- Greatest worth: Sq.

- Greatest for low processing charges: Helcim

- Greatest for on-line companies: PayPal

- Greatest for multichannel cost platforms: Stripe

- Greatest for invoicing: Wave

Disclaimer: Once I say “free,” I imply “no upfront costs, no monthly subscription fees, and no contracts.” I do not imply “no processing fees.”

Each time a transaction is made electronically, whether or not on-line or in-person, a prolonged chain of stakeholders is concerned in processing the switch of funds, and every one takes a reduce. So, there’s no actually free solution to settle for funds — besides money, that’s.

That stated, these service provider account suppliers all provide no month-to-month charges, long-term contracts, or month-to-month minimums; and, they provide aggressive transaction charges. See our detailed comparability beneath.

High free service provider account suppliers in contrast

| Our score (out of 5) | Greatest for | In-person transaction charge | On-line transaction charge | Free card reader? | |

|---|---|---|---|---|---|

| Sq. | 4.58 | All-in-one answer | 2.6% + $0.10 | 2.9% + $0.30 | Sure, 1st magstripe reader |

| Helcim | 4.24 | Low processing charges | 1.83% + $0.08 (common) | 2.27% + $0.25 (common) | No |

| PayPal | 4.19 | On-line-only companies | 2.29% + $0.09 | 2.99% + $0.49 | Sure, 1st card reader discounted |

| Stripe | 4.11 | Promoting in individual and on-line | 2.7% + $0.05 | 2.9% + $0.30 | No |

| Wave | 3.83 | Accumulating funds through invoicing | N/A | From 2.9% | N/A (on-line funds solely) |

Sq.: Greatest worth

Our score: 4.58

We’re speaking free, proper? Properly, what if we would like free stuff along with free providers? Properly, that’s why Sq. is on the prime of my listing.

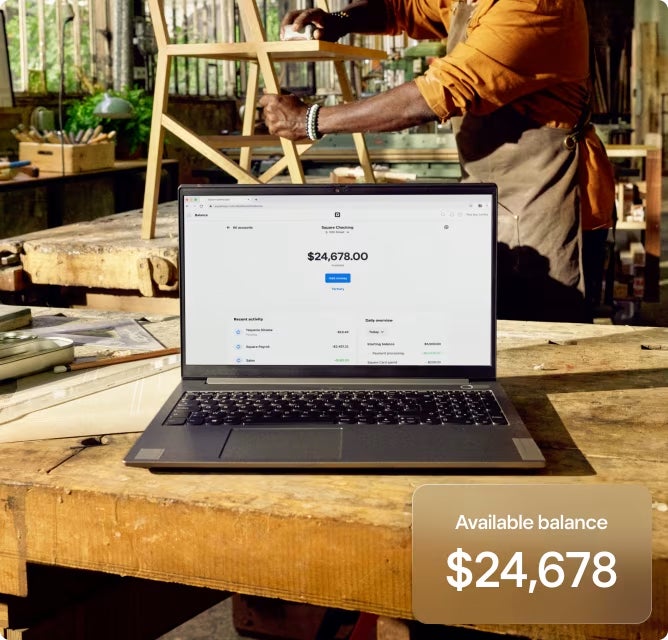

To be clear, Sq. has many benefits, not simply the free reader they ship to new accounts after they signal on. Sq. typically makes our best-of lists due to its handy providers and all the cost instruments it presents totally free.

Listed below are among the issues you’ll be able to declare for signing up with Sq. for no value apart from what you pay in processing charges:

- A free magstripe card reader peripheral.

- Entry to in-person card cost processing through Sq.’s POS.

- Entry to digital POS performance and manual-entry transaction processing.

- Entry to free web site constructing, internet hosting, and on-line storefront help.

- Entry to invoicing together with “click to pay” buttons on your clients to pay on-line.

Why I selected Sq.

I discussed a number of of the freebies Sq. throws your approach within the listing above. Along with the freebies, the charges Sq. does cost are flat-rate, clear, and simple to finances for.

Backside line: Sq. comes up so often as a result of manufacturers that promote in individual, particularly sole proprietors or small operations, stand to learn dramatically from these a lot decrease obstacles to entry. And on this economic system, any leg up when beginning a enterprise is welcome.

Pricing

Pricing plans

- Free — $0/month plus processing charges.

- Plus — $29/month plus processing charges.

- Premium — $89+/month plus processing charges.

Processing charges

- In-person — 2.6% + $0.10.

- On-line — 2.9% + $0.30.

- Manually entered — 3.5% + $0.15.

- Invoices — 3.3% + $0.30.

Add-ons instruments: From $5/month.

Options

- Free Sq. account contains POS, on-line retailer/checkout, digital terminal, invoicing, and extra.

- Sq. features a free cell card reader with each signup; in-person charges are business normal.

- A great deal of add-ons and upgrades with worthwhile options at cheap costs.

