Choices for POS techniques and full EMV bank card terminals.

- Sturdy dispute decision help with Chargeback Gurus.

- Fraud detection instruments like Tackle Verification System (AVS) know-how, tokenization, P2PE knowledge encryption, and 3D Safe know-how.

Execs and cons

| Execs | Cons |

|---|---|

|

|

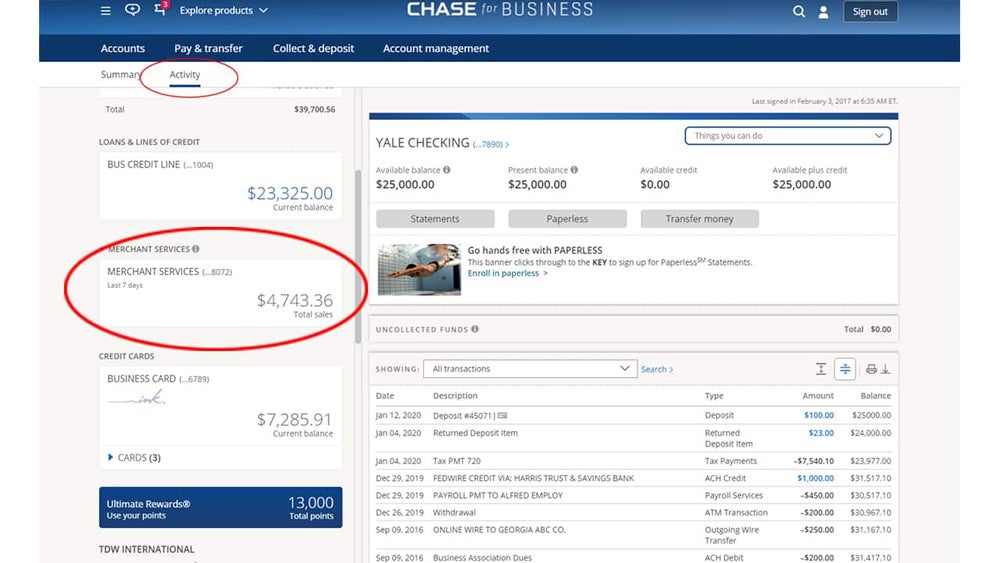

Chase Cost Options: Finest direct processor

Our ranking: 4.55 out of 5

Chase is a famend banking and monetary establishment that additionally affords a service provider account service, Chase Cost Options. What units Chase other than different suppliers is that it will possibly leverage its robust banking infrastructure to supply higher transaction charges, quicker fund transfers, strong insights, and stable safety.

Why I selected Chase Cost Options

I like that Chase can supply customized interchange-plus charges for certified retailers — it’s truly one of many few direct processors that may rival the charges Helcim affords small companies. In the end, to totally get pleasure from all of Chase’s options, you’ll want a Chase enterprise checking account. Having Chase as each the processor and receiving financial institution in transactions can present higher pace and safety due to the shortage of an middleman.

Pricing

- Month-to-month price: $0

- Cost processing charges:

- 2.6% plus 10 cents for in-person transactions.

- 2.9% plus 25 cents for on-line transactions.

- ACH processing charges:

- 1% (capped at $25), non reversible, for actual time deposits.

- 1% (capped at $25), reversible, for same-day deposits.

- $2.50 for the primary 10 transactions, 15 cents for extra, reversible, for traditional deposits (1-2 enterprise days).

- Different price:

Options

- Direct processor.

- Free service provider account.

- Free same- and next-day funding.

- Superior analytics that supply distinctive insights (Chase Buyer Insights).

- Fast Settle for cell app for in particular person and over-the-phone funds.

- Chargeback and threat monitoring.

Execs and cons

| Execs | Cons |

|---|---|

|

|

Dharma: Finest for transparency

Our ranking: 4.45 out of 5

Dharma affords low-cost interchange-plus pricing, with quantity reductions for retailers processing greater than $100,000 or 5,000 transactions. General, Dharma is a well known processor with a superb fame for equity and transparency.

It additionally affords versatile {hardware} choices and accounts and help for a wide range of enterprise sorts, together with retail, eating places, in-person, and on-line companies.

Why I selected Dharma

Dharma is thought for being very clear in pricing, with each price listed on its web site. Dharma makes a speciality of serving to nonprofits, having donated over $750,000 to nonprofits. It has one of many lowest charges for card-not-present transactions. If your online business processes at the very least $10,000 in month-to-month bank card transactions, Dharma is an effective answer for you.

Pricing

- Month-to-month price: $15

- Cost processing charges:

- Interchange plus 0.15% + 8 cents for in-person transactions.

- Interchange plus 0.20% + 11 cents for on-line transactions.

- Interchange plus 0.25% + 8 cents for in-person American Categorical transactions.

- Interchange plus 0.30% + 11 cents for on-line American Categorical transactions.

*Reductions accessible for retailers processing over $100,000 monthly, over 5,000 transactions monthly.

- Different charges:

- $49 for account closure.

- $25 chargeback price.

- $39.95 monthly if not PCI compliant.

