NVIDIA, a reputation synonymous with cutting-edge know-how and innovation, was based just a few three many years in the past in 1993.

From humble beginnings as a graphics chip designer centered on the gaming business, NVIDIA has developed into a world chief in AI and high-performance computing.

NVIDIA was valued at ‘just’ round $100 billion in 2019. It’s now price some $2 trillion, inserting it because the third largest firm on the earth by market cap, beneath Microsoft and Apple and forward of Saudi Aramco, Amazon, Google, and Meta Platforms.

NVIDIA was based by Jensen Huang, Chris Malachowsky, and Curtis Priem, who shared a imaginative and prescient of revolutionizing pc graphics.

Within the early Nineteen Nineties, the trio acknowledged the untapped potential of specialised graphics processors and got down to create an organization that will rework the burgeoning gaming business.

One of many firm’s early triumphs got here from a second of serendipity.

In 1995, Sega was creating its next-generation gaming console, the Sega Saturn. Sega was on the lookout for a 3D graphics chip to energy the console and had initially partnered with NVIDIA competitor 3Dfx Interactive.

Nevertheless, an opportunity assembly between an NVIDIA engineer and a Sega govt at a convention noticed NVIDIA display the corporate’s NV1 chip, which inspired Sega. Sega determined to make use of NVIDIA’s chip within the Saturn as an alternative of 3Dfx’s.

Apparently, the NV1 chip used within the Sega Saturn was not a business success for NVIDIA within the PC market. The corporate’s subsequent product, the RIVA 128 (NV3), was its first profitable PC GPU and laid the groundwork for its future dominance within the graphics card market.

One other early breakthrough got here in 1999 with the GeForce 256, marketed because the world’s first GPU.

This laid the inspiration for NVIDIA’s dominance within the gaming business, and the GeForce line of GPUs shortly turned a family title amongst gaming fanatics.

As NVIDIA continued to push the boundaries of graphics know-how all through the early 2000s, releasing more and more highly effective GPUs that delivered immersive gaming experiences, the corporate’s R&D established it as a frontrunner in parallel processing.

That may later be instrumental in NVIDIA’s future AI and high-performance computing success.

Past gaming: the rise of GPGPU and CUDA

Whereas the gaming business catalyzed NVIDIA’s early success, the corporate’s management acknowledged GPUs’ potential past graphics rendering alone.

In 2006, NVIDIA launched Compute Unified Machine Structure (CUDA), a programming mannequin that allowed builders to harness the parallel processing energy of GPUs for general-purpose computing (GPGPU).

CUDA simplified the method of programming GPUs, enabling builders to put in writing code utilizing acquainted languages like C and C++. This opened up new alternatives for NVIDIA in scientific analysis, oil and gasoline exploration, monetary simulations, and medical imaging, thus opening a myriad of latest partnerships for NVIDIA.

This additionally confirmed how NVIDIA would change into elementary in high-tech crucial infrastructure, increasing its clientele past company patrons to governments and public establishments.

Semiconductors: a notoriously difficult market to beat

The semiconductor business is notoriously complicated and extremely aggressive, with solely a handful of corporations making their mark.

A key motive for the restricted variety of massive semiconductor producers is the intense price and complexity of the manufacturing course of.

Semiconductor fabrication requires state-of-the-art amenities, often known as foundries, which may price billions of {dollars} to construct and keep.

These foundries should function in extraordinarily clear environments to forestall even the tiniest particles from interfering with the manufacturing course of.

Moreover, the gear used for semiconductor manufacture, corresponding to lithography machines, is extremely specialised and costly, with some machines costing upwards of $100 million.

Collectively, this creates huge entry boundaries for brand new business gamers, which has helped hold NVIDIA on the high of the pecking order regardless of competitors from AMD, Intel, and Qualcomm.

The AI revolution

Because the demand for AI and machine studying grew within the 2010s, NVIDIA was completely positioned to capitalize on this rising development.

With parallel processing R&D below its belt, the corporate’s GPUs turned the popular {hardware} for coaching deep neural networks and powering AI workloads.

Recognizing AI’s immense potential, NVIDIA made strategic investments within the area, collaborating with main analysis establishments and know-how corporations to advance AI applied sciences.

The corporate’s early assist for OpenAI confirmed its potential to faucet into cutting-edge industries and take dangers to develop its buyer base.

NVIDIA additionally developed specialised compute modules, such because the DGX sequence, particularly designed to speed up the coaching of enormous language fashions (LLMs) and different AI architectures. These highly effective programs shortly turned the go-to {hardware} for AI researchers and builders worldwide.

And that’s a pivotally essential level. In terms of high-end AI {hardware}, there may be NVIDIA, after which there are the others.

