Payroll software program can dramatically simplify the way you run your online business. It streamlines processes, saves you beneficial time, and ensures your workers receives a commission — however solely so long as you select the fitting payroll service to your group’s distinctive wants.

There are dozens if not a whole lot of payroll software program instruments made for companies like yours, so it is sensible should you’re unsure tips on how to begin narrowing down your choices. Hold studying to be taught extra about what to search for in payroll software program, which options to prioritize, and extra.

What to search for in a payroll software program

View our payroll software program analysis guidelines to be used in your payroll software program analysis course of. Utilizing this record, you’ll be able to examine off the options which might be vital for you, then make sure to ask for these options throughout demos with the corporate. You may as well search for them when evaluating suppliers and testing software program utilizing free trials.

1. Is it simple to make use of?

Once I consider a payroll software program for its ease of use, my first step is to see if the software program supplier presents a free trial or a free account I can use to check the product myself. If I can not check the product myself by signing up for an account on the supplier’s web site, I both attain out to the corporate to ask for a free trial, or I ask for a product demo.

As I discover the product, I particularly take note of:

- How simple it’s to arrange the software program and add workers.

- How simple it’s to seek out options that I’ll most use.

- If there are strategically positioned hyperlinks or buttons that make it clear what my choices are inside every function and subsequent steps for finishing frequent duties.

- As soon as I click on on a button to start a course of throughout the software program, if the software program guides me on tips on how to full or arrange the method.

- If finishing frequent duties requires technical information or if duties may be accomplished by filling out easy kinds.

- How simple it’s to arrange integrations with key software program I plan to make use of together with the payroll software program, equivalent to my time-tracking or accounting software program.

- If there are a variety of further options I’ll by no means use that overwhelm me.

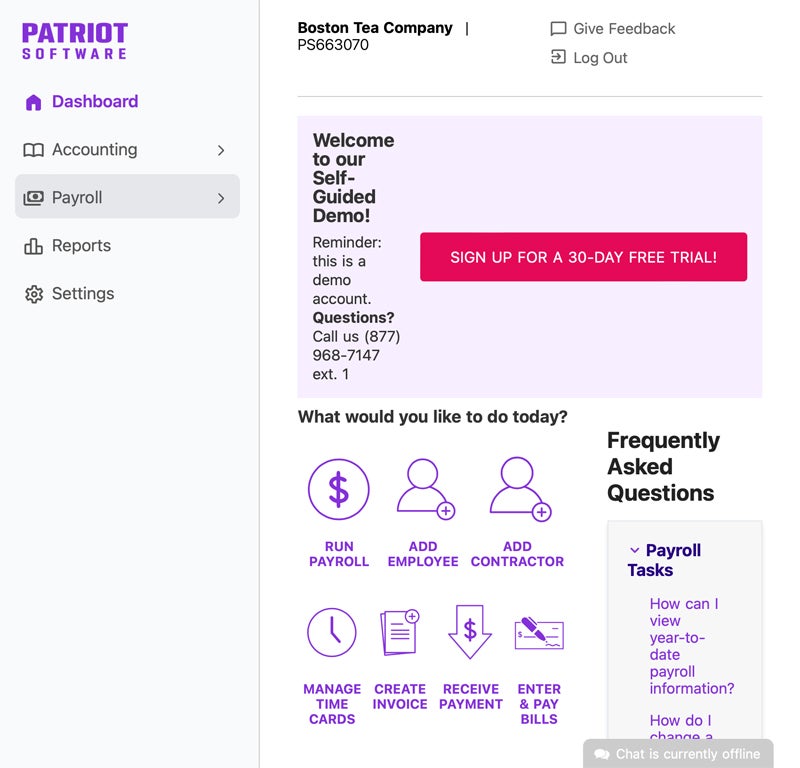

For instance, Patriot presents a guided and intuitive person expertise. Buttons are strategically positioned all through the platform with motion objects related to the content material on every web page. For instance, the platform’s payroll dashboard presents buttons equivalent to “create invoice,” “add employee,” and “run payroll.”

