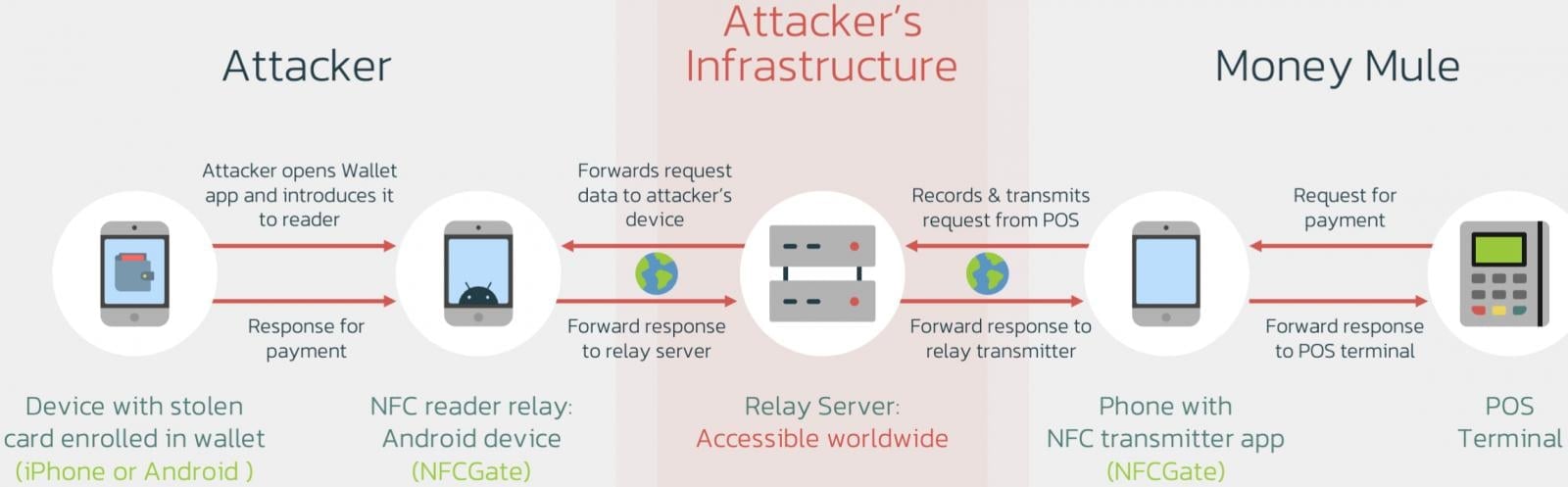

Cybercriminals have devised a novel methodology to money out from stolen bank card particulars linked to cell fee methods corresponding to Apple Pay and Google Pay, dubbed ‘Ghost Faucet,’ which relays NFC card knowledge to cash mules worldwide.

The tactic builds upon the strategies beforehand deployed by cell malware like NGate, documented by ESET in August, which concerned relaying Close to Area Communication (NFC) alerts from fee playing cards.

Ghost Faucet is extra obfuscated and tougher to detect, doesn’t require the cardboard or the sufferer’s system, would not want continuous sufferer interchange, and entails cash mules on a number of distant places interacting with Level of Sale (PoS) terminals.

Cell safety agency Menace Cloth found Ghost Faucet, which warns concerning the growing adoption and potential of the brand new tactic, telling BleepingComputer it has not too long ago seen a spike in utilizing this tactic within the wild.

Supply: Menace Cloth

Ghost Faucet overview and comparability to NGate

Step one within the assault is to steal the information of fee playing cards and intercept the one-time passwords (OTP) wanted for digital pockets enrollment on Apple Pay and Google Pay.

Stealing the fee card knowledge could be completed by way of banking malware that shows overlays that mimic digital fee apps or by way of phishing pages and keylogging. OTPs could be stolen by way of social engineering or by malware that screens textual content messages.

Within the earlier NGate-based assaults, the sufferer wanted to be tricked into scanning their card utilizing their system’s NFC system utilizing specialised malware that guided them by way of this course of.

The NFCGate device remains to be used to relay fee card data. Nevertheless, a relay server is positioned in between now, sending the main points to an intensive community of cash mules whereas obfuscating their precise places.

The mules then carry out retail purchases at scale and a number of places utilizing their system’s NFC chip, making it arduous to map the fraud community or hint the first attacker.

Within the NGate assaults, the menace actors have been restricted to small contactless funds and ATM withdrawals that risked their anonymity and even led to arrests in some instances.

With the brand new Ghost Faucets operation, the menace actors not conduct ATM withdrawals. As a substitute, they solely conduct point-of-sale money outs and unfold them amongst a large community of mules worldwide.

This obfuscates the path to the principle operators of the malicious exercise, solely placing the mules in danger.

Supply: Menace Cloth

Defending towards Ghost Faucet

Menace Cloth warns that the brand new tactic is difficult for monetary establishments to detect and cease because the transactions seem legit and span a number of places.

Whereas many financial institution’s anti-fraud mechanisms detect purchases from uncommon places, corresponding to when touring to a different nation, the researchers say the quite a few small funds might bypass these detections.

“The new tactic for cash-outs poses a challenge for financial organisations: the ability of cybercriminals to scale the fraudulent offline purchases, making multiple small payments in different places, might not trigger the anti-fraud mechanisms and might allow cybercriminals to successfully buy goods that can be further re-sold (like gift cards),” explains ThreatFabric.

Even with all these small transactions showing to return from a single system (tied to the identical Apple Pay/Google Pay account), the overall quantity misplaced could be important if the assault is utilized at scale.

To evade monitoring, the mules put their gadgets in “airplane mode,” which nonetheless permits the NFC system to operate as normal.

The one technique to defend towards Ghost Faucet is for banks to flag transactions produced from the identical card however at places that aren’t bodily doable to get to within the timeframe between fees. For instance, conducting a fraudulent transaction in New York after which ten minutes later, performing one in Cyprus.

From the buyer’s perspective, monitoring for fraudulent transactions and reporting them to your financial institution instantly is essential for blocking the cardboard and minimizing the losses.