- Greatest total bank card reader for Android: Sq.

- Greatest for personalization: Stripe

- Greatest low cost, primary reader: SumUp

- Greatest for accepting a number of cost strategies: PayPal Zettle

- Greatest for ecommerce companies: Shopify

Android units have made vital technological developments in recent times. Like iPhones, they will now be used as cost terminals because of NFC expertise and cost apps accessible on the Play Retailer, its app market.

To seek out one of the best bank card reader for Android, I thought-about affordability, cost choice flexibility, transaction charges, and, extra importantly, reliability and safety. I evaluated dozens of Android bank card readers towards a 22-point rubric and examined them myself as a payor and payee.

High bank card readers for Android comparability

Alongside pricing, some essential options set the cell bank card readers for Android aside. The desk beneath illustrates which of the highest 5 Android card readers embody these key options.

| Sq. Reader | |||||

| Stripe M2 | |||||

| SumUp Plus | |||||

| PayPal Zettle Reader 2 | First reader discounted to $29 |

||||

| Shopify Faucet & Chip Card Reader |

Sq.: Greatest total bank card reader for Android

Our score: 4.63 out of 5

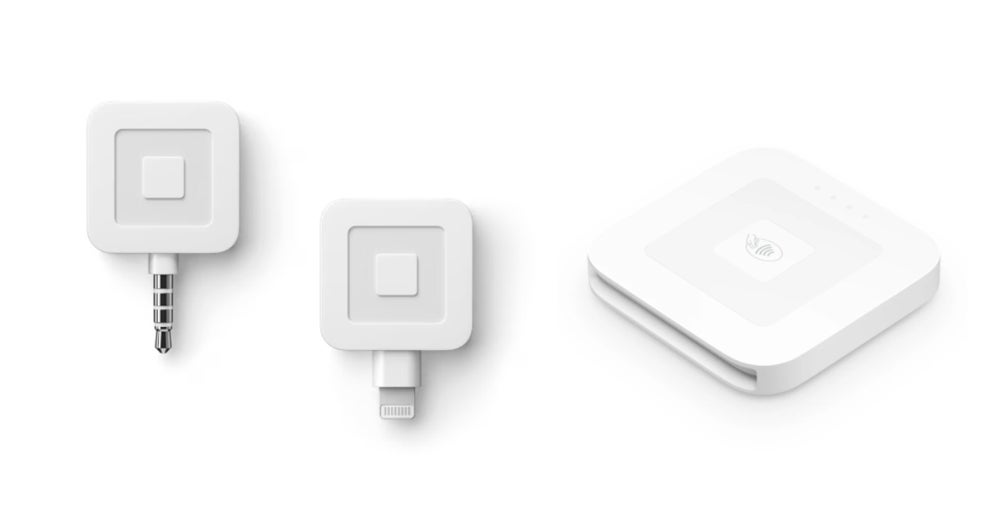

Sq. Readers persistently rank amongst our prime picks for bank card readers for Android and iPhone units. They’re extremely rated by customers and specialists alike. Their modern design and useful measurement make them a wonderful alternative for accepting funds wherever, along with the Sq. POS app.

Sq. helps you to settle for funds without cost — it doesn’t cost month-to-month charges or require month-to-month minimums; you may even get your first magstripe reader without cost, making it appropriate for the informal consumer. And but, it offers a fully-featured POS system excellent for full-time companies.

Why I selected Sq.

I like how Sq. stays inexpensive and nonetheless helps you to settle for a full vary of cost choices. You additionally pay the identical transaction charge irrespective of which card a buyer makes use of — even American Specific, which is notorious for having greater charges.

Among the many card readers I’ve evaluated, it’s one of many card readers that received good marks for card reader options (free POS app and reader, nice aesthetics, and a digital receipts function) — SumUp being the opposite one.

Other than the same old faucet, dip, and NFC funds, Sq. helps you to settle for reward playing cards and echecks (with an extra cost). You can even settle for worldwide playing cards, however you have to be within the nation the place you activated your Sq. account (no cross-border funds).

However what I like greatest about Sq. is its lively fraud prevention and dispute administration function. It has a wonderful chargeback coverage — no chargeback charges apart from the same old processing price that the sale incurred. In actual fact, Sq. and SumUp are the one suppliers on this listing that don’t cost dispute charges.

Pricing

- Month-to-month processing price: $0

- Transaction charges:

- Card current: 2.6% + 10 cents

- Keyed-in: 3.5% + 15 cents

- On-line, Recurring, and Invoicing: 2.9% + 30 cents

- Card readers:

- First magstripe reader free; extra orders $10 every

- $49-$59 for Sq. Reader (1st and 2nd technology)

- Accepts faucet, dip, Apple Pay, Google Pay, and different NFC funds

- Accepts offline funds; syncing of funds must be accomplished inside 24 hours

Options

- 4.7 out of 5 cell app score on Google Play based mostly on greater than 230,000 consumer evaluations.

