Stripe quick infoOur score: 4.59 out of 5 Beginning worth: $0 per consumer per 30 days Key options:

|

Stripe is a fee processing platform designed to deal with all the pieces from easy on-line transactions to complicated fee flows. It affords highly effective APIs, in depth integration choices, and superior security measures that make it a best choice for builders and tech-savvy companies. I like that it has a complete set of instruments that make it an appropriate processor for small companies, and, on the similar time, present scalability and customizability for mid- to large-sized companies.

In my Stripe overview, I leveraged my years of order and fee processing to check Stripe’s system first-hand, evaluating its instruments and pricing, that can assist you determine whether it is proper for what you are promoting.

Stripe pricing

Any enterprise can join a Stripe account and immediately begin accepting funds. It makes use of a flat-rate pricing construction, with potential quantity reductions and/or interchange-plus pricing for companies which have excessive month-to-month transaction quantity. I like that Stripe’s pricing construction is clear, but affords flexibility as you develop.

- Month-to-month charge: $0 per 30 days.

- Card processing charge: 2.9% + $0.30 per transaction.

- Manually-entered: +0.5% per transaction.

- Worldwide playing cards: +1.5% per transaction.

- Foreign money conversion: +1% per transaction.

- In-person card processing by way of Stripe Terminal: 2.7% + $0.05 per transaction.

- Faucet to Pay transactions: + $0.10 per transaction.

- ACH fee processing charge: 0.8%, capped at $5 per transaction.

- Instantaneous payout: 1.5%, minimal of $0.50 per payout.

- Chargeback charge: $15 per chargeback.

- Stripe Billing: 0.7% of billing quantity.

- Stripe Invoicing: 0.4% per paid bill.

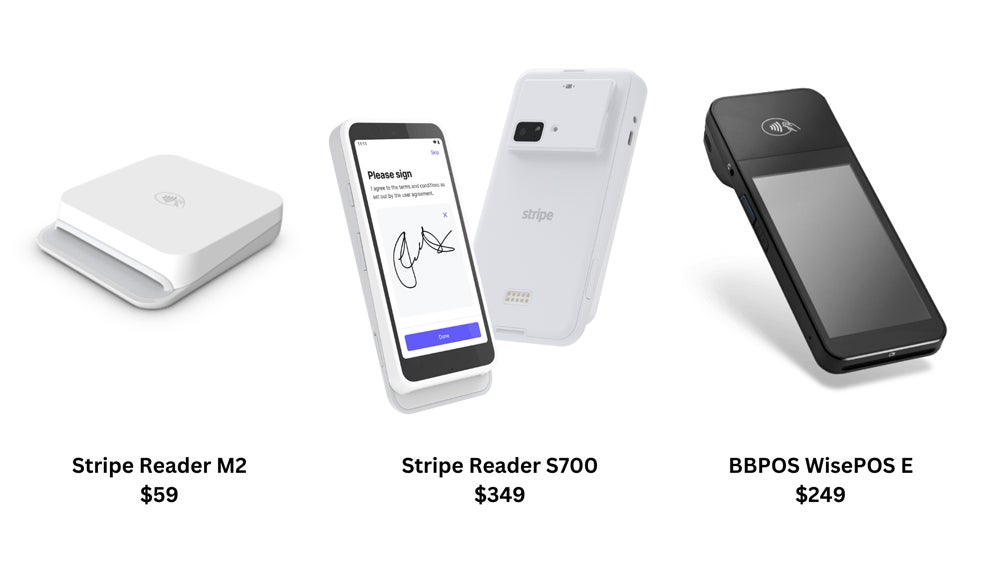

Stripe {hardware}

Though Stripe is finest identified for its on-line fee options, it additionally affords in-person fee capabilities. Stripe has card readers companies can buy for in-store transactions, in addition to tap-to-pay performance on cellular gadgets. These choices make it simple for companies to just accept funds in bodily places, complementing Stripe’s sturdy on-line platform.

