Reconciling your financial institution transactions to your enterprise guide is crucial to the monetary well being of your organization. Nonetheless, if you happen to’ve by no means reconciled your organization’s transactions earlier than, the method can sound a bit intimidating.

Learn on to find the important steps in financial institution reconciliation and to see a number of examples of what a financial institution reconciliation would possibly appear like.

What’s financial institution reconciliation?

A financial institution reconciliation assertion compares an organization’s checking account stability to the stability on its accounting information. A financial institution reconciliation will present any discrepancies between the 2 accounts. Financial institution reconciliation helps firms detect each unintentional errors and intentional fraud.

Why is financial institution reconciliation necessary?

Financial institution reconciliation advantages firms in quite a few methods. Initially, the financial institution reconciliation course of will aid you uncover and repair errors in your books. It should additionally aid you determine fraud, wrongful funds, extra charges and different improper funds which might be costing your enterprise cash.

Financial institution reconciliation additionally helps you keep on high of the monetary well being of your enterprise. The financial institution reconciliation course of permits you to observe your enterprise’ profitability over time. It is possible for you to to categorise tax-deductible bills as you undergo your information, serving to you get tax breaks and guaranteeing you’re able to file taxes.

Kinds of financial institution reconciliation

Along with finishing an general financial institution reconciliation, you might also want to do a reconciliation for under sure sorts of transactions. Listed here are 5 sorts of financial institution reconciliation that each enterprise proprietor ought to know:

Vendor reconciliation

Vendor reconciliation helps you notice any variations between funds to suppliers and the overall ledger. It includes evaluating statements from distributors to the transactions on the overall ledger to make sure the general stability is correct.

Buyer reconciliation

In the event you let clients purchase your services or products on credit score, then you definitely’ll must conduct a buyer reconciliation. Throughout this course of, buyer transactions made on credit score are in comparison with the accounts receivable ledger in addition to the receivables management account, which is a part of the overall ledger.

Bank card reconciliation

In distinction to buyer reconciliation, bank card reconciliation includes purchases your personal enterprise has made on credit score. Throughout this course of, you’ll examine transactions made on firm bank cards to receipts and expense reporting to make sure all purchases are accounted for and that no payments go unpaid.

Money reconciliation

Companies with retail areas might want to conduct a money reconciliation on the finish of every work day. In a money reconciliation, cashiers confirm that the amount of cash remaining within the register matches up with the transactions carried out that day.

Stability sheet reconciliation

Stability sheet reconciliation confirms that each one of an organization’s monetary statements are correct. Throughout this course of, the balances on the stability sheet are in contrast towards the overall ledger in addition to different supporting documentation like financial institution statements and invoices.

do a financial institution reconciliation

Collect your paperwork

To conduct a financial institution reconciliation, you’ll need your financial institution information for a set time frame, often the previous month. You possibly can entry this information by referring to your final banking assertion or logging into your on-line enterprise financial institution accounting.

Some accounting apps may also routinely import your banking transactions, dashing up the reconciliation course of. Additionally, you will want entry to your organization books for that very same time frame, whether or not that’s in a spreadsheet, logbook or accounting software program.

Examine your books and financial institution accounts

When you’ve acquired all of your paperwork collectively, examine your books to your financial institution statements to determine discrepancies. As an example, you might need logged a cost to a vendor in your books, however that cost may not have truly hit your checking account but. Create an inventory of all of the discrepancies and attempt to decide the reason for every.

Alter the books and checking account

When you’ve acquired a grasp listing of discrepancies, it’s good to add your lacking guide transactions to your checking account and your lacking financial institution transactions to your books. Make certain all withdrawals and deposits are accounted for in the course of the interval you’re reconciling.

Examine the adjusted balances

When you’ve made all the mandatory additions and subtractions, it’s time to check the guide stability to the financial institution stability. In the event you’re carried out your calculations proper, these two numbers needs to be actual and equal, and also you’ll have completed with the financial institution reconciliation course of.

Right errors if obligatory

Frequent accounting errors will affect a financial institution reconciliation. Some frequent errors to be careful for embody information entry errors, omissions errors, transposition errors, fraudulent transactions and an incorrect starting money stability. Additionally, be careful for service charges you’ve forgotten to account for.

