In 2023, the whole transaction worth of crypto gateway funds recorded worldwide was $1.62 billion. That is projected to develop at a CAGR of 17% from 2023 to 2030. Since most crypto transactions are by direct wallet-to-wallet transactions, the precise worth of cryptocurrency transactions used for cost of products may very well be considerably larger than this worth.

Companies seeking to get a bit of that pie are exploring methods to begin accepting cryptocurrencies past the standard wallet-to-wallet crypto transactions. A crypto cost gateway permits companies to just accept cryptocurrencies equivalent to Bitcoin, Ethereum, and Tether as funds inside a safer cost circulation. Crypto cost gateways may additionally enable retailers to maintain the funds as cryptocurrencies, convert cryptocurrencies to fiat currencies, and settle for cross-border funds.

RELATED: Prime Cryptocurrency Predictions for 2024

Apart from the elevated adoption of crypto funds, another advantages of accepting cryptocurrency funds are decrease transaction prices, no danger of chargebacks, enhanced safety, and entry to a novel buyer base.

Prime crypto cost gateways comparability

The most effective crypto cost gateways supply a mixture of seamless integration, in depth cryptocurrency assist, strong security measures, and aggressive pricing. The comparability desk under illustrates the transaction charges, variety of crypto and fiat currencies supported, and e-commerce plugins for every crypto cost gateway.

| Our score (out of 5) | Transaction payment* | Cryptocurrencies | Fiat settlement currencies | E-commerce plugins | |

|---|---|---|---|---|---|

| NOWPayments | 4.54 | 0.5% (if no forex trade) | 200+ | 20+ | 9 |

| BitPay | 4.30 | 1%–2% + 25 cents | 15 | 9 | 6 |

| Coinbase Commerce | 4.25 | 1% | 13 | 1 | 4 |

| OpenNode | 3.98 | 1% | 1 | 8 | 6 |

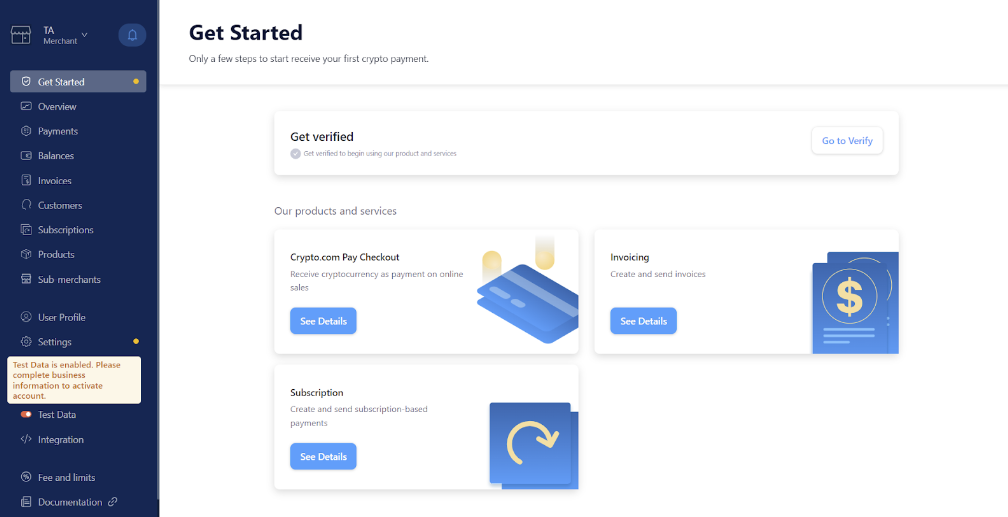

| Crypto.com | 3.98 | 0 | 30+ | 4 | 6 |

| *Crypto transactions at all times incur a community or gasoline payment for executing operations on the blockchain. The transaction payment charged by the cost gateway is a separate payment. | |||||