When you click on on a button, every motion merchandise walks you thru finishing the method utilizing easy kinds to fill out. These steps are accomplished briefly kinds. When you’re performed with a step, you’ll be able to click on “next” to maneuver on to the subsequent one.

2. What varieties of staff are you able to pay?

Whereas most payroll software program permit customers to pay workers, many additionally permit customers to pay contractors. As well as, most will let you pay U.S.-based workers, however a handful additionally will let you pay international workers and contractors. As such, take a list of the varieties of staff you at the moment make use of and your plans for working with different varieties of staff sooner or later.

In case you discover that you simply need to work with international workers or contractors, along with guaranteeing you’ll be able to pay each 1099 and W-2 workers, examine to see if the software program you select presents employer of file (EOR) and contractor of file (COR) companies that may will let you rent and pay workers in international nations with out having to arrange enterprise entities throughout the nation. As well as, examine to see what currencies you should use to pay workers and the nations it helps.

In case you plan to rent contractors, make sure that safeguards are in place to make sure compliance with classification legal guidelines and safety in opposition to misclassification penalties; these kinds of safeguards might help you identify whether or not a employee may be categorized as a contractor. Deel, for instance, presents COR companies that will let you cross on misclassification liabilities to Deel whereas leaning on Deel consultants to advise you on the right classification for every new rent.

3. How are labor taxes dealt with?

Once I consider a payroll software program, I pay shut consideration to the way it helps shopper companies in managing their labor tax obligations. Since many small companies don’t have on-staff tax consultants, I imagine the most effective payroll software program ought to supply the next helps:

- Automated labor tax calculations and deductions.

- Automated tax cost remittance to native, federal, state, and world if relevant authorities.

- Multi-state tax administration assist.

- Tax error detection alerts.

- Penalty safety that covers punitive prices ought to the software program miscalculate or miss paying the correct quantity of taxes.

- Finish-of-year tax submitting instruments, processes, and assist.

- An worker self-serve portal the place workers can entry their tax paperwork routinely.

- Tax consultants to information you in any questions you could have relating to your labor taxes.

4. Does it supply automated payroll calculations?

At its most simple, payroll software program exists to calculate worker paychecks routinely so that you don’t must. Most payroll software program can accommodate salaried and hourly workers, however double-check that each are included within the payroll service you select earlier than signing up.

If in case you have hourly workers, make sure that your payroll software program both integrates with time and attendance software program or presents a built-in time monitoring answer; in any other case, you’ll must enter workers’ hours labored by hand, which wastes time and will increase the potential of launched errors.

Paycheck calculation is about greater than calculating an worker’s gross pay, or the whole compensation they’re entitled to based mostly on their hours labored. Payroll software program additionally calculates workers’ web pay, which accounts for paycheck deductions like the next:

- Wage garnishment, or court-ordered paycheck deductions for money owed like spousal or youngster assist.

- Revenue, Medicare, and Social Safety taxes.

- Advantages deductions, equivalent to employee-paid premiums for medical health insurance.

- Retirement contributions to 401(ok) accounts or different retirement financial savings accounts.

The perfect payroll software program ought to embrace payroll tax calculations with each plan, however wage garnishment is commonly an add-on function that prices further. (Companies that embrace wage garnishment at no further price, equivalent to OnPay, are comparatively unusual.) Some payroll software program, like Patriot Payroll, allows you to enter advantages deductions by hand however doesn’t embrace computerized advantages administration.

5. What cost choices does it supply?

When a software program’s cost choices, I have a look at its direct deposit choices, its examine choices, whether or not it presents a pay card, what pay schedules it might probably accommodate, whether or not I can run limitless pay runs every month, and if I will pay off-schedule funds equivalent to bonuses. Right here’s what to think about relating to every of those choices:

- Direct deposit: Most payroll software program supply one- or two-day direct deposit payroll choices; some supply same-day direct deposit choices. In case you want a same-day direct deposit, examine to see if any charges are related to making this fast choice accessible.