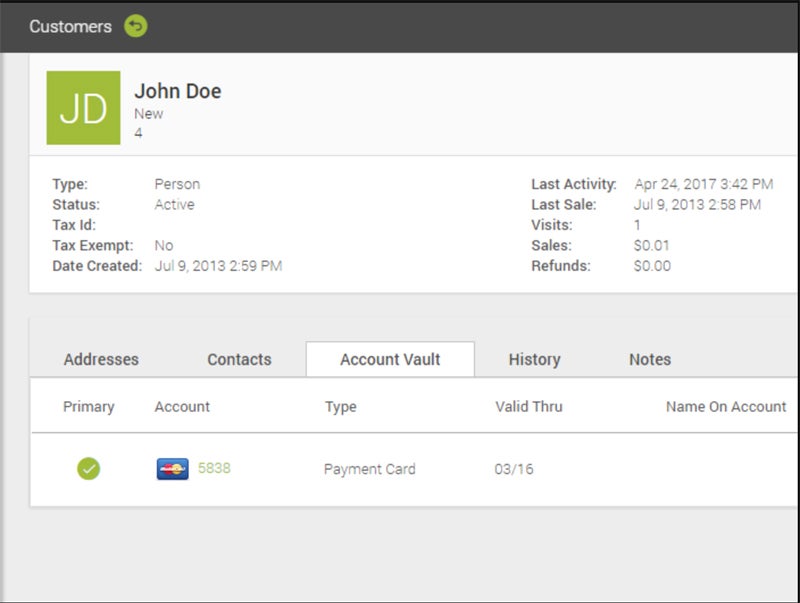

Options

- Versatile, works with a number of POS techniques resembling Clover, Aloha, Lava, and Shopify.

- Free digital terminal and cell POS.

- Offline processing.

- Surcharging from the MX Service provider platform (MX Benefit).

- Sturdy on-line reporting.

- Buyer database with card-on-file storage.

- Assured two-business-day funding with each day 7 p.m. community cut-off time.

Execs and cons

| Execs | Cons |

|---|---|

|

|

US Financial institution Service provider Providers: Finest for quick deposits

Our ranking: 4.42 out of 5

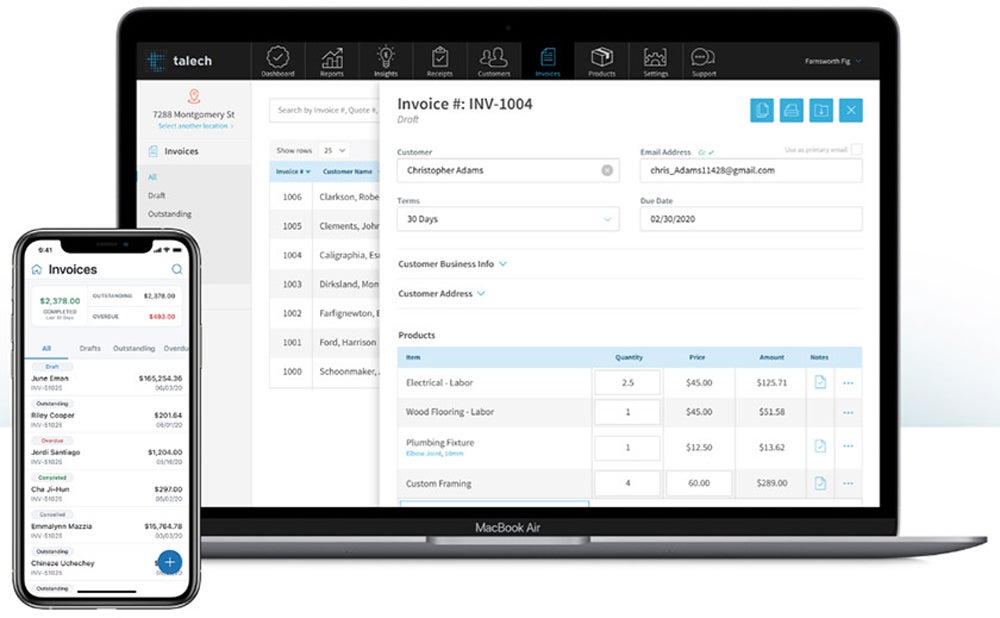

US Financial institution offers enterprise banking, fee processing, and point-of-sale providers. It has its personal processing service (Elavon) and POS system (talech) however can work with different fee gateways, ecommerce platforms, and different POS techniques. US Financial institution additionally processes virtually all fee strategies, together with deposit checks, debit playing cards, and Zelle enterprise funds.

Why I selected US Financial institution

Of all of the service provider providers I like to recommend, US Financial institution is the one service offering On a regular basis Funding. This allows you to get funds seven days per week, together with weekends, and is out there at no extra value for deposit account clients. Be aware, although, that same-day funding depends on batch instances. Activation often takes three to 5 enterprise days from the service request date.

Pricing

- Month-to-month price: $0–$99.

- Cost processing charges:

- 2.6% + 10 cents per card-present transaction.

- 2.9% + 30 cents per card-not-present transaction.