It’s an uncommon setup, even in Large Tech. Google, Amazon, Meta, Apple, and Microsoft will not be so totally different if you boil down their core enterprise models.

There are so few gamers within the semiconductor market, partly as a result of it’s robust and partly as a result of NVIDIA has made it so via strategic funding.

NVIDIA’s cohesive ecosystem additionally supplies certainty to builders, as NVIDIA has change into so reliable. It is a firm free from the controversies of Large Tech, the management tussles, regulatory motion, and reliance on much less tangible digital applied sciences like social media.

NVIDIA understands this, utilizing software program and {hardware} to tighten dominance over the AI ecosystem and create a collection of software program instruments and libraries that improve go-to-market methods for his or her clients.

The Omniverse and the Metaverse

Regardless of its manufacturing focus, NVIDIA has made a concerted effort to spearhead visionary software program.

Constructing on its graphics, AI, and simulation experience, NVIDIA launched Omniverse, a platform for creating and simulating life like 3D environments.

Omniverse leveraged NVIDIA’s cutting-edge applied sciences to allow collaborative design, engineering, and content material creation, opening up new prospects for the automotive, manufacturing, structure, and leisure industries.

Firms may streamline design processes, optimize manufacturing traces, and check merchandise in digital settings earlier than bodily implementation by creating digital replicas of real-world objects and environments.

NVIDIA’s Omniverse platform shortly gained traction as a key participant in creating the metaverse, a collective digital shared house that blends bodily and digital realities.

It was a sensible transfer, as why Meta plowed into their very own model of the Metaverse, NVIDIA noticed that this would possibly finest swimsuit enterprise shoppers moderately than the buyer market.

NVIDIA’s function in generative AI

The rise of generative AI additional solidified NVIDIA’s place as an AI powerhouse. That is the stage upon which NVIDIA really established itself as some of the influential corporations on the earth.

Generative AI entails coaching fashions on huge knowledge to create new content material based mostly on realized patterns and types, corresponding to textual content, photos, and music.

Recognizing its immense potential, NVIDIA launched AI Foundations, a cloud-based platform that democratized entry to state-of-the-art generative AI fashions.

AI Foundations permits companies and builders to harness the ability of generative AI with out the necessity for in depth in-house assets or experience.

NVIDIA’s AI Foundations initially included pre-trained fashions, corresponding to NeMo for pure language processing and Picasso for picture and video technology.

Once more, this reveals NVIDIA’s dedication to constructing an ecosystem moderately than particular person merchandise. That is the place they differentiate from different producers, significantly rivals in semiconductor manufacturing.

NVIDIA is a one-stop-shop for cutting-edge AI improvement, providing {hardware}, software program, and powerful collaborations with cloud assets by way of Google, Microsoft, Amazon, and others.

NVIDIA’s GPU assault

Within the midst of the generative AI increase, NVIDIA has vastly expanded its AI chip portfolio, introducing a number of groundbreaking processors designed to push the boundaries of AI and computing applied sciences throughout varied sectors.

Let’s take a better have a look at these chips and their contributions:

- A100 and H100: The H100 shortly turned NVIDIA’s flagship for AI functions, clocking speeds 6x sooner than its predecessor, the A100.

- HGX H200 GPU: Primarily based on the Hopper structure, the H200 introduces HBM3e reminiscence, offering practically double the capability and a couple of.4 instances extra bandwidth than its predecessor, the A100. It’s designed to double the inference velocity on Llama 2, a 70 billion-parameter LLM, in comparison with the H100. The H200 is appropriate with varied knowledge heart configurations and is scheduled for launch in early-to-mid 2024.

- GH200 Grace Hopper Superchip: The GH200 combines the HGX H200 GPU with an Arm-based NVIDIA Grace CPU. It’s aimed toward supercomputing functions to deal with complicated AI and HPC functions. The GH200 is predicted to be utilized in over 40 AI supercomputers worldwide, together with vital initiatives just like the JUPITER system in Germany, which is projected to be the world’s strongest AI system upon its 2024 set up.

- Blackwell GPU: Unveiled at GTC 2024, the Blackwell GPU is NVIDIA’s next-generation processor, succeeding the H100 and H200 GPUs. Touted because the world’s strongest chip by NVIDIA, Blackwell is designed particularly for the calls for of generative AI. It provides a 30x efficiency enhance over the H100 for LLM workloads with 25x higher power effectivity.

Blackwell will likely be huge, with NVIDIA’s press launch showcasing curiosity from a roster of Large Tech’s greatest names, corresponding to Microsoft’s Satya Nadella, Google and DeepMind’s Sundar Pichai and Demis Hassabis, OpenAI’s Sam Altman, and quite a few others.