Professionals and cons

| Professionals | Cons |

|---|---|

| Plenty of freebies, together with free {hardware}. | Much less suited to companies that settle for most of their funds as card-not-present. |

| Choices for B2B providers like advertising and marketing and enterprise banking. | Processing charges will not be the bottom accessible. |

| Customized processing charges accessible for high-volume sellers. |

SEE: Greatest cloud POS methods

Helcim: Greatest for low processing charges

Our score: 4.24

If the account is free, then the most important bills you’re prone to cope with are the processing charges. You’ll be able to’t get round these charges, however you’ll be able to reduce their affect by discovering those most amenable to your group. Helcim cuts down the prices throughout the board, however the numbers should get sort of sophisticated to make it occur.

The place Sq. and Stripe flatten transaction processing charges to a single value, Helcim doesn’t. The previous two can solely obtain a flat charge format by various their very own revenue margin, which means they often take a much bigger reduce. Helcim does the other, making use of the identical (quite skinny) revenue margin to each transaction.

In observe, it seems like your charges are everywhere — as a result of they’re — however you’re by no means paying additional simply to get the flat charge. You solely ever pay the interchange charges plus their flat margin. That’s why it’s often called “Interchange Plus pricing.”

Why I selected Helcim

Along with interchange-plus charges, Helcim additionally presents pass-through charges; which permits clients and donors to pay processing charges and ship you the total transaction quantity. This isn’t generally finished in retail gross sales or different for-profit contexts.

However should you’re operating a nonprofit, a charity, or the rest that takes donations quite than promoting items/providers, this may be fairly the lifesaver. Donors are already wanting that can assist you profit from the cash they’re giving, so the bulk are blissful to maintain the charges from consuming into what you obtain.

Interchange Plus and pass-through charges alone qualify Helcim for this listing.

Pricing

- No month-to-month charges.

- No contracts.

- Interchange Plus: Helcim’s processing charges are the bottom interchange price plus its flat margin price — .0.40% + $0.08 for in-person transactions, and 0.50% + $0.25 for on-line and handbook entry.

Options

- Interchange Plus pricing means you’ll pay much less for processing charges with Helcim than anyplace else.

- Cross-through charges choice so you’ll be able to arrange your processing to present the payee the choice to eat the price of these charges themselves.

- Quantity-based reductions aid you save extra the extra you promote.

Professionals and cons

| Professionals | Cons |

|---|---|

| Tremendous low processing charges, although calculations are a bit extra complicated. | You save much less should you course of principally high-interchange transactions (e.g., AmEx). |

| Higher suited to companies processing excessive volumes, nonprofits accepting donations, and organizations doing a lot of ACH transactions. | Fewer add-ons and ancillary options accessible. |

| Save extra whenever you course of low-interchange transactions (Visa playing cards, and so on.). | Restricted choices for speedy disbursement. |