Examples of financial institution reconciliation

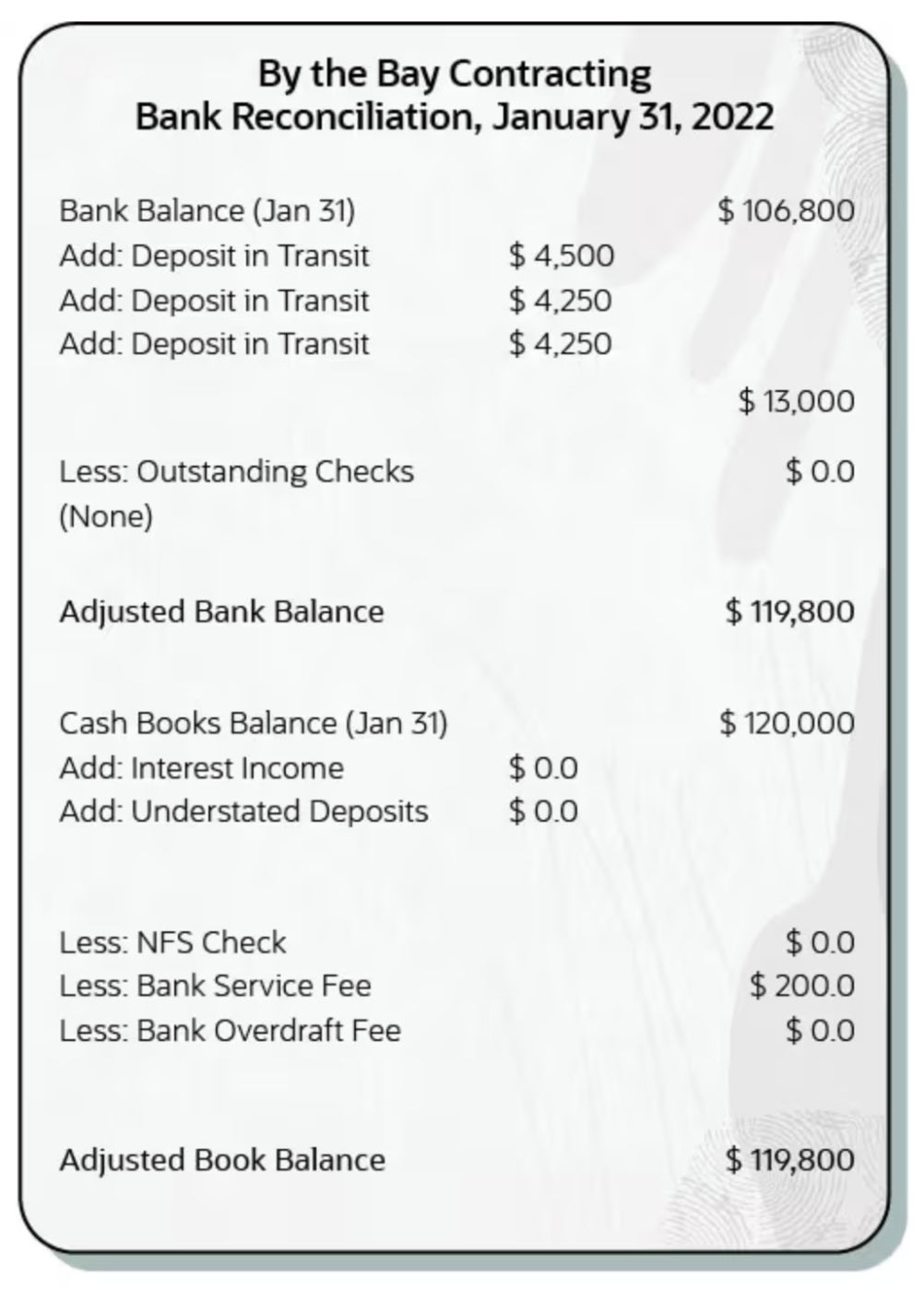

Easy financial institution reconciliation instance

Our first financial institution reconciliation comes courtesy of NetSuite, an enterprise accounting software program, and incorporates a mock firm referred to as By the Bay Contracting. As you’ll be able to see on this easy instance, the corporate wants so as to add $13,000 in complete to its financial institution stability and subtract $200 in charges from its books to make every thing stability out.