Whereas I feel one of the simplest ways to maximise Stripe’s capabilities remains to be with customized builds, Stripe now has extra choices for no-code point-of-sale options. Since Stripe Terminal’s launch in 2018, it has elevated the variety of no-code off-the-shelf options.

Companies may additionally use Stripe’s Faucet-to-Pay function to just accept contactless in-person funds by means of the Stripe Dashboard with none extra {hardware}. The one necessities are a appropriate cellular gadget and Stripe Terminal integration.

Stripe key options

Stripe is extensively identified for its versatile fee processing options. Its highly effective API and feature-rich platform make it a go-to for companies and builders seeking to construct customizable and scalable fee programs. Listed below are a few of my favourite key options that set Stripe other than its rivals:

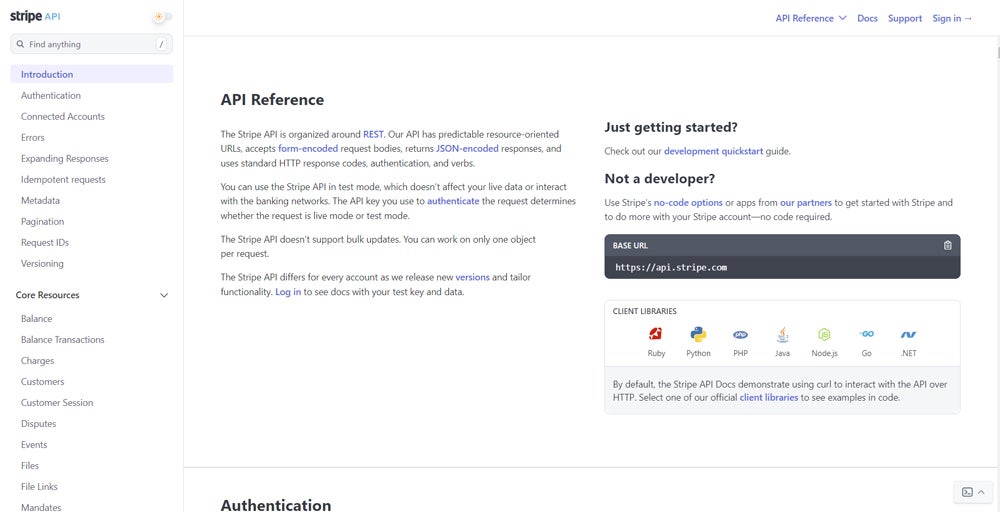

Complete API and developer instruments

Stripe’s API is among the most versatile within the fee trade. Though it permits builders to combine fee processing seamlessly into their purposes, I discover it may be a bit daunting for companies that lack some technical know-how and like an out-of-the-box resolution. For companies which can be searching for customizability and flexibility, Stripe’s in depth documentation and developer help make it simple to construct customized fee options to go well with particular wants.

