Paycor’s quick informationPricing: Contact for pricing Key options:

|

Paycor is a well-liked cloud-based payroll software program utilized by greater than 2 million individuals throughout 40,000 totally different companies. Paycor is understood for its payroll platform, however the software program presents human capital administration (HCM) instruments as properly.

Let’s dive into Paycor’s pricing plans, options, execs and cons that will help you resolve if that is the correct payroll software program for what you are promoting.

Paycor pricing

Paycor doesn’t disclose pricing on its web site, so you could contact the gross sales group for a quote. It does record out 4 totally different tiers of plans for companies below 50 staff and what options are included in every one, and we’ll get into these particulars beneath. TechRepublic’s different picks for the greatest payroll software program are cut up on whether or not or not they disclose pricing, so this isn’t utterly uncommon, however I desire that payroll software program be upfront about their pricing.

A 14-day free trial is supposedly accessible so you may strive before you purchase, but it surely’s very tough to seek out. Nonetheless, I used to be in a position to enroll in entry for a demo account with dummy knowledge utilizing solely my e-mail, and I appreciated that it didn’t require a bank card to take action.

Paycor Fundamental Plan

The Fundamental plan consists of basic payroll options equivalent to wage garnishments, off-cycle payruns, on-line test stubs and on-line reporting.

Paycor Important Plan

Along with all of the options supplied on the Fundamental plan, the Important plan additionally features a month-end accounting package deal, a common ledger report, a day off supervisor, onboarding instruments and extra.

Paycor Core Plan

Along with all of the options supplied on the Fundamental and Important plans, the Core plan consists of expense administration, worker surveys and management instruments.

Paycor Full Plan

Along with all of the options supplied on the Fundamental, Important and Core plans, the Full plan consists of profession administration, compensation planning and expertise improvement performance.

Paycor add-ons

Paycor additionally presents extra add-ons that aren’t included in any of their important payroll plans. These add-on options are:

- Staff’ compensation insurance coverage.

- Time and scheduling.

- Advantages administration.

- Recruiting and hiring instruments.

Paycor key options

Payroll and tax options

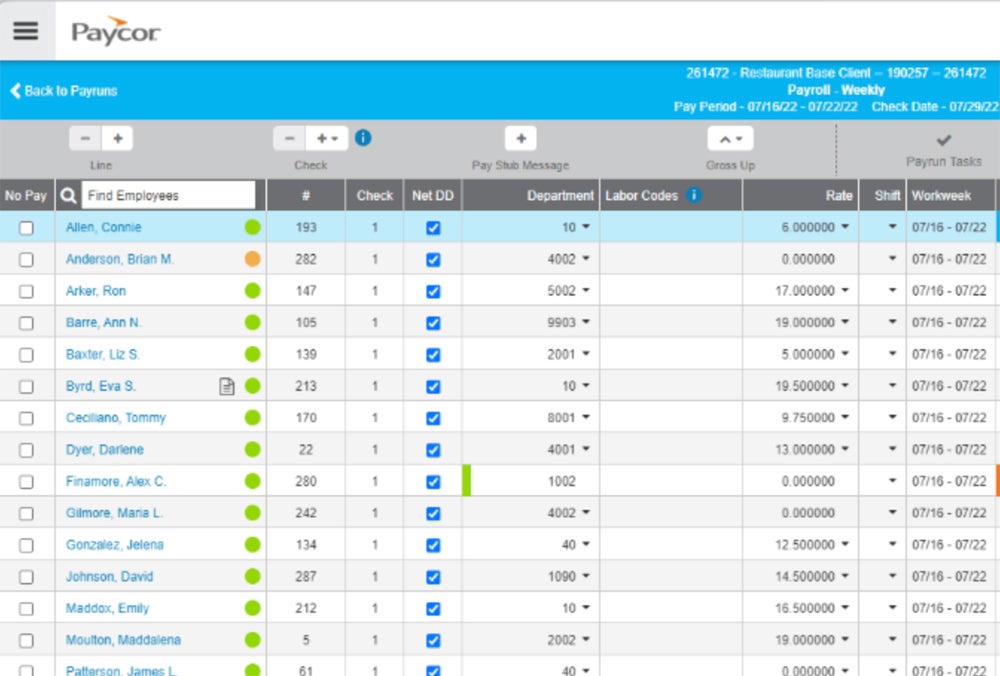

Paycor’s payroll module does supply limitless payroll runs, so it received’t cost you further for off-cycle funds or different extra runs, which is useful if it is advisable to make funds steadily. It additionally presents a useful payroll function known as AutoRun that may run payroll robotically at one other date and time. All adjustments are made in real-time, so that you don’t have to attend for them to load. Extra payroll options embrace direct deposit, federal and state tax submitting, worker self-service and test stuffing (the latter of which prices an extra function).