NVIDIA outsmarts the US authorities

NVIDIA’s success extends to its agile company technique, governance, and response to market pressures. That features swerving the US authorities’s efforts to curb high-end {hardware} exports to China, one in every of its greatest clients.

In August 2022, the US Commerce Division imposed licensing necessities on importing sure high-end GPUs, together with NVIDIA’s A100 and H100 chips, to China and Russia. This prompted its inventory to quickly dip by nearly 8%.

The restrictions have been designed to forestall these chips from being utilized in army functions, corresponding to supercomputers and AI programs.

In October 2022, the US additional tightened its export controls, introducing a sweeping algorithm that aimed to chop China off from sure semiconductor chips made wherever on the earth with US gear. These guidelines additionally restricted the export of US-made instruments and elements important for chip manufacturing.

With every iteration of those guidelines, NVIDIA has discovered methods to navigate them by altering its chips to particularly evade export bans.

For instance, in November, NVIDIA launched three new merchandise – HGX H20, L20 PCle, and L2 PCle – based mostly on NVIDIA’s highly effective H100 chip however designed to adjust to export restrictions.

These chips are much less highly effective than the beforehand restricted A100 and H800 fashions however nonetheless provide efficient efficiency capabilities for AI duties.

As famous by SemiAnalysis, “Nvidia is perfectly straddling the line on peak performance and performance density with these new chips to get them through the new US regulations.”

In response to the South China Publish, an estimated 20 to 25% of NVIDIA’s knowledge heart income is generated from Chinese language patrons, even regardless of ever-stricter export bans.

Robotics with Mission GR00T and Jetson Thor

NVIDIA helps cutting-edge and rising applied sciences via its enterprise robotics improvement platforms.

On the GTC 2024 convention, the corporate introduced Mission GR00T and Jetson Thor. GR00T intends to revolutionize humanoid robotics by offering a general-purpose basis mannequin that allows robots to be taught from human actions and quickly be taught coordination, dexterity, and different abilities.

Right this moment is the start of our moonshot to unravel embodied AGI within the bodily world. I’m so excited to announce Mission GR00T, our new initiative to create a general-purpose basis mannequin for humanoid robotic studying.

The GR00T mannequin will allow a robotic to grasp multimodal… pic.twitter.com/EqN19Z3cXH

— Jim Fan (@DrJimFan) March 18, 2024

Jetson Thor, launched alongside Mission GR00T, is a brand new computing platform designed for these humanoid robots. It’s outfitted with a next-generation GPU based mostly on NVIDIA’s Blackwell structure.

NVIDIA can be actively creating its Isaac Robotics Platform to assist the event of refined robots with pure asynchronous motion and dexterity.

NVIDIA’s monetary efficiency and market dominance

NVIDIA’s success in gaming, AI, and high-performance computing translated into outstanding monetary efficiency. In 2023, the corporate reported income of $26.9 billion, a staggering 61% enhance from the earlier 12 months.

The info heart phase, which incorporates AI and high-performance computing, accounted for $11.2 billion, or 42% of the full income, highlighting the rising significance of those areas for NVIDIA’s enterprise.

Impressively, NVIDIA’s gaming phase continued to thrive, contributing $9.3 billion, or 35% of the full income, demonstrating its potential to keep up its management within the gaming business whereas concurrently increasing into new markets.

NVIDIA’s monetary success reached new heights within the first quarter of fiscal 12 months 2024, with income hovering to $13.5 billion, a powerful 88% enhance from the earlier quarter. The info heart phase was the first driver, with document gross sales surpassing $10 billion.

