The near-ubiquitous availability of strong, safe, wi-fi connectivity nonetheless includes navigating substantial complexities for service suppliers. Within the transportation and logistics sector, service suppliers are confronted with the necessity to join not solely the automobiles of their fleets but in addition the masses being transported. More and more, these embrace the flexibility to attach the load and its contents together with pallets, giant objects, property in transit and even parcels. Though connectivity choices can be found in each the low energy vast space (LPWA) community area and with international navigation satellite tv for pc system (GNSS) connections, mobile connectivity offers an optimum resolution for the transport and logistics sector, for many functions, more often than not.

This whitepaper subsequently focuses on the functions of mobile connectivity in fleet automobiles and the objects they transport. Mobile sits within the candy spot between value, protection, safety and reliability that transport service suppliers require from their connectivity. The problem at the moment is to realize mobile connections with the minimal of friction, permitting automated provisioning, better flexibility and maximised alternative. Concurrently, the change to 4G and 5G, brought on by the sunsetting of 2G and 3G networks, have to be dealt with easily to keep away from disruption and keep away from pointless prices.

The transport and logistics sector has been an early adopter of Web of Issues (IoT) know-how to assist enhance effectivity and to serve prospects higher. The sector has seen the worth of rolling-out administration methods and augmented these with connectivity. Because the Eighties, giant transport and logistics suppliers have used transport administration methods (TMS) which assist them to plan, execute and optimise how bodily items are moved. Adoption of those methods continues however the richness of information they now depend on has elevated enormously as automobiles, packages and containers can talk not solely their areas but in addition data resembling shock, temperature and moisture.

Analyst agency Berg Perception estimates that the worth of the European TMS market reached round US$1.16 billion in 2022. Rising at a compound annual progress fee (CAGR) of 11.4%, the market worth of transport administration methods in Europe is forecast to achieve US$1.89 billion in 2027. The North American TMS market is on the similar time predicted to develop from US$1.47 billion in 2022 to achieve nearly US$2.42 billion in 2027, representing a CAGR of 10.6%.

Particular sub-sections of the transport and logistics sector have been fast to undertake IoT applied sciences to help excessive worth and delicate cargo. ABI Analysis reviews that the worldwide pharmaceutical trade, for instance, will surpass US$1.9 trillion in revenues by 2027 and on-line pharma revenues will surpass US$185 billion by 2027. With on-line healthcare, tailor-made medicines and regulatory stringency all rising alongside an elevated concentrate on drug provide safety following the Covid-19 pandemic, pharma provide chains have drawn appreciable consideration.

Digital transformations are getting used to make sure not solely resilient provide but in addition to allow aggressive differentiation. As a consequence of this, the analyst agency predicts that chilly chain observe and hint income for refrigerated containers within the pharma trade is anticipated to achieve US$2.9 billion globally by 2027 as corporations look to deal with the US$35 billion value of merchandise misplaced to failures in temperature-controlled logistics inside the trade every year.

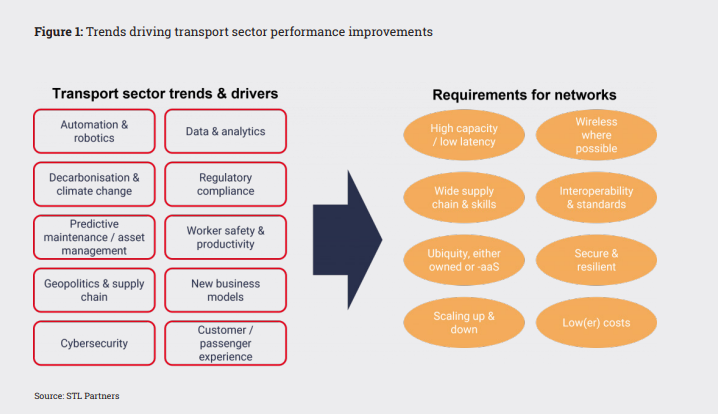

It’s not solely the pharmaceutical trade that’s pioneering adoption of latest applied sciences to streamline logistics efficiency. STL Companions has detailed among the key traits enabling the following technology of transport and logistics in a current report. The agency highlights automation and robotics that are being deployed in transport hubs and warehouses to allow better effectivity. This extends additional to port cranes, provide chain dealing with methods and the utilisation of automated guided automobiles.

Robots and automatic methods are more and more utilizing video cameras for detecting packages and to allow distant management by operators. The agency says that transport and logistics corporations are on the forefront of data-rich functions which vary from digital twins of jet engines, wind generators and rail locomotives, to optimised scheduling and packaging of products in warehouses. Higher-connectivity underpins progress and related tools, IoT sensors and video enter can enhance turnaround occasions, cut back cargo errors and decrease power consumption.