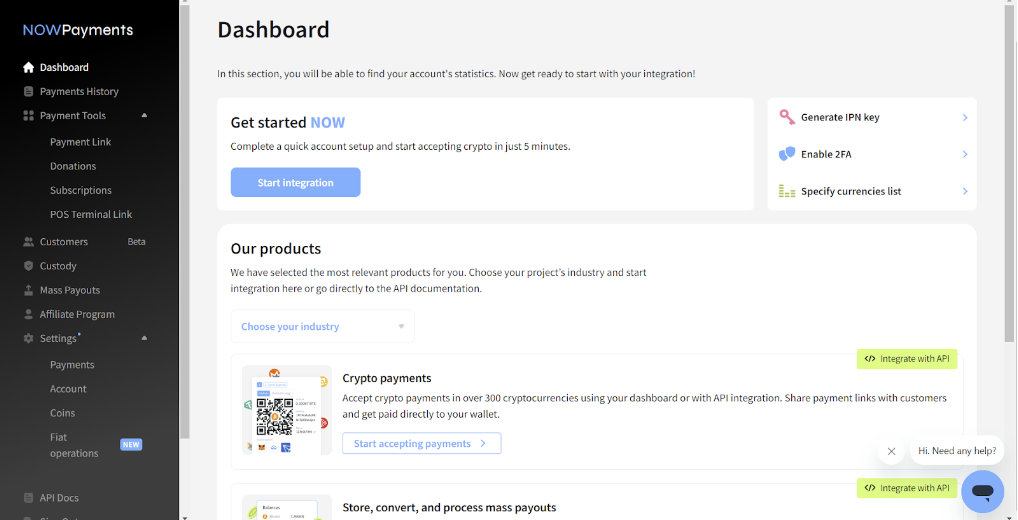

NOWPayments: Greatest general

Our score: 4.54 out of 5

NOWPayments is a versatile cryptocurrency cost gateway that enables companies to just accept each crypto and fiat funds. It gives a variety of integration choices and settlement strategies, giving retailers management over how they handle their funds.

Why I selected NOWPayments

NOWPayments’ greatest power is the entire flexibility it gives to retailers with regards to accepting funds. It permits retailers to obtain each fiat and cryptocurrencies. Upon receiving the cost, the service provider has continued flexibility on what to do with it (preserve it in the identical forex or convert it to a special forex) and the place to place it (preserve the cost in custody or withdraw it to a crypto pockets or checking account).

Apart from the settlement flexibility, NOWPayments gives all of the attainable methods to just accept crypto funds. Its Custody characteristic permits retailers to just accept cryptocurrency funds with out a crypto pockets and make forex exchanges with out paying community charges. It additionally has a community payment optimization that may assist decrease blockchain charges when changing or transferring cryptocurrencies.

NOWPayments gives a extra complete set of options than different crypto cost gateways on this listing. This makes it a superb match for companies looking for full management and adaptability in managing their crypto funds.

Pricing

- Transaction payment: 0.5% for funds with out trade.

- Conversion payment: 0.5%.

Options

- Prompt account registration.

- Accepts over 100 cryptocurrencies as funds.

- Settles in additional than 20 fiat currencies.

- Custody characteristic.

- Methods to just accept crypto funds:

- API integration.

- Invoices or cost hyperlinks.

- Ecommerce plugins: PrestaShop, Magento 2, OpenCart, Zen Cart, Shopware, WooCommerce, WHMCS, Ecwid, Shopify.

- QR code.

- Subscription.

- Donation button.

- Cost circulation:

- Settle for crypto > preserve in custody

- Settle for crypto > convert to different cryptocurrency > preserve in custody

- Settle for fiat > convert to cryptocurrency > preserve in custody

- Settle for crypto > withdraw to your crypto pockets

- Settle for crypto > convert to different cryptocurrency > withdraw to your crypto pockets

- Settle for crypto > convert to fiat > withdraw to your checking account

- Custody steadiness > withdraw to your crypto pockets

- Custody steadiness > convert to fiat > withdraw to your checking account/

- Mounted-rate trade possibility.

- Crypto-to-fiat withdrawal: 1 enterprise day.

- Mass payouts.

- Community payment optimization.

- API to combine with any cell POS terminal.

- Sandbox setting for testing.

- 24/7 buyer assist.

Professionals and cons

| Professionals | Cons |

|---|---|

| Settlement flexibility. | Advanced refund course of. |

| Custody characteristic to avoid wasting on community. charges for forex exchanges. | Restricted reporting instruments. |