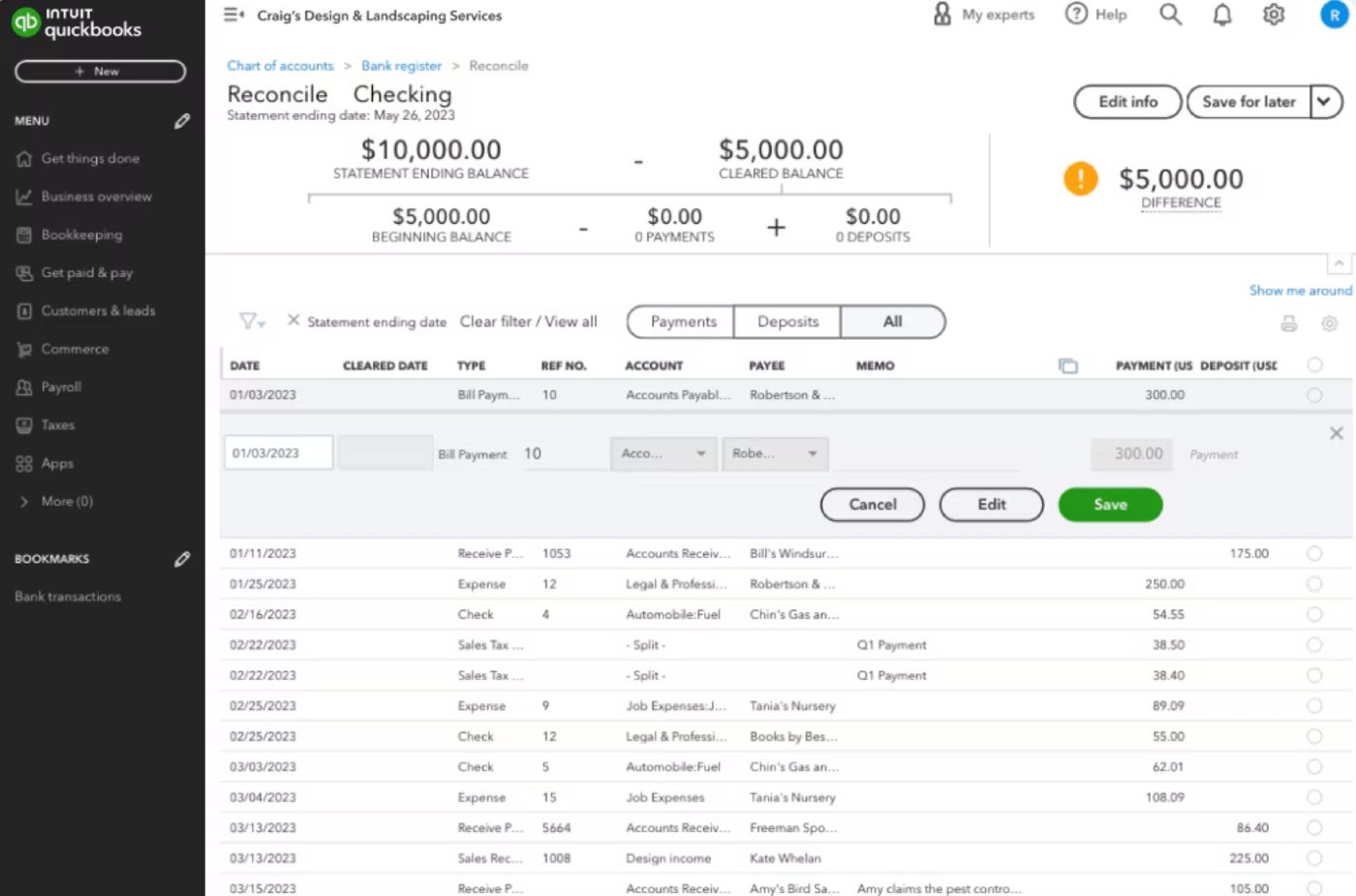

Complicated financial institution reconciliation instance

Our subsequent instance reveals a extra sophisticated financial institution reconciliation in QuickBooks. As you’ll be able to see, there’s a $5,000 discrepancy between the statement-ending stability and the cleared stability for Drag’s Design and Landscaping Companies. The enterprise proprietor wants so as to add all excellent funds and deposits till the 2 balances match up.