- Card reader options:

- Free magstripe reader is offered with lightning or audio jack enter; can settle for funds through magstripe (swiped).

- Sq. Reader connects through Bluetooth, can work with out Web connectivity, and may settle for funds through EMV (chip) or NFC (Apple Pay, Google Pay).

- Clear and flat-rate processing charges.

- Offline cost processing.

- Free, highly effective POS app.

- No chargeback or dispute charges.

Execs and cons

| Execs | Cons |

|---|---|

|

|

Associated: Greatest Free Credit score Card Readers for iPhone & Low-cost Options

Stripe: Greatest for personalization

Our score: 4.41 out of 5

Stripe is greatest recognized for its extremely customizable checkout pages, and that extends to its cost terminals, too. When you have the means to rent a developer (or have the know-how your self!), you’ll definitely admire Stripe’s versatile terminal instruments — you may actually customise in-person cost experiences.

Furthermore, you need to use the Stripe M2 reader with your personal POS app or combine it with different apps for stock or buyer relationship administration.

Why I selected Stripe

Given all of the excessive stage customization choices you get with Stripe, I like that it nonetheless affords a low-cost card reader choice, permitting you to promote in-person. Stripe is usually recognized for on-line funds, and whereas its in-person gross sales options usually are not as effectively often known as that of Sq. — it scored above common on most classes throughout my analysis.

Stripe and SumUp are the one card readers on this listing that settle for magstripe (swipe) funds, together with chip and faucet. Whereas this expertise isn’t usually used anymore, it may come in useful when the connection (NFC or Bluetooth) turns into spotty. As a consequence of its top-notch safety and fraud detection, Stripe is one of the best bank card swiper for Android.

Additionally price mentioning is the app’s excessive consumer overview scores, 4.50 out of 5 — one of many highest scores among the many apps I function on this listing. I seen Stripe actively listens to consumer suggestions — the latest overview as of this writing requested a function and Stripe added the performance within the app instantly.

Pricing

- Month-to-month processing price: $0

- Transaction charges:

- Card current: 2.7% + 5 cents

- On-line: 2.9% + 30 cents

- Keyed-in (Handbook): 3.4% + 30 cents

- Touchless: 2.9% + 30 cents

- Faucet-to-pay on cell: +10 cents per authorization

- Invoicing: + 0.4%–0.5%

- Recurring Billing: + 0.5%–0.8%

- Worldwide funds: + 1.5% price, 1% unfold for foreign money conversion

- ACH: 0.8%, $5 cap

- Card readers:

- $59.00 for Stripe Reader M2

- $249.00 for BBPOS WisePOS E (good reader with a touchscreen show)

- $349.00 for Stripe Reader S700 (Android-based good reader)

- Accepts EMV chip playing cards, contactless playing cards, magstripe playing cards, and digital wallets.

- Chargeback price: $15 per dispute.

Options

- 4.50 out of 5 cell app score in PlayStore based mostly on practically 25,000 consumer evaluations.

- Card reader options:

- Bluetooth connectivity.

- Offline mode.

- Battery—2 hours charging time, 28 hours lively use, 42 hours standby.

- Customizable checkout course of.

- Customizable threat administration and fraud detection instruments.

- Multi foreign money cost processing.

- Finish-to-end encryption (E2EE) and point-to-point encryption (P2PE).

- Seamless integration with Stripe Terminal software program growth package (SDK).

Execs and cons

| Execs | Cons |

|---|---|

|

|

SumUp: Greatest low cost, primary reader

Our score: 4.35 out of 5

SumUp is primarily designed to be an end-to-end cell cost processing resolution. Other than inexpensive card readers, you may settle for funds through invoicing and digital terminals. There aren’t any month-to-month minimums and contract charges. And in contrast to the Sq. Reader, SumUp Plus accepts magstripe funds (swipe playing cards) and features a display to indicate transaction particulars.

In comparison with different feature-rich POS methods like Stripe and Sq., SumUp’s functionalities are primary at greatest. Nevertheless, for companies on a finances and solely have simple cost wants, SumUp is a superb choice.

Why I selected SumUp

If we’re speaking completely about card readers for cell app funds, SumUp’s readers are top-notch. Its entry-level card reader (accessible in black and white variations) is among the many least expensive readers I’ve reviewed.