- Checks: Look to see should you can print out checks from the payroll software program or if the supplier delivers printed checks to your online business. Remember that some payroll software program don’t supply a pay-by-check choice, so should you want this selection, confirm together with your supplier its availability.

- Pay schedules: Look to see in case your chosen payroll software program accommodates the pay schedule you’re used to, equivalent to weekly, bi-weekly, or month-to-month. Additionally, think about whether or not you’ll be able to pay off-cycle funds equivalent to bonuses.

- Variety of payroll runs: In case you plan to pay workers greater than as soon as a month, make sure to guarantee your chosen software program accommodates a couple of payroll run monthly. Many supply limitless payroll runs to take away this concern out of your record.

- Pay card choices: These are cost playing cards usually offered by employers to workers who do not need a checking account and would love an alternate mode of receiving their funds through direct deposit.

6. Is it scalable?

A scalable payroll software program lets you proceed utilizing it effectively whilst you broaden the variety of customers. To take action, it usually contains the power to faucet into automations to extend efficiencies as wanted and pricing plans that accommodate extra customers as wanted. It may also embrace instruments to will let you outsource or hand over duties to customers, equivalent to an EOR service and an worker self-serve portal. Different components to think about are the variety of customers the platform permits and should you can enhance your plan capability and capabilities by buying greater tiered plans or add-ons.

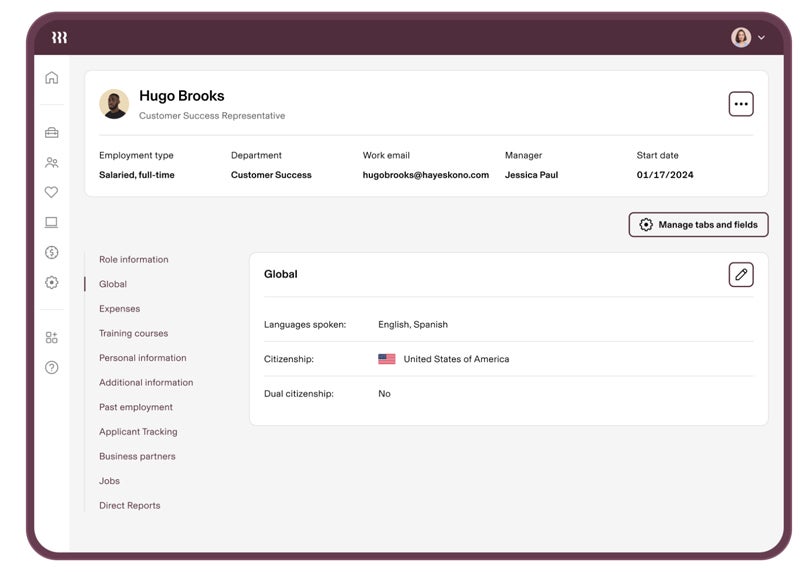

For instance, Rippling presents an worker grid (in depth worker profile) that captures key details about your workers, equivalent to their roles, pay charges, areas, and extra. Then, when a change is made, for instance, to an worker’s position, all of their entry choices, pay charges, advantages, and even credentials are routinely modified to mirror and accommodate the wants of the brand new position. Because of this even once you’re dealing with a big workforce, modifications may be performed immediately, permitting you to effectively handle extra.

7. What reporting and analytics does it supply?

By offering reporting and analytics features, payroll software program helps firms maintain monitor of their obligations and guarantee they’ll meet them. Some examples of key payroll studies to search for embrace:

- Payroll abstract report: This report lets you filter payroll details about an worker, division, or your complete workforce by a date vary and sometimes contains an accounting of gross and web wages, withholdings, and deductions.

- Payroll tax legal responsibility report: On this report, you’ll see what taxes had been withheld from every worker’s wages and the way a lot was remitted to authorities companies in consequence. You’ll additionally be capable of see how a lot you continue to owe.

- Retirement contributions: This report presents the contribution quantity to retirement plans equivalent to 401(ok) and 403(b) plans from each the employer and worker.