| Accepts each crypto and fiat funds. | Minimal cost fluctuates. |

| API integration with any cell POS terminal. |

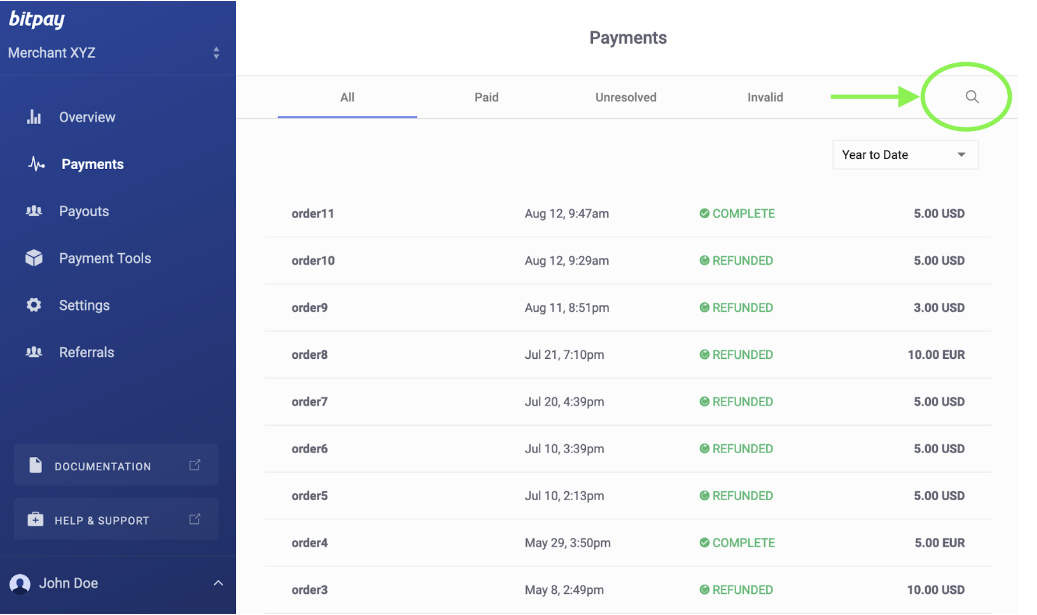

BitPay: Greatest for multi-user entry

Our score: 4.30 out of 5

BitPay is a cryptocurrency cost gateway identified for its user-friendly interface and multi-user account capabilities. It gives tiered transaction charges that lower with larger month-to-month volumes. Nevertheless, it gives restricted flexibility to retailers as funds are mechanically transformed and settled into the service provider’s checking account or cryptocurrency pockets.

Why I selected BitPay

BitPay is the one crypto cost gateway on this listing that enables multi-user entry. This makes it a fantastic selection for companies that require a number of workforce members to handle funds. It additionally locks in trade charges on the time of buy, which helps defend retailers from crypto worth fluctuations.

Whereas its transaction charges could also be larger than others on this listing, BitPay is a dependable and well-known supplier, and its cell POS app makes it straightforward to just accept crypto funds in-store.

Pricing

- Transaction payment (primarily based on month-to-month quantity):

- < $500,000: 2% + 25 cents

- $500,000–$999,999: 1.5% + 25 cents

- $1,000,000 and above: 1% + 25 cents

- Utility payment: $75

- Minimal withdrawal quantity: is determined by forex; $20 for USD

Options

- Prompt account registration.

- Accepts 15 cryptocurrencies as funds.

- Settles in 9 fiat currencies.

- Computerized quantity reductions.

- Each day settlement.

- Methods to just accept crypto funds:

- API integration.

- Invoices or cost hyperlinks.

- Subscription.

- E-commerce plugins: Magento 2, Shopify, WHMCS, Wix, WooCommerce, BigCommerce.

- Straightforward to embed cost button.

- Donation button.

- Cell POS app.

- Cost circulation:

- Settle for crypto > transformed to your chosen forex > each day settlement to your chosen checking account or cryptocurrency pockets.

- Multi-user login entry.

- Locks in price on the time of buy.

- Lightning community assist.

- Buyer assist through e-mail inside 1 enterprise day.

Professionals and cons

| Professionals | Cons |

|---|---|

| Multi-user functionality. | Fewer e-commerce plugins. |

| Cell POS app for accepting funds in-store. | Utility payment. |

| Locks in price at time of buy. | Greater transaction charges, even with the automated quantity reductions. |