Time administration options

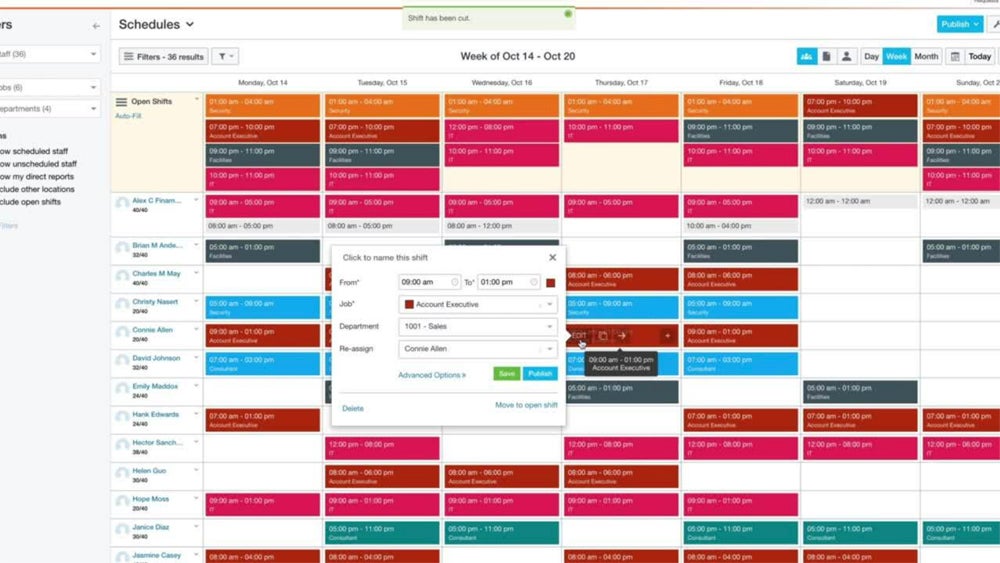

Paycor does supply instruments for time and scheduling, however you’ll need to pay an undisclosed quantity so as to add them on, even in the event you go for the costliest plan. Since a lot of payroll platforms embrace time and scheduling instruments on their increased tier plans, I wasn’t thrilled to see that Paycor fees further for it, it doesn’t matter what. Paycor presents a spread of timeclock choices in addition to time guidelines so your group can customise the way it calculates time balances. Paycor additionally presents a scheduling function that permits you to assign shifts and examine your complete group’s schedule at a look. All of this time knowledge flows over to the payroll module, eliminating guide calculations that may result in payroll errors.

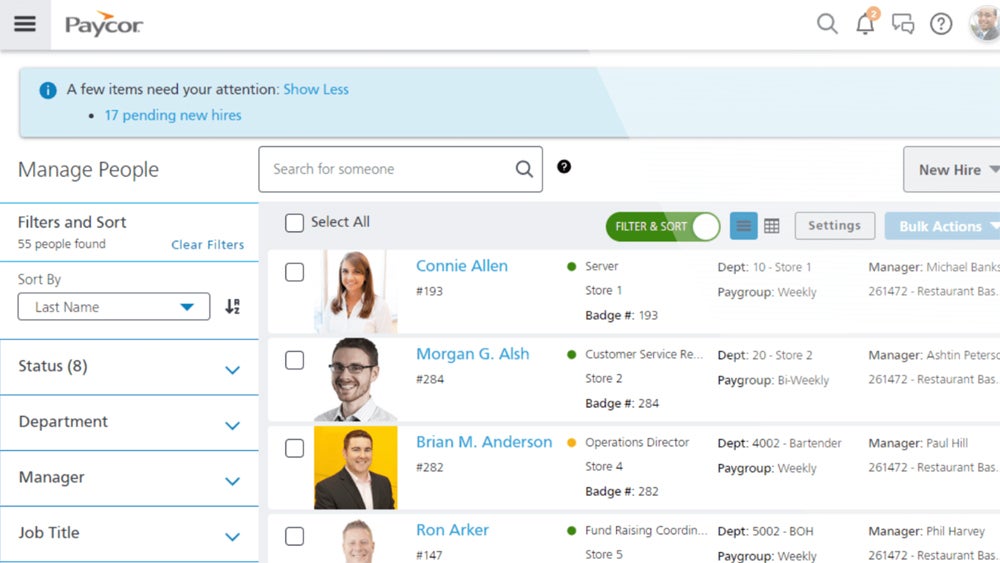

HR instruments

Paycor presents a number of instruments to help the human sources division. The Management Insights module gives insights to assist managers enhance their effectiveness. Paycor additionally creates an worker profile for every particular person, which centralizes all their data in a single place. The software program additionally presents a digital doc creation and storage module, which will help what you are promoting go paperless in the event you haven’t already. The software program additionally presents some automation instruments to eradicate guide workflows, reminders and notifications.