SumUp is the one card reader, apart from PayPal Zettle, that incorporates a display to indicate transactions on its gadget and has a PIN function. It’s also tied with Sq. for scoring good marks on card options. Nevertheless, SumUp is the highest card reader relating to cost choices — Zettle doesn’t have an offline mode, and Sq. Reader can’t do swipe funds. SumUp Plus can do each.

Nevertheless, SumUp is sort of limiting in case you want a full-featured POS system and ecommerce integrations. Not like others on this listing, It solely affords primary studies like transaction and income summaries.

Pricing

- Month-to-month processing price: $0

- Transaction charges:

- Card current: 2.6% + 10 cents

- On-line and keyed-in: 3.5% + 15 cents

- Invoicing (cost hyperlink): 2.9% + 15 cents

- Card readers:

- $54 for SumUp Plus (Connects through Bluetooth to your smartphone or pill)

- $99 for SumUp Solo (Standalone gadget with a modern touchscreen)

- $169 for SumUp Solo printer bundle (Standalone gadget with printer)

- Accepts swipe, faucet, dip, Apple Pay, Google Pay, and different NFC funds

Options

- 3.70 out of 5 cell app score in PlayStore based mostly on greater than 105,000 consumer evaluations.

- Card reader options:

- 8 hour battery life lets you settle for funds on the go.

- Course of over 500 transactions on a single cost.

- Connects through Bluetooth (SumUp Plus).

- Join through WiFi and with free, limitless cell knowledge with the built-in SIM card (SumUp Solo and printer bundle).

- Cell-first cost processor.

- No add-on charges for worldwide bank cards.

- No further price for e-check funds with invoicing.

- No chargeback charges.

Execs and cons

| Execs | Cons |

|---|---|

|

|

PayPal Zettle: Greatest for accepting a number of cost strategies

Our score: 4.10 out of 5

PayPal Zettle is the most suitable choice if you must settle for a wide range of funds in particular person at a low price and with no commitments. Other than faucet and dip (EMV chip, contactless, and digital wallets), Zettle can settle for Venmo and PayPal funds. QR funds are doable with the assistance of the POS app, too.

When you have a seasonal enterprise or a facet hustle, the Zettle Reader is a terrific choice. It affords very inexpensive transaction charges: 2.29% + 9 cents.

Why I selected PayPal Zettle

Other than the added cost choices PayPal Zettle can settle for, I like that it offers an added safety function to transactions, having a PIN function when processing funds. It additionally has a show display. Amongst these on this listing, solely Zettle Reader and SumUp Plus have these options.

PayPal Zettle additionally has the bottom card-present (in-person) transaction charge among the many card readers featured on this information. Nevertheless, be aware that PayPal Zettle is greatest for accepting funds on the go and nothing extra. It doesn’t supply plan upgrades or integrations for on-line promoting.

Pricing

- Month-to-month price: $0

- Transaction charges:

- Card current and QR codes: 2.29% + 9 cents

- Keyed-in: 3.49% + 9 cents

- Invoicing (PayPal funds): 3.49% + 49 cents

- Invoicing (playing cards and various cost strategies): 2.99% + 49 cents

- Card reader: $79 (first one, $29)

- Accepts debit and credit score EMV playing cards, NFC funds, reward playing cards, and Venmo funds

- Chargeback price: $20

Options

- 3.20 out of 5 cell app score within the Play Retailer based mostly on greater than 43,000 evaluations.

- Card reader options:

- 8-hour battery life (100 transactions)

- PIN card function

- Scan QR codes by way of smartphone

- No long-term contract or termination charges.

- Accepts a wide range of cost sorts — chip and contactless cost strategies, together with Venmo and PayPal funds.

- Subsequent-day funding, identical day with price.

Execs and cons

| Execs | Cons |

|---|---|

|

|

Shopify: Greatest for ecommerce companies

Our score: 3.99 out of 5

The Shopify Faucet & Chip Card Reader is essentially the most appropriate and handy choice for accepting funds in particular person when you’ve got an internet enterprise and, extra so, use Shopify as your ecommerce platform. You don’t need to pay an extra month-to-month price.

Just like the Sq. Reader, the Shopify Faucet & Chip Card Reader is unique to Shopify’s funds and ecommerce ecosystem. Shopify’s related ecosystem permits gross sales and stock to sync seamlessly throughout your gross sales channels.

Why I selected Shopify

I’ve over a decade of expertise working with primarily online-first companies, and Shopify has been my constant decide for ecommerce platforms. Although Shopify is understood for ecommerce, I’ve skilled its equally sturdy POS platform for cell and in-store gross sales — additional cementing Shopify as one of the best resolution for multichannel sellers.