| Low minimal withdrawal quantity. |

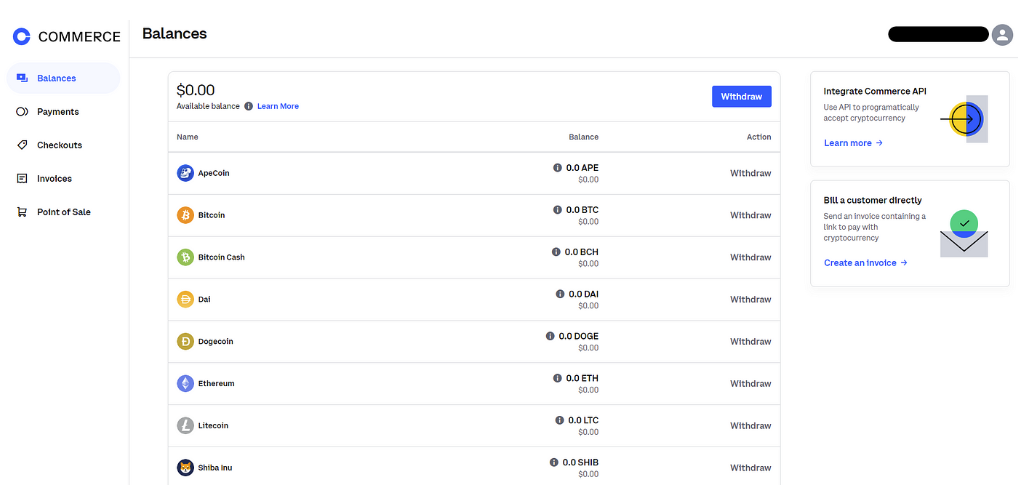

Coinbase Commerce: Greatest for immediate settlement

Our score: 4.25 out of 5

Coinbase Commerce is a cryptocurrency cost gateway that makes it easy and easy for companies to just accept cryptocurrency funds. It mechanically converts incoming crypto funds into USD or USDC and gives on the spot settlement to the deposit deal with supplied by the service provider.

Why I selected Coinbase Commerce

Companies which might be simply exploring crypto funds and want to begin small will discover Coinbase Commerce easy and straightforward to make use of. In contrast to different gateways on this listing, Coinbase Commerce doesn’t present the choice to maintain different currencies besides USD and USDC. As an alternative, it locks in trade charges on the time of buy and transfers funds on to the service provider’s chosen deposit deal with.

Whereas it lacks forex trade choices and is restricted to web site funds, its ease of use and assist for in style e-commerce platforms like Shopify and WooCommerce make it a super selection for companies prioritizing easy, hassle-free transactions.

Pricing

Options

- Accepts 13 cryptocurrencies as funds.

- Settles in 1 fiat forex solely.

- Each day settlement.

- Methods to just accept crypto funds:

- API integration.

- E-commerce plugins: Jumpseller, Primer, Shopify, WooCommerce.

- Cost circulation: Prompt settlement to deposit deal with indicated.

- Locks in price on the time of buy.

- Lightning community assist.

- Buyer assist through account dashboard solely.

Professionals and cons

| Professionals | Cons |

|---|---|

| Easy and easy. | No forex trade. |

| Prompt settlement eliminates price volatility. | No sandbox setting for testing. |

| All incoming funds are transformed to USD or USDC. | |

| Just for accepting funds on an internet site. |

OpenNode: Greatest for Bitcoin-only funds

Our score: 3.98 out of 5

A cryptocurrency cost gateway targeted completely on Bitcoin, OpenNode gives options equivalent to cut up settlement and scheduled payouts. Its Lightning community assist makes it extremely environment friendly for Bitcoin transactions.

Why I selected OpenNode

OpenNode stands out as the best choice for companies that need to settle for Bitcoin and nothing else. Its options, like customized computerized settlement schedules, a number of methods to just accept crypto funds, and restricted settlement currencies, make it a super possibility for companies that need to restrict their crypto cost acceptance however want to settle for it in varied cost channels.

Though restricted to Bitcoin, OpenNode’s simplicity, mixed with robust e-commerce integrations, makes it a fantastic match for companies targeted on Bitcoin funds.

Pricing

- Transaction payment: 1%.

- Withdrawal payment: 1% for on-demand bitcoin payout.

Options

- Accepts 1 cryptocurrency solely (Bitcoin).

- Settles in 8 fiat currencies.

- Methods to just accept crypto funds:

- API integration.

- Cost button.

- Invoices or cost hyperlinks.

- E-commerce plugins: Shopify, Magento, BigCommerce, Prestashop, WooCommerce, OpenCart.

- QR code.

- Cost circulation: Settle for bitcoin > preserve as bitcoin or convert to native forex > switch to checking account or bitcoin pockets.

- Service provider could select to provoke payouts or to set them on a schedule.

- Break up settlement.

- Lightning community.

- KYC compliant.

- 24/7 buyer assist.