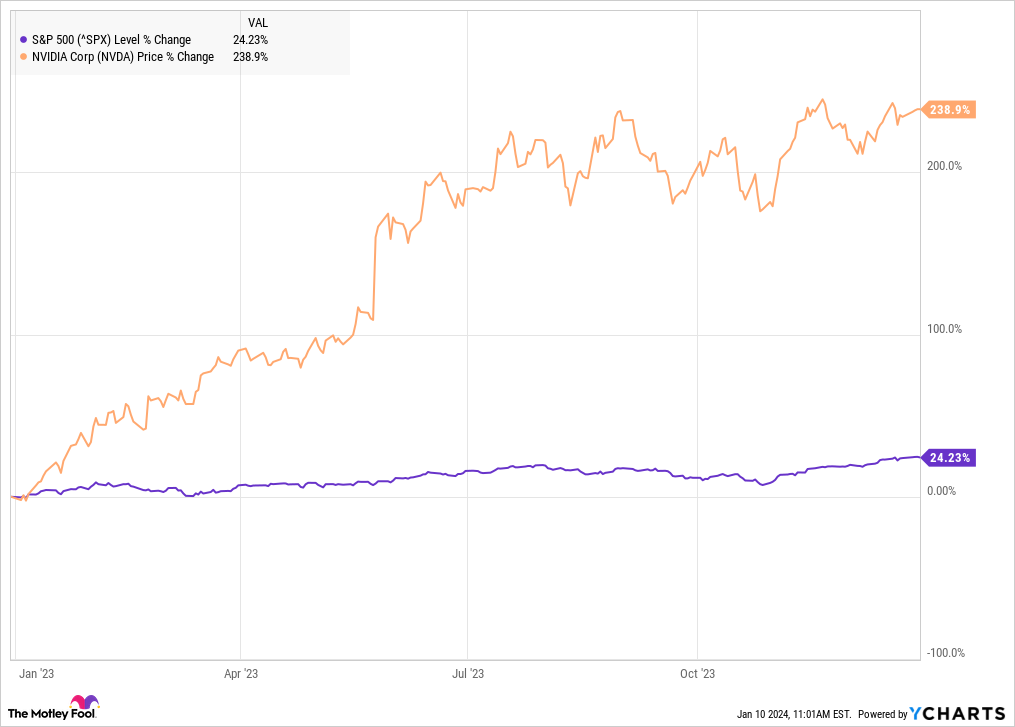

This distinctive efficiency propelled NVIDIA’s market valuation previous the $1 trillion mark in mid-2023, which was already extraordinarily spectacular – however inside simply months, the corporate managed to double its market cap to the $2 trillion mark, the place it sits immediately.

Will NVIDIA’s rise proceed?

The tech business, on the entire, is experiencing a outstanding resurgence, with Alphabet, Meta, and Microsoft reporting spectacular leads to 2023.

Alphabet, Amazon, NVIDIA, Apple, Meta, and Microsoft dominate the S&P 500 index, accounting for 9% of its gross sales, 16% of its internet earnings, and a few 25% of its market cap.

Nevertheless, what really defies market dynamics is that Large Tech grows and grows, with annual common development typically falling between 13% and 16% for a decade or longer.

As an illustration, Alphabet’s annual common gross sales development is a outstanding 28%, which means they have to add $86bn in 2024 to maintain that, then $111bn in 2025, and so forth. It’s an exceptionally robust cycle to keep up.

NVIDIA’s income final 12 months was about $60 billion, a 126% enhance from the prior 12 months. Its excessive valuation and inventory worth are based mostly on that income and its predicted continued development.

For comparability, Amazon has a decrease market worth than NVIDIA, but made nearly $575 billion in gross sales final 12 months.

This disparity reveals the steep path NVIDIA should navigate to e book massive sufficient earnings to justify its $2 trillion valuation, particularly as competitors within the AI chip market intensifies.

However regardless of that, analysts have elevated their worth targets for NVIDIA, with UBS analyst Timothy Arcuri lately elevating it to 1,100 from 800, citing the potential for NVIDIA to seize demand from world enterprises and governments with Blackwell.

Nevertheless, some imagine that NVIDIA’s inventory chart reveals indicators of weakening. Certainly, it’s extraordinarily excessive for a corporation that has but to ship the overwhelming majority of its A100 and H100 orders.

Wanting forward, the way forward for huge tech and NVIDIA’s development stays unsure. Whereas the expansion potential is immense, corporations should additionally deal with the opportunity of a cooling AI love affair, technological limitations, and regulatory hurdles.

Visitors to ChatGPT, for instance, has dropped off since Could 2023, and a few buyers are slowing down their investments in AI-related corporations. There’s some concern that generative AI has come on too quick, shortly acquiring a peak that it’d wrestle to surpass within the close to future.

Furthermore, brute pressure computing is resource-heavy, each for NVIDIA and its clients. When summed throughout world AI workloads, chips want fixed energy that rivals the capability of small nations.

And it’s not simply energy, however water too, which is pumped via knowledge facilities to the tune of billions of gallons a day. Pure assets required to construct high-end AI {hardware}, corresponding to uncommon earth metals, are additionally not limitless.

NVIDIA could be very a lot aware of the business’s power challenges, therefore why their new chips are significantly extra power environment friendly.

At GTC 2024, Huang stated, “Accelerated computing has reached the tipping point. General-purpose computing has run out of steam. We need another way of doing computing so that we can continue to scale, so that we can continue to drive down the cost of computing, so that we can continue to consume more and more computing while being sustainable.”

At the very least Huang is life like about these points.

You possibly can make certain that NVIDIA will channel extra funds into unlocking energy-efficient AI development that rids the business from the shackles of brute-force accelerated computing.