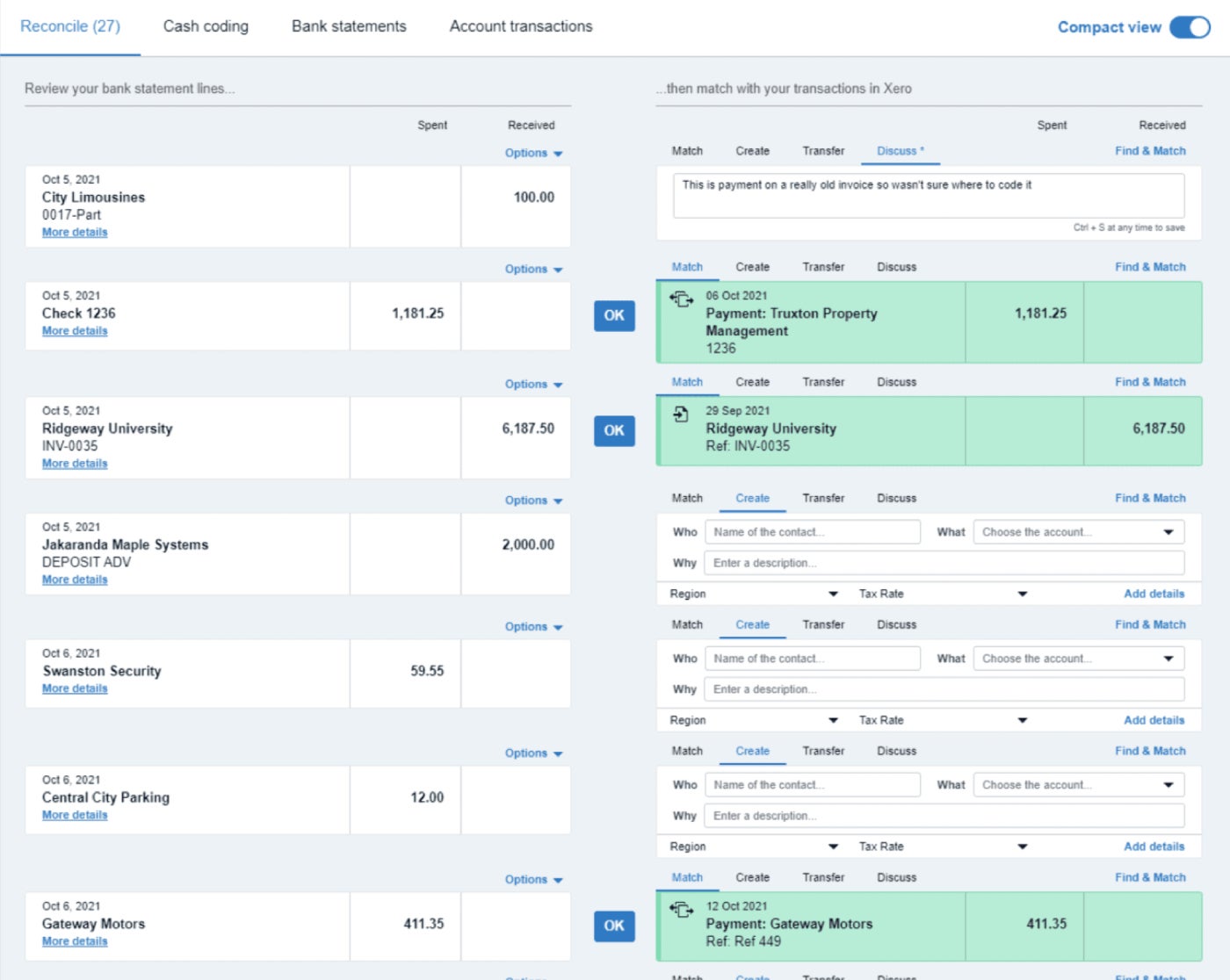

Financial institution reconciliation software program instance

Our remaining financial institution reconciliation instance demonstrates how a software program like Xero can import and categorize financial institution transactions to hurry up financial institution reconciliation. As seen within the instance, the accounting software program routinely matches financial institution assertion hyperlinks to recorded transactions in Xero and prompts you so as to add unrecorded financial institution transactions to your books.

Frequent financial institution reconciliation questions

What’s the that means of financial institution reconciliation?

Financial institution reconciliation is the method of evaluating an organization’s checking account stability to the stability on its accounting information to verify that each one transactions have been accounted for.

What’s one function of financial institution reconciliation?

The aim of a financial institution reconciliation is to assessment all transactions which have been recorded in your financial institution statements and books. Creating financial institution reconciliations helps determine unrecorded transactions and fraudulent or faulty prices.

What are the 4 steps in financial institution reconciliation?

After gathering your paperwork, the 4 predominant steps of financial institution reconciliation are evaluating your books and financial institution statements, adjusting the books and financial institution to right discrepancies, evaluating the adjusted balances to one another and fixing any remaining errors if obligatory.

What’s an instance of financial institution reconciliation?

If an organization’s financial institution statements present that it has $10,000 in money, however the books solely present that they’ve $9,000, then the corporate should carry out reconciliation to determine the lacking $1,000 in deposits.