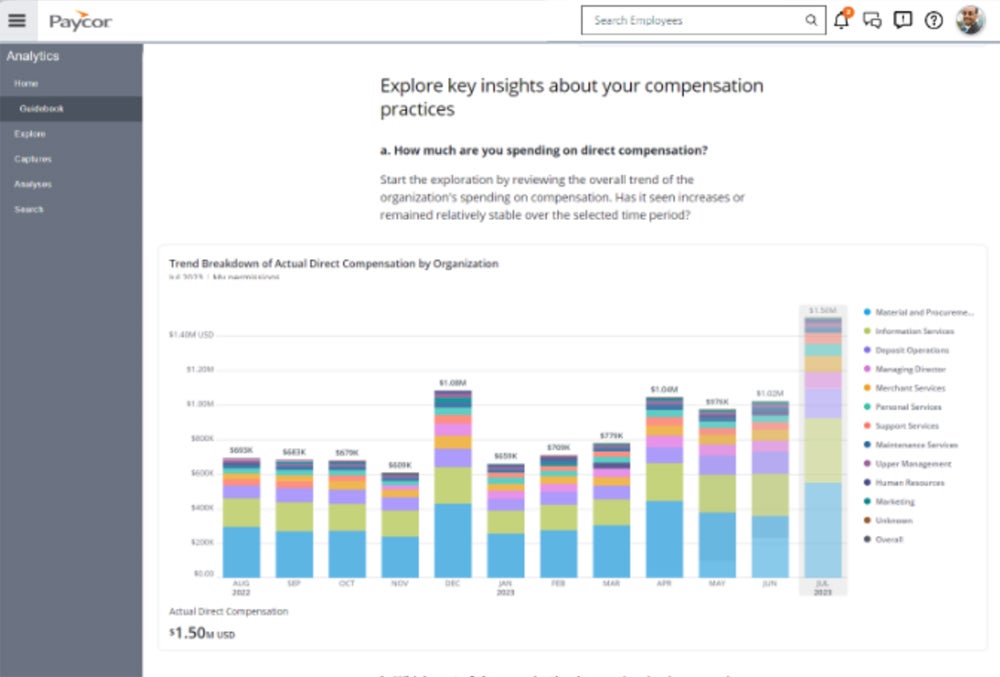

Reporting and analytics

Paycor presents fundamental analytics on the Important and Core plans — you’ll must improve to the Full plan if you need entry to the total suite of analytics options. You may import your HR knowledge to 30+ normal reporting templates or create your personal customized report. For those who simply want a fast reply, strive submitting your workforce knowledge inquiries to Paycor’s AI assistant, which ought to return a right away reply in pure language. These analytics and reporting options assist your group consider pay practices, benchmark in opposition to opponents and make strategic enterprise choices based mostly on knowledge.

Paycor execs

- Limitless payroll runs included on all plans.

- Choice to automate payroll with AutoRun function.

- Customized reporting along with 30+ templates.

- Self-service worker portal.

Paycor cons

- Pricing is just not clear.

- Prices further for a lot of key add-ons like time monitoring.

- Extra charges for sure payroll actions, like test stuffing.

- Lacks just a few key integrations, equivalent to QuickBooks.

Paycor options

| Beginning worth | ||||

| Limitless payroll runs | ||||

| Computerized payroll | ||||

| Time monitoring | ||||

| Advantages administration |

Rippling

For those who’re on the lookout for a payroll platform with much more HR options than Paycor, check out Rippling. Rippling presents worldwide in addition to home U.S. payroll and medical insurance advantages in all 50 states. Rippling additionally presents finance and IT administration instruments that Paycor doesn’t, so that you could possibly centralize much more features in a single software program. Sadly, Rippling doesn’t disclose its pricing data, so that you’ll must contact their gross sales group for a quote.

For extra data, learn the full Rippling evaluate.

Gusto

For those who’re on the lookout for a payroll app with clear pricing and fundamental HR options, try Gusto, which begins at simply $40 monthly, plus $6 per worker monthly for its entry-level plan. Nonetheless, you will want to improve to the Plus or Premium plans if you need entry to all of the HR options, like native time monitoring, PTO administration and efficiency evaluations. Gusto does combine with QuickBooks on-line, whereas Paycor doesn’t.

For extra data, learn the full Gusto evaluate.

OnPay

For those who simply want a payroll platform with out extra HR options, then take into account OnPay. OnPay solely presents one easy pricing plan, which prices $40 monthly, plus $6 per worker monthly. With this plan, you’ll get limitless pay runs and automatic tax funds and filings. It additionally consists of restricted HR instruments equivalent to PTO administration and built-in 401(ok) retirement plans. OnPay lacks some options supplied by Paycor and different options, however it is going to greater than suffice for a lot of small companies.

For extra data, learn the full OnPay evaluate.

Assessment Methodology

To put in writing this evaluate, I took a guided on-line tour of Paycor and in addition considered demo movies of assorted options. I additionally reviewed respected rankings, buyer scores, and testimonials and different professional evaluations from credible sources.