- Advantages studies: You should utilize this report back to discover what number of workers versus employers pay premiums.

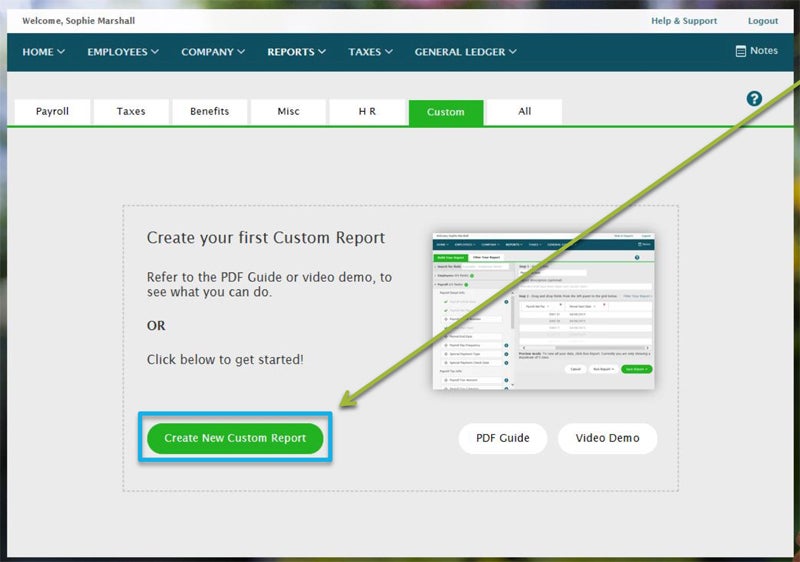

Many software program, equivalent to ADP, supply the power to create {custom} payroll studies that may usually be created from scratch or from a template you alter to accommodate your wants. For instance, you’ll be able to select what information or fields you’d like to incorporate, which workers it should cowl, and filter choices. For instance, it’s possible you’ll embrace solely managers inside a specific division, a discipline displaying paid-time-off (PTO) accumulations and remaining balances, and a date vary of solely 30 days. When you’ve created your {custom} report, you’ll be able to usually reserve it to proceed monitoring the required information.

8. Does it supply compliance assist?

Corporations should rigorously adhere to compliance legal guidelines pertaining to worker pay on the state and federal degree; if they don’t, they could be fined. As a result of the legalities concerned in payroll compliance may be technical and sophisticated, I search for a payroll software program that automates and guides companies to adhering to those rules, whilst they modify. Some compliance duties an excellent payroll software program could assist to handle embrace:

- Wage withholdings for youngster assist and different garnishments.

- Adherence to the Truthful Labor Requirements Act (FLSA), the Equal Pay Act (EPA), the Federal Insurance coverage Contributions Act (FICA), and federal revenue taxes (FIT), the Federal Unemployment Tax Act (FUTA) (together with withholdings and remittance of related funds).

- Adherence to rules surrounding minimal wage and extra time pay necessities.

- Help for prevailing wages, usually with state-specific authorized steering indicating the requirement to pay at minimal the typical pay for equally employed staff.

- Licensed payroll necessities for federal contract jobs.

- Help for state-specific final paycheck and payday necessities.

9. Does it combine with different software program?

Many payroll software program suppliers supply a method to straight combine your payroll software program with different expertise you utilize to run your online business’s accounting and HR features. For instance, many supply integrations with widespread accounting, HRIS, and time-tracking software program. This enables your payroll software program to retrieve and sync worker information throughout all methods for extra correct payroll processing.

For instance, should you combine your time-tracking software program together with your payroll software program, your payroll software program positive factors instantaneous entry to the hours workers labored, permitting it to routinely calculate every worker’s pay every pay cycle. In doing so, you keep away from guide enter of hours labored and any errors that will come up from that human course of.

So, take a list of the expertise you’d prefer to combine together with your payroll software program and examine together with your payroll software program supplier to make sure these integrations are potential, both through a direct integration partnership between the 2 platforms or an API that lets you create a {custom} integration.