- 3.5% + 15 cents per keyed-in transaction.

*Customized charges and plans accessible.

Options

- On a regular basis Funding — get funding seven days per week, at no extra value for US Financial institution enterprise depository account clients with a US Financial institution fee options account.

- Bank card surcharging.

- Cloud-based POS suite — talech.

- Distant deposit seize (RDC).

- Offline processing.

- 24/7 buyer help and devoted account supervisor.

- Full gross sales reporting.

Execs and cons

| Execs | Cons |

|---|---|

|

|

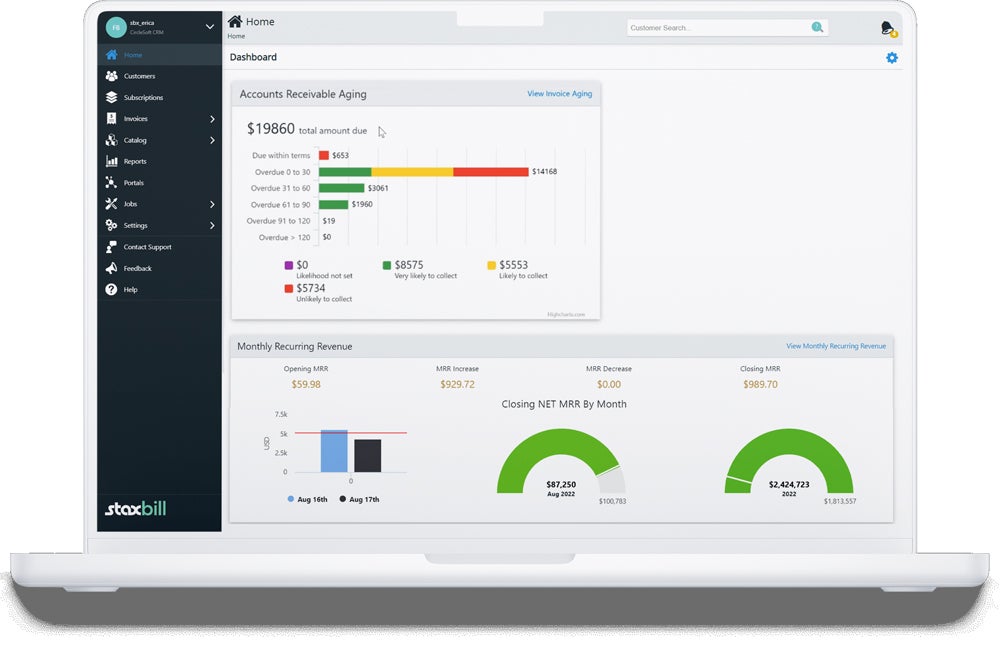

Stax: Finest for recurring or subscription billing

Our ranking: 4.39 out of 5

Stax affords membership-based interchange-plus pricing that’s better-suited for companies processing greater than $10,000 monthly. Settle for a wide range of fee strategies—invoicing, hosted fee pages, fee hyperlinks, QR codes, and a one-click on-line buying cart. You too can schedule recurring funds and get suitable {hardware} from different POS suppliers. Stax additionally affords surcharging by way of its sister firm, CardX, which lets you legally cross alongside processing charges to clients.

Why I selected Stax

Stax has excellent options tailor-made for subscriptions and recurring billing. You’ve got entry to safe card-on-file funds, superior CRM, and self-service buyer portals. One of many options you additionally don’t often get with recurring billing are quick message service (SMS) text-to-pay options and strong reporting — one thing you get with Stax.

Pricing

- Month-to-month charges:

- $99 for companies that deal with transactions as much as $150,000 per 12 months.

- $139 for companies that deal with transactions between $150,000 and $250,000 per 12 months.

- $199 for companies that deal with transactions greater than $250,000 per 12 months.

- Cost processing charges:

- Interchange plus 8 cents per card-present transaction.

- Interchange plus 18 cents per card-not-present transaction.

Options

- Wholesale interchange-plus pricing.

- One-click buying cart.

- Buyer relationship administration (CRM).

- Stax Invoice — invoicing and recurring billing with self-service portal.

- Surcharging by way of CardX, Stax’s sister firm.

- Stax Join — dispute administration.

Execs and cons

| Execs | Cons |

|---|---|

|

|

How do I select the most effective service provider providers for my enterprise?

As with all fee providers, the most effective service provider service will rely upon the sorts of providers your online business wants. Some service provider providers are extra suitable with sure companies than others. Know your fee strategies, which instruments you want (invoicing, recurring billing, digital terminal, POS {hardware}, and so on.), and which of them match your required enterprise integrations, like accounting software program. It’s also essential to consider security measures and chargeback administration.

Methodology

I evaluated dozens of service provider providers and scored them utilizing our in-house rubric of 19 knowledge factors throughout classes like pricing and contract necessities, options, safety, and stability. I additionally factored in our personal expertise and suggestions from real-world customers. Lastly, I solely included service provider providers that supply direct service provider accounts, which offer extra safety and stability.

This text and methodology had been reviewed by our retail professional, Meaghan Brophy.