World fee help

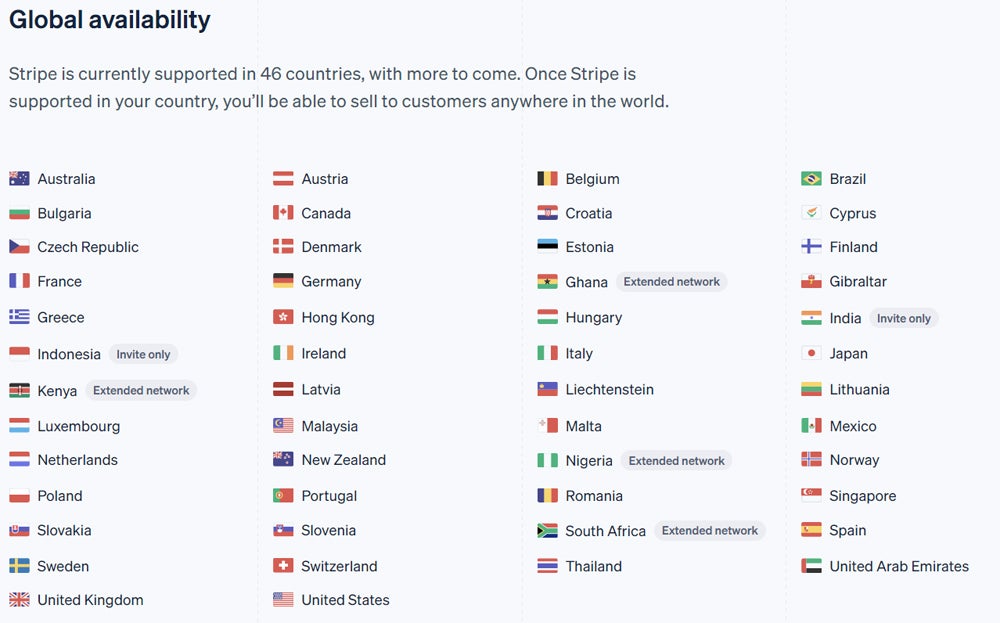

Stripe helps funds in over 135 currencies, 46 international locations, and varied fee strategies, together with bank cards, ACH, and even cryptocurrencies. This makes it splendid for companies with a world buyer base, offering a seamless fee expertise throughout borders.

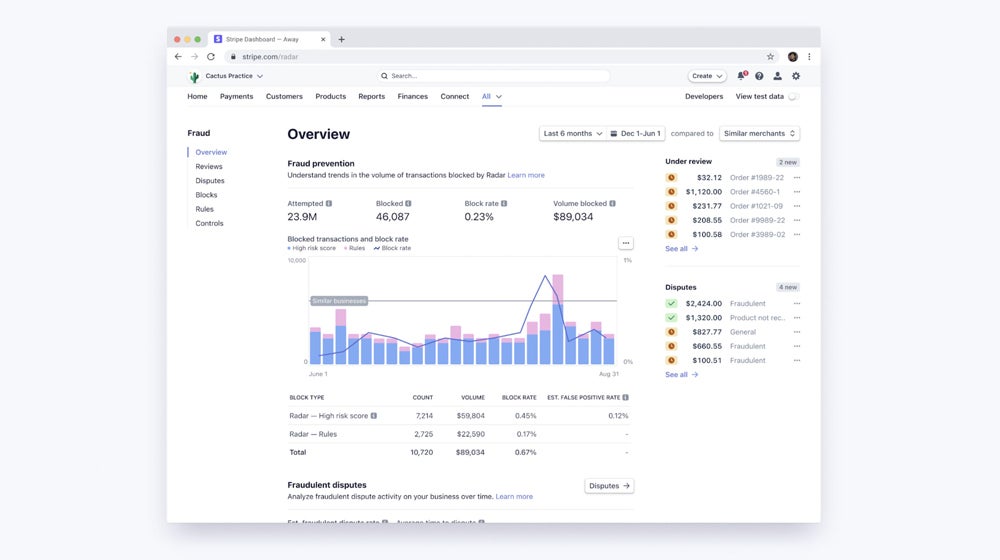

Superior fraud detection

Stripe has a machine learning-based fraud detection and prevention system referred to as Radar, which adapts to evolving threats in real-time. It helps cut back chargebacks and unauthorized transactions. This ensures companies can function securely with much less handbook intervention for fraud administration.