A key driver behind funding in related methods is that transport service suppliers are in a capital-intensive sector. The price of downtime for a car or crucial system in a warehouse or airport terminal may be big. STL Companions subsequently identifies a big alternative for utilizing networked data and sensors to allow predictive upkeep.

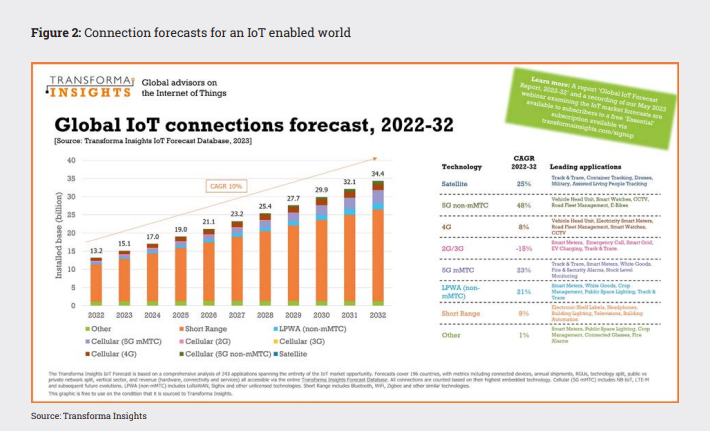

The superior uptake of applied sciences enabled by connectivity within the transport and logistics sector will see transport service suppliers overshadowed as innovators as IoT functions are adopted at mass scale by shoppers. Analyst agency Transforma Insights predicts that in 2032 the patron sector will account for 61% of all connections. Of the enterprise section in 2032, 30% of units might be accounted for by cross-vertical use circumstances resembling generic track-and-trace, workplace tools and fleet automobiles, 26% by utilities, most prominently sensible meters, 22% by retail and wholesale, 8% by authorities, 4% by transport and storage, and a pair of% every for agriculture, forestry and fishing, finance and insurance coverage, and manufacturing.

Whereas the market matures on this means, it’s clear that mobile connections might be adopted for non-short vary situations. Inevitably, as 2G and 3G networks proceed to be sundown, 4G and 5G will step in to fill the hole, persevering with to ship ubiquitous, safe, wi-fi connectivity with greater than enough capability and latency for transport and logistics use circumstances.

Later on this decade, the efficiency of newer-generation mobile connectivity is prone to have stronger relevance to move and logistics functions as richer knowledge is required and video is more and more used to allow robots and help in-depth situation monitoring. The automobiles themselves will grow to be ever-more related in keeping with Kaleido Intelligence which predicts that telematics connections will attain 573 million subscriptions by 2028.

The agency acknowledges that telematics functions gained’t use the identical quantity of information as infotainment methods however expects knowledge charges to develop. It says the common knowledge fee per connection is ready to develop by 47% between 2023 and 2028, as using video telematics turns into extra frequent in highway haulage fleets. This may double telematics connectivity income over the identical interval.

The agency additionally notes that though direct monitoring of cargo by mobile means is changing into extra frequent, connections will develop at lower than 9% CAGR all through the forecast interval. 2G and 3G shutdowns in a number of nations are a major contributing issue to this comparatively low progress fee. Logistics corporations and suppliers might want to undertake LTE-based monitoring, and the price of substitute of older tools might be prohibitive in lots of circumstances. Consequently, Kaleido Intelligence expects lower than 40 million cargo monitoring mobile connections to be in place by 2028.

A key consideration for transport and logistics organisations at the moment is how one can future-proof their know-how selects and guarantee they’ve maximised flexibility to energy by way of the sunsets and into the 5G period. 4G within the type of LTE and LTE-Superior might be fashionable enabling applied sciences with operators desiring to proceed to supply 4G for the foreseeable future.

What has modified?

Transport and logistics has surfed a wave of radically elevated volumes of shipments and logistics and now encompasses a number of fairly completely different actions. Final mile deliveries for instance are very completely different from delivery twenty-foot equal (TFE) containers across the globe or making certain foodstuffs don’t spoil in refrigerated transport. To take care of buyer satisfaction and be prepared for better demand, organisations are remodeling their operations to reap the benefits of new alternatives and deal with prospects’ wants. There are three important drivers remodeling the sector:

Finish customers now anticipate to have the ability to observe their shipments in transit and acquire correct data on demand. Service suppliers equally want well timed, correct location knowledge to help their providers. Chilly chain or pharmaceutical deliveries, for instance, depend on the transport service supplier with the ability to show the merchandise have been delivered inside a suitable temperature vary and timescale. Customers are acquainted with monitoring dongles within the shopper market and anticipate to have at the very least the identical performance obtainable for his or her items in transit. Customers even have the expectation that their service suppliers will minimise their environmental affect, so with the ability to display minimised emissions by way of route optimisation and car effectivity is now a part of the enterprise of transport and logistics.