The Shopify cell card reader isn’t any exception. Whereas it has restricted offline performance, I like that it accepts many cost choices — bank card, contactless, digital wallets, on-line funds, reward playing cards, worldwide/cross-border, and even cryptocurrency — rivaling PayPal Zettle.

Pricing

- Month-to-month price: $0–$89 (plus Shopify ecommerce plan starting from $5-$399 — required)

- Transaction charges:

- In-person: 2.4%–2.7%

- On-line: 2.4%–2.9% + 30 cents

- Card reader: $29–$49

- One-year restricted guarantee (minimal)

- Accepts each chip and contactless funds.

- Chargeback price: $15

Options

- 3.30 out of 5 cell app score within the Play Retailer based mostly on practically 2,300 evaluations.

- Card reader options:

- Accepts chip and contactless funds

- Customary 1-year guarantee or an prolonged 2-year guarantee on POS Professional

- Accepts bank cards (through EMV chip), contactless (through NFC and QR), digital wallets, on-line funds, reward card, worldwide/cross-border, and cryptocurrency.

- Native cost strategies might be accepted for an add-on price.

- No long-term contract or termination charges.

- Sync on-line and in-person gross sales and stock.

- In depth integrations for scalability.

- A number of gross sales channels, together with social channels and on-line marketplaces like Amazon and Walmart.

- 24/7 buyer assist.

Execs and cons

| Execs | Cons |

|---|---|

|

|

Associated: The 6 Greatest Cell POS Techniques for 2024

How do I select one of the best Android bank card reader for my enterprise?

The perfect Android bank card reader for your enterprise is one which matches your enterprise wants and is appropriate along with your Android gadget’s working software program. Prioritize cell card readers with excessive safety and minimal studies of downtimes or failed transactions. Connectivity must also not be an issue. It must be straightforward to attach along with your cell cost app.

Particularly, it’s best to take into account:

- Reliability, compatibility, and connectivity: Most card readers join through Bluetooth to your Android gadget. There are card readers that embody a SIM card to get their very own WiFi connection.

- Accepted cost strategies: EMV (chip) and NFC (contactless) funds are the commonest cost strategies for card readers. Your card reader ought to have the ability to settle for these on the minimal — faucet and dip readers are what they’re known as. In order for you to have the ability to settle for different cost strategies like QR, invoicing, and Venmo, be certain to test the cardboard reader first earlier than buying.

- Simple-to-use cell app with sturdy options: Cell card readers work collectively along with your cost processor’s cell cost app. Their cell apps are often free, so test their options in the event that they match your enterprise wants earlier than buying.

- {Hardware} pricing: Cell bank card readers are typically very inexpensive. Most supply card readers between $50 and $100, and a few difficulty your first reader without cost or at a reduced worth. In order for you a tool that gives extra refined features, corresponding to a built-in printer or scanner, put together to shell out greater than $100 per gadget.

Methodology

Primarily based on my expertise serving to retail companies launch their ecommerce shops and streamline their in-store and on-line gross sales operations, I seemed on the prime cost suppliers and service provider companies which have cell apps and supply card readers for Android.

From my preliminary listing, I graded them utilizing an in-house rubric of twenty-two knowledge factors based mostly on pricing, cost sorts, card options, safety and stability, and consumer evaluations. I prioritized Android card readers with excessive evaluations on safety and reliability — minimal failed transactions and downtimes.

This text and methodology had been reviewed by our retail knowledgeable, Meaghan Brophy.

Continuously requested questions (FAQs)

What are the variations between cell bank card readers for Android?

The principle variations between Android bank card readers are the cost strategies they settle for and their transaction charges.

How do you settle for bank card funds in your Android telephone?

You’ll be able to settle for bank card funds in your Android telephone by way of Faucet to Pay. Your gadget will function a cost terminal by way of a cell cost app. You can even settle for bank card funds in your Android gadget with the assistance of a appropriate card reader.

Are there any bank card readers for Android that work offline?

Sure, there are Android bank card readers that work offline. Sq., Stripe, and SumUp are a number of nice examples.

Are there any free bank card readers for Android?

Sure, there are free Android card readers. Sq. offers your first magnetic stripe reader without cost, and PayPal Zettle additionally affords a reduced charge in your first card reader.

What card readers work with Google Pay?

Most Android card readers can settle for NFC funds and cell wallets corresponding to Google Pay. Sq., SumUp, Stripe, PayPal Zettle, and Shopify have nice card readers that course of Google Pay funds.

Does Samsung Pay nonetheless work with any card reader?

Sq., PayPal Zettle, and Stripe cell card readers settle for Samsung Pay.