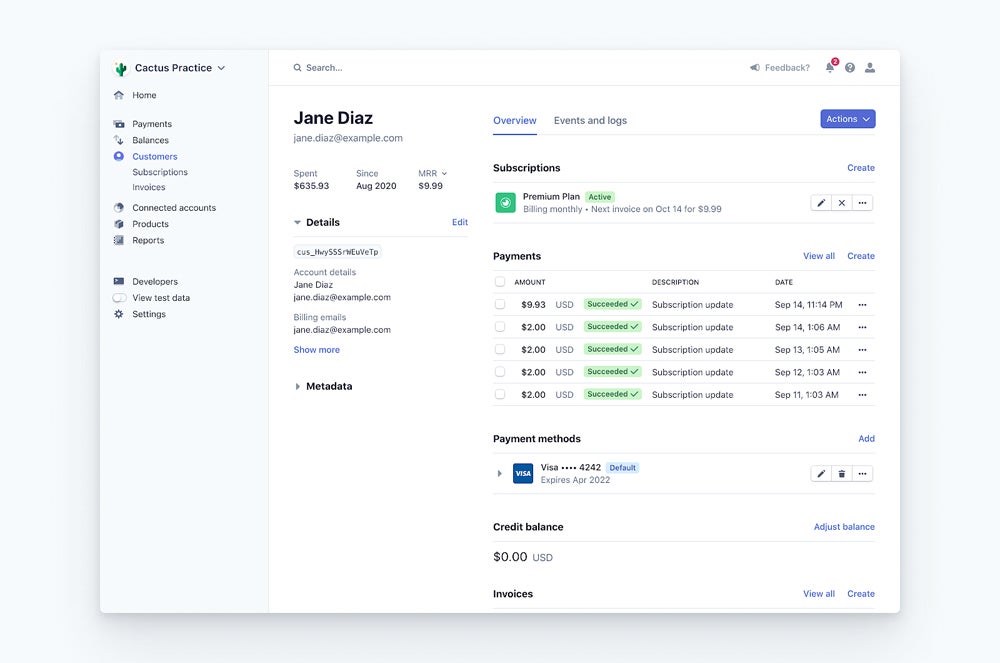

Subscription administration and recurring billing

Stripe affords an entire suite of instruments for managing recurring funds, together with help for subscriptions, computerized invoicing, and versatile billing intervals. These options are important for SaaS companies and firms with recurring income fashions. Nevertheless, it’s vital to notice that Stripe fees extra charges for utilizing Stripe Billing to handle these recurring funds.

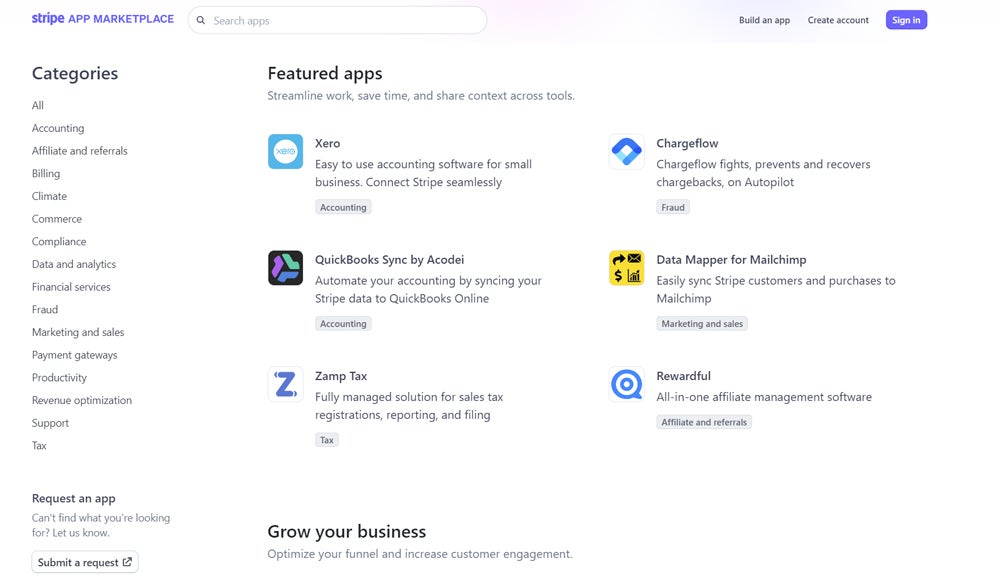

Third-party integrations

Whereas Stripe is understood for its developer-friendly instruments, it additionally affords seamless third-party integrations. I feel this makes Stripe a viable possibility even for companies that don’t have the technical know-how for full customized builds as a result of it permits them to seamlessly combine with widespread platforms and providers with out the necessity for in depth coding or developer abilities. The Stripe App Market has integrations with ecommerce platforms, accounting instruments, and CRMs to assist streamline enterprise processes. With pre-built connectors and plugins, companies can simply add fee performance to their present programs, making Stripe accessible to non-technical customers as properly.