Embedded SIM (eSIM) and embedded common built-in circuit playing cards (eUICC) allow SIM performance to be put in into units on the level of manufacture so a world SIM can then provoke its personal connection – generally known as bootstrapping – on the level of deployment. This implies car producers, and the retrofit market, can ship international merchandise with a single stock-keeping unit (SKU) designation. For transport suppliers this implies their units can activate and routinely hook up with the most effective obtainable operator no matter their location. This decouples the connection from the native cellular operator so organisations aren’t locked-in to contracts and have the flexibility to modify operators if protection is poor or, with the 2G and 3G sundown, terminated. There’s no want to interchange a bodily SIM so cash is saved and adaptability and scalability enhanced.

With the arrival of 5G and numerous classes of 4G, mobile connections now provide high-speed throughput alongside resilience and safety. For a lot of fundamental monitoring apps, this functionality isn’t wanted or inexpensive however, for larger worth shipments, the flexibility to repeatedly observe and monitor is a monetizable enterprise alternative. On the decrease finish choices resembling narrowband-IoT and LTE Cat 1 bis, provide ample capability to allow easier transport and logistics capabilities.

These three dynamics have come collectively to allow a brand new diploma of information transmission for the transport and logistics trade. This extends from connectivity in automobiles and likewise retrofitted tools all the way down to advances in sensor know-how which may monitor temperature, shock and velocity whereas additionally monitoring location all the way down to the centimetre degree, if required.

Future-proofing transport and logistics

The sheer quantity of shipments calls for better administration and connectivity simplification. Logistics suppliers can’t handle a whole bunch of relationships with completely different community suppliers, they should simplify and automate to deal with the size and cope with the doubtless very brief lifespans of connections, which can exist just for the lifetime of a single cargo or an adhesive label on a parcel.

In help, options have to accommodate better intelligence to course of helpful knowledge and ship solely related data for consumption. This would possibly contain the richer insights detailed earlier or affirmation that an EV has been used for a supply.

How KORE Wi-fi helps

KORE has been on the coronary heart of delivering connectivity to IoT organisations of all kinds because the daybreak of IoT. It at present covers greater than 200 corporations through relationships inside extra of 500 carriers and sells its choices to telematics tools OEMs in addition to transport and logistics service suppliers and their know-how suppliers. The corporate gives a complete vary of connectivity and connectivity-as-a-service choices that are augmented by its sector-specific choices and its administration platforms which embrace the KORE One Platform.

Within the transport and logistics sector particularly, KORE has choices that allow crucial asset and chilly chain monitoring, container monitoring and reusable transport asset monitoring. This portfolio encompasses managed providers for visibility and traceability with actionable knowledge that may assist convey collectively the disparate parts of the fragmented international logistics sector.

The corporate’s modern capabilities have enabled it to harness the potential of latest developments resembling eSIM and eUICC. For instance, when AT&T and Verizon within the US introduced their plans to retire 3G, eSIM would have enabled organisations to modify to the remaining 3G networks in that space, doubtlessly enabling 10 months or extra of extra utilization by a tool. This flexibility is essential and, whereas Verizon has dedicated to LTE till 2030, modifications in protection and capability availability repeatedly affect IoT functions. The power to have the ability to change to the most effective obtainable community to help a enterprise case is prime to the enterprise success of IoT.

As fleets shift and electrify, additional complexity is added and methods might be wanted to handle the charging calls for of automobiles. It’s, nonetheless, unlikely that enormous vans will flip to electrical energy completely within the brief to medium time period however prospects will need to be assured that environmental affect related to their shipments is being minimised and this might want to backed up with knowledge collected by superior methods.

For transport and logistics organisations, KORE’s capacity to offer multi-carrier connectivity ensures optimised protection with out the headache of getting a buyer organisation handle a number of provider relationships in all of the markets it operates in. KORE’s platforms automate and simplify administration and operations vastly chopping the necessity for guide community duties to be accomplished and releasing up sources for different actions. The range of KORE’s community footprint means prospects can handle their international deployments and scale up or down simply with KORE as their one community.

An additional profit is that KORE is know-how agnostic and is ready to present narrowband-IoT, LTE-M and LoRaWAN, along with 4G and 5G networks, to help low-power IoT units and to make sure maximised redundancy and failover choices within the occasion of community outages. It is a important distinction to providers supplied by a world provider which, whatever the measurement of the provider, might be delivered utilizing a patchwork of most popular companions who are sometimes able to shift blame amongst themselves and create obstructions to environment friendly service administration. International carriers merely can’t provide the optimum protection and capability for each utility in each market on the planet by way of their relationships.

KORE’s purpose is to summary the complexity and fragmentation of world connectivity away from prospects to allow them to concentrate on their core enterprise of service supply and buyer satisfaction. KORE has designed its protection, administration and repair choices to realize this and unencumber IoT corporations in all industries to concentrate on their improvements, not the community connectivity.

Touch upon this text through X: @IoTNow_