10. Are you able to customise the software program?

Many payroll software program supply strategies you should use to customise the platform to your wants or model. These customizations may be so simple as importing your organization’s brand to the software program’s dashboard so shoppers and workers can expertise a branded person interface. Or, customizations may be extra complicated.

For instance, UKG Prepared Payroll presents a customizable reporting performance. You may create a number of dashboards with solely the payroll studies you need on them, equivalent to payroll fairness studies. You may as well save these dashboards to share together with your crew. From there, the platform will collect insights out of your custom-built studies and supply AI-powered steering on how your crew ought to put them into motion to enhance your online business.

A great way to guage whether or not an organization presents the customizations your organization wants is to e-book a demo with a gross sales consultant and go over your particular customization wants. The consultant can then stroll you thru whether or not these customization choices can be found and the way simple or tough will probably be to implement them.

How to decide on payroll software program for your online business

1. Take into account your online business’s workforce

Make an in depth record of your organization’s payroll software program wants. Take into account the varieties of staff you rent, what number of you’ve got, the place they work (in a specific state or in another country), in the event that they’re seasonal, your cost schedule, and the way you propose to pay workers.

2. Perceive which payroll options you want

When you’ve thought rigorously about your workforce’s wants, it’s time to dig into which payroll software program options you’ll be able to’t stay with out. You could find a extra detailed description of the highest payroll options in our complete payroll information.

3. Rigorously calculate payroll prices

Almost the entire finest small-business payroll software program methods cost each a month-to-month base price and a per-employee price. Take into account each in your calculations. You’ll additionally need to think about add-on charges for companies like accounting software program integration, worldwide payroll, worker advantages administration, multistate tax service, and time-clock software program. Take into account prioritizing software program with a number of plans you could simply scale as much as as you rent extra individuals.

4. Slim down your payroll software program choices

Our article on the finest payroll software program of the yr can function a jumping-off level to your analysis as you slim down your choices to the most effective payroll software program to satisfy your wants.

If studying an extended evaluate is overwhelming, right here’s our greatest-hits record of payroll software program to think about:

- Gusto ($40 monthly plus $6 per individual) is usually thought-about the highest payroll software program supplier for small, midsize, and huge companies.

- Paychex ($39 monthly plus $5 per individual) has extra add-on charges than most of its opponents, but it surely additionally has the most effective HR libraries of any mixed HR and payroll product.

- OnPay ($40 monthly plus $6 per individual) is without doubt one of the most totally featured payroll firms with the fewest add-on charges and hidden prices.

- SurePayroll by Paychex ($20 monthly plus $4 per individual) is without doubt one of the least expensive payroll companies made particularly for small-business house owners.

- ADP ({custom} pricing solely) presents a wide selection of versatile payroll merchandise that may accommodate the smallest of small companies in addition to large world enterprises.

In case you’re on the lookout for probably the most reasonably priced choice, go to our finest low cost payroll software program and our finest free payroll software program guides.

5. Reap the benefits of demos and free trials

Many payroll software program suppliers supply a free trial or free account setup; those who don’t will normally supply free, custom-made demos that stroll you thru each facet of the software program. Payroll software program firms with free trials embrace the next:

Whereas Gusto and Sq. Payroll don’t supply free trials, each choices permit clients to arrange accounts free of charge; you gained’t be charged till you resolve to run payroll for the primary time.

6. Get skilled recommendation from a payroll specialist or accountant

In case you’re a brand new enterprise proprietor processing payroll for the primary time, I strongly suggest talking with an accountant and payroll specialist to higher perceive your payroll obligations, together with and particularly your payroll tax obligations. An accountant may also level you towards the finest payroll software program for accountants, which may affect your closing software program determination.

7. Reevaluate as wanted

In case you’ve signed up for a payroll plan, began operating payroll, and located that you simply love your new payroll software program, that’s good news. Consider, although, that it’s okay to modify suppliers in case your payroll wants change or in case your new software program doesn’t allow you to as a lot as you hoped it will.