Stripe professionals

- Clear flat-rate pricing.

- Extremely customizable API.

- Accepts all kinds of fee strategies.

- Helps over 135 currencies and 46 international locations.

- Properly-structured and in depth documentation.

- Actual-time detailed reporting and analytics.

- Constructed-in PCI compliance, knowledge encryption, and fraud detection.

- Fast setup with minimal friction.

Stripe cons

- Add-on charges for Stripe Billing and Stripe Invoicing.

- No high-risk service provider help.

- No built-in POS system.

- May be complicated for non-developers.

- Account holds or freezes.

Stripe options

In the event you assume Stripe doesn’t suit your wants, I like to recommend trying into the next fee processing options.

| Month-to-month charge (begins at) |

||||

| On-line processing charge | ||||

| Standout function |

Sq.

Sq. is well-known for its omnichannel fee processing capabilities. It has a free web site builder and point-of-sale (POS) system, each of which aren’t natively accessible in Stripe. This doesn’t imply you can not construct your personal web site or have a POS system with Stripe, however you have to to depend on APIs and third-party integrations.

However, Sq. affords out-of-the-box options for constructing your personal web site and utilizing a POS system. Sq. additionally doesn’t cost any further charges for paid invoices or recurring billing. This makes Sq. a superb possibility for small companies seeking to settle for fee in varied channels with none further coding or add-on charges.

Helcim

Whereas Stripe affords clear, flat-rate pricing, it might not be essentially the most cost-effective, particularly for companies which have excessive month-to-month transaction volumes. Helcim, alternatively, affords not simply interchange-plus pricing but additionally computerized quantity reductions. Each are additionally accessible by means of Stripe, however you have to to get in contact with Stripe’s gross sales group, and it’s topic to approval.

Other than this, Helcim additionally affords out-of-the-box fee options just like Sq.. It has a free and easy web site builder, in addition to a free POS software program. I feel that for companies prioritizing prices and options requiring much less coding, Helcim is a superb possibility.

PayPal

Though Stripe is well-known within the funds area, PayPal is a extra acquainted model due to its presence in consumer-to-consumer transactions. Though Stripe nonetheless affords extra highly effective APIs for constructing customized options, I might contemplate PayPal to have probably the most in depth one-click integrations, particularly within the ecommerce area.

factor to notice with PayPal is you don’t want to make use of it as your unique fee processor — it’s usually accessible as an extra fee possibility even in case you are already utilizing Stripe.

PaymentCloud

I feel a giant hole with Stripe is its lack of help for high-risk retailers. Companies thought-about high-risk are more likely to get rejected once they apply for a Stripe account, and it’s best to enroll with a high-risk service provider account supplier as a substitute, resembling PaymentCloud.

PaymentCloud affords versatile options, permitting companies to select from easy-to-use ones that require much less coding to completely customizable choices by means of their accomplice suppliers.

Assessment methodology

This Stripe overview relies on an intensive analysis of its key options, pricing, and total efficiency. My evaluation included hands-on testing of Stripe’s API, fee processing instruments, and Stripe Market to know its real-world utility.

I additionally took under consideration Stripe’s charge construction, together with its extra prices for options like Stripe Billing. To make sure a well-rounded analysis, I in contrast Stripe to different main fee processors available in the market, score it on standards resembling performance, scalability, and developer expertise.

This text and methodology have been reviewed by our retail skilled, Meaghan Brophy.