Professionals and cons

| Professionals | Cons |

|---|---|

| Retailers could set a customized computerized settlement schedule. | Bitcoin solely. |

| Lightning community assist. | Withdrawal payment for on-demand bitcoin payout. |

| Break up settlement. |

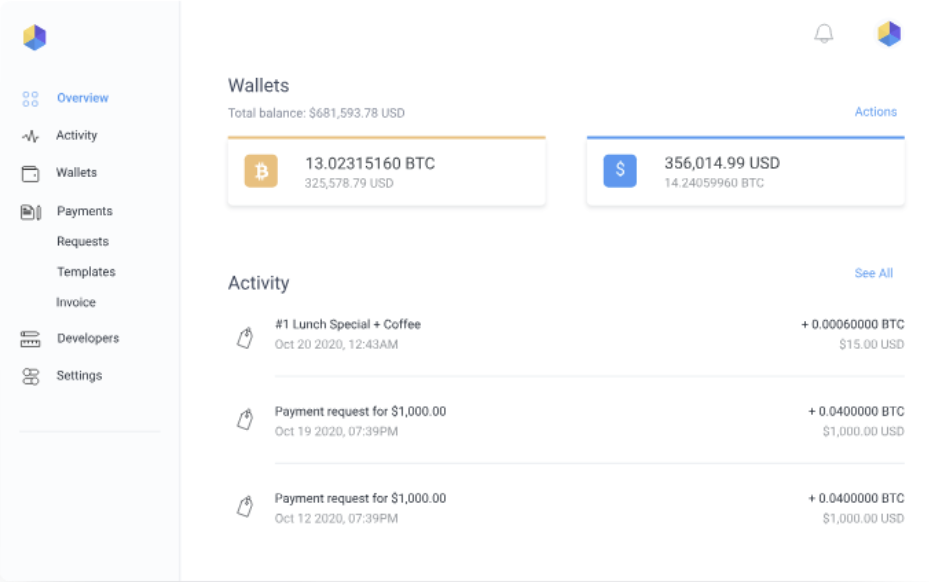

Options

- Prompt account registration.

- Accepts over 30 cryptocurrencies as funds.

- Settles in 4 fiat currencies.

- Methods to just accept crypto funds:

- API integration.

- Invoices or cost hyperlinks.

- Ecommerce plugins: Shopify, WooCommerce, OpenCart, Ecwid, NopCommerce, PrestaShop.

- Subscription.

- Cost circulation:

- Settle for crypto > convert to your chosen forex.

- Account steadiness > withdraw to checking account or cryptocurrency pockets.

- Any conversion and switch charges are charged to the client.

- Buyer pays utilizing a QR code or by linking to Crypto.com, Metamask, WalletConnect, or different cryptocurrency wallets.

- The service provider receives the precise pricing quantity.

- Lightning community assist.

- 24/7 buyer assist.

Professionals and cons

| Professionals | Cons |

|---|---|

| Retailers obtain the precise worth of the products/providers. | Restricted fiat and cryptocurrencies for settlement. |

| Permits retailers to decide on pricing forex in fiat or crypto. | No POS possibility for in-person funds. |

| Service provider will not be subjected to trade price volatility. | No superior reporting instruments. |

Advantages of utilizing a crypto cost gateway

Utilizing a crypto cost gateway gives some benefits for companies, together with:

- Decrease transaction charges in comparison with conventional cost processors.

- Prompt funds and faster settlements.

- International attain.

- No chargebacks or cost reversals.

- Enhanced safety with the blockchain know-how.

- For some gateways, flexibility to transform crypto into fiat or preserve as digital forex.

How do I select the very best crypto cost gateway for my enterprise?

When selecting a cryptocurrency cost gateway for what you are promoting, take into account these key components:

- Transaction charges: To maximise your income, search for a gateway with low charges, particularly in the event you course of a excessive quantity of transactions.

- Supported cryptocurrencies: Be certain that the platform helps in style cryptocurrencies or these most related to your buyer base.

- Fiat conversion choices: Should you don’t need to maintain crypto, select a gateway that provides straightforward conversion to fiat currencies.

- Ease of integration: Make sure the platform integrates easily together with your web site, POS, or e-commerce platforms.

- Settlement occasions: Take into account how briskly the gateway settles funds into your financial institution or crypto pockets to take care of your money circulation.

Methodology

For this listing of the very best crypto cost gateways, I targeted on options that supply flexibility, safety, and ease of use for companies seeking to settle for cryptocurrency funds. I evaluated every gateway primarily based on particular standards: integration, developer instruments, and consumer expertise (25%); supported cryptocurrencies and cost choices (25%); safety, compliance, and privateness (20%); pricing and transaction charges (15%); and buyer assist and sources (15%).

My analysis included an intensive overview of product documentation, pricing pages, buyer suggestions, and hands-on testing or demo environments the place accessible. The purpose was to advocate gateways that supply a robust steadiness of options, ease of use, and safety for companies throughout totally different industries.

This text and methodology have been reviewed by our retail professional, Meaghan Brophy