What’s ATM jackpotting?

ATM jackpotting is the exploitation of bodily and software program vulnerabilities in automated banking machines that end result within the machines allotting money. These assaults can occur at any time and usually take little or no time so culprits can rapidly commit the crime.

ATM jackpotting makes use of the weather of each bodily crime and cybercrime to get an ATM to dispense money. The offenders use a conveyable system to bodily hook up with the ATM. This “rogue” system could be a laptop computer, a smartphone or a pill PC. Additionally they use malware to focus on the machine’s money dispenser and drive it to dispense money.

Moreover, attackers will typically use deception to restrict danger, like dressing as service personnel to keep away from scrutiny whereas deciding on simpler targets, comparable to ATMs in remoted areas or unprotected by human safety guards.

With bodily entry to a machine, ATM jackpotting permits the theft of the machine’s money reserves, which aren’t tied to the steadiness of anyone checking account. Profitable thieves who stay undetected can probably stroll away with all of the money that was saved within the machine at the moment.

How does ATM jackpotting work?

The rogue system performs an essential function in executing ATM jackpotting assaults. The system primarily mimics the ATM’s inner laptop. It’s both straight linked to the money dispenser or to the ATM’s community. A direct connection permits the system to order the ATM to dispense money. Connecting to the community permits it to seize the cardholder knowledge passing between the ATM and the financial institution’s centralized transaction processing middle.

Some criminals additionally use a conveyable, malware-infested USB system that’s plugged into the machine’s USB port. Doing so installs the malware on the ATM’s arduous drive and permits the attacker to take management of the system to steal its money.

Malware utilized in ATM jackpotting

Two of probably the most generally used ATM malware households are Ploutus and Anunak.

Found within the wild in 2013, Ploutus permits criminals and cash mules to bypass an ATM’s safety measures and bodily management it so as to steal its cash. That may be completed in just some minutes both by attaching an exterior keyboard to the machine or remotely by way of SMS messaging. As a result of Ploutus could be remotely managed after its set up on the ATM’s inner laptop, criminals can use it to steal money at will. Furthermore, the malware can function undetected in order that it might probably persist within the system and probably trigger vital losses for banks and their prospects.

Anunak malware, also called Carbanak malware, is a backdoor based mostly on Carberp malware that permits attackers to remotely management the contaminated ATM and money out massive quantities of cash at will. The malware consists of capabilities like key logging and desktop video seize that permit them to steal each ATM knowledge and money. Carbanak can be used for espionage.

Targets and outcomes of ATM jackpotting

Standalone ATMs, comparable to these in retail premises like malls and repair shops, are the extra doubtless targets of ATM jackpotting assaults as a result of they’re away from the tighter monitoring and safety controls of a financial institution’s premises. ATMs that obtain much less foot visitors are additionally extra susceptible than ATMs in busier areas.

The safety controls of older machines won’t be absolutely updated, which makes them frequent targets for ATM jackpotters. That stated, any ATM can change into the goal of an ATM jackpotting assault, so all ATM homeowners needs to be cognizant of the danger and apply enough controls to forestall incidents.

Along with stealing money from the goal, attackers can even set up malware on it or exchange its arduous drive. They will additionally reboot the ATM, making it briefly unavailable and inflicting entry issues for the ATM’s prospects.

ATM jackpotting assaults world wide

In 2010, Barnaby Jack, a New Zealand-born hacker, supplied an indication of ATM jackpotting on the Black Hat Safety Convention. After he hacked into the ATM, it displayed the phrase “Jackpot” on display screen. It isn’t clear whether or not the time period “jackpotting” is a play on the phrase “jackpot” or the identify “Jack.”

A number of years later, attackers focused 450 ATMs in Mexico. They contaminated the ATMs with Ploutus malware and stole over $40 million in what turned out to be one of many world’s first large-scale jackpotting assaults.

A rash of ATM jackpotting broke out in Latin America in 2017. Previous to that, assaults have been famous in Ukraine in 2015, believed to be the brainchild of the Carbanak cybercrime group. Carbanak can be believed to be behind ATM jackpotting assaults in Taiwan in 2016 in addition to different varieties of assaults on banks in no less than 40 international locations between 2013 and 2018.

Following these incidents, assaults occurred in Europe, Asia and the US in 2018. In January 2018, the U.S. Secret Service warned ATM producers that ATM jackpotting assaults utilizing Ploutus malware had been found within the U.S. Following the warning, two well-known ATM producers, NCR and Diebold Nixdorf, issued advisories to their prospects, outlining the steps that they may take to safeguard their machines.

Methods to forestall ATM jackpotting assaults

ATM monitoring is probably the most primary safety management that every one banks ought to implement to forestall jackpotting assaults. Routine monitoring might help to determine suspicious actions like a number of failed login makes an attempt which may point out a felony making an attempt to launch a jackpotting assault.

It is also essential to recurrently replace the ATM with all required safety patches and software program upgrades. As well as, up to date safety software program, comparable to firewalls, antivirus software program and antimalware also needs to be put in to guard the machine.

One other technique is to disable the ATM’s auto-start and auto-boot capabilities. Attackers typically benefit from these capabilities to compromise ATMs, so disabling them closes no less than one door on this sort of crime.

Digital surveillance methods are one other essential safety measure for ATMs. Whereas human safety guards are additionally essential, they can not monitor the situation 24/7. They’re additionally liable to human weaknesses like fatigue and sleepiness that have an effect on their capacity to stay alert to potential assaults. Furthermore, they won’t be educated to detect and mitigate jackpotting assaults. Video cameras, movement sensors, intruder alarms and entry controls assist to plug these gaps and supply extra dependable 24/7 surveillance of ATMs, permitting banks to detect and in lots of instances, forestall, ATM jackpotting assaults.

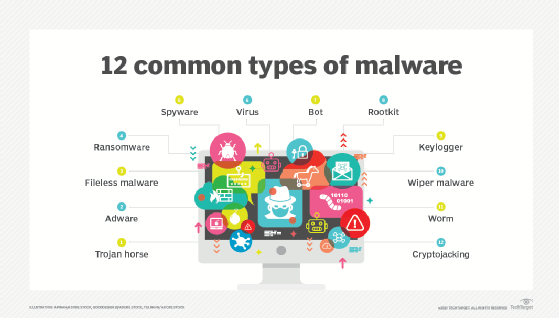

Organizations want to know how they’re being attacked to remain secure from cybercrime. Discover 16 frequent varieties of cyberattacks and the best way to forestall them.