PayPal: Greatest for on-line companies

Our score: 4.19

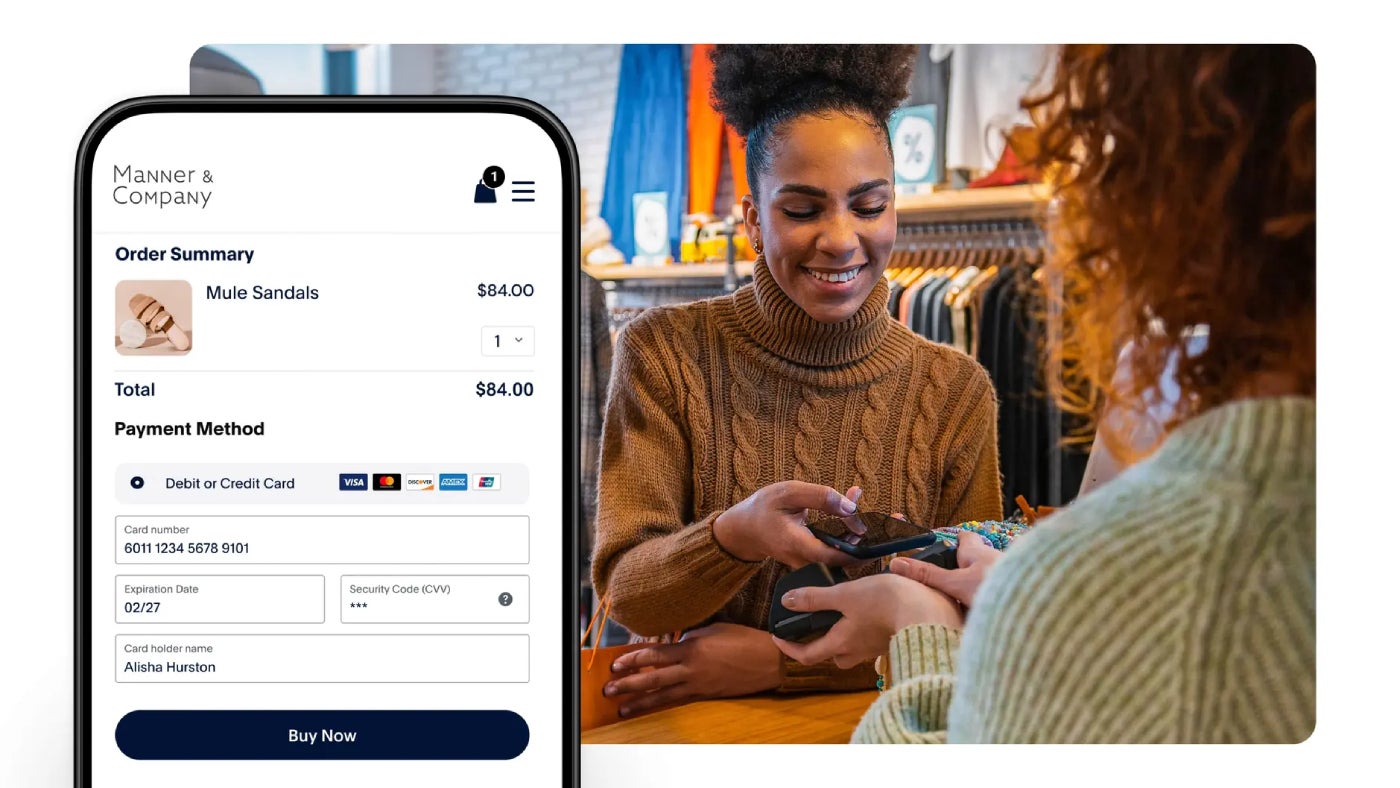

PayPal has been round for a very long time: it’s a well-known and trusted cost establishment. For years, PayPal was purely a web based service, facilitating e-commerce and card-not-present transactions solely.

That background is obvious in how PayPal operates now, at the same time as the corporate began providing POS options and in-person processing. The place Sq. tilts the scales of its charges in the direction of the face-to-face expertise, PayPal does a bit of the other. PayPal makes it simpler and cheaper for up-and-coming companies to just accept cost and revenue from on-line gross sales.

Why I selected PayPal

Higher charge charges for on-line transactions will not be the one causes to select PayPal, although. Throughout, PayPal is healthier outfitted to help and allow manufacturers which might be making an attempt to ascertain a foothold in on-line markets. It’s free to get an account, and you’ve got an in depth listing of suitable cost strategies, from QR codes, to copious third-party integrations and embedded cost portals, to even cost apps, and installment-based funds.

What’s extra, PayPal can be utilized to facilitate transactions in your digital storefront mainly anyplace you may construct a web site or have already got one constructed.

SEE: Greatest worldwide service provider accounts

Pricing

- No month-to-month charges.

- Commonplace credit score/debit funds: 2.99% + mounted charge.

- In-person and QR code transactions: 2.29% + mounted charge.

- PayPal Checkout: 3.49% + mounted charge.

- Pay with Venmo: 3.49% + mounted charge.

- Different transaction varieties: 3.49% + mounted charge.

Be aware: The mounted charge is a flat quantity added to each transaction — just like the “plus $0.15” you may see in different processors’ pricing — with the one distinction being that the charge relies on the kind of foreign money used within the transaction.

Options

- Plenty of choices for on-line promoting and e-commerce.

- One of many longest lists of accepted funds.

- Invoicing, digital storefront, and embed/integration performance.

- Free cell POS app.

Professionals and cons

| Professionals | Cons |

|---|---|

| A significant cost answer and a trusted identify within the area. | Restricted choices for in-person promoting in comparison with opponents on this listing. |

| Works with nearly any type of cost, foreign money, and digital market. | Just one POS choice accessible. |

| Extremely adaptable for various web sites and on-line checkouts. |

Stripe: Greatest for multichannel cost platforms

Our score: 4.11

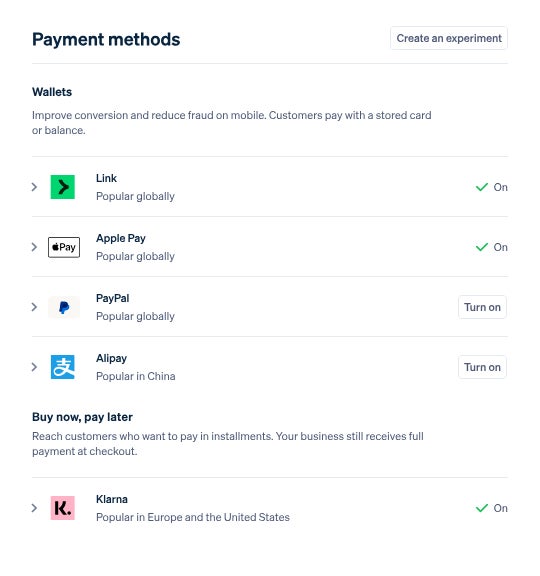

Stripe gives its customers with superior customization instruments at no additional value. You’re not penalized for eager to tailor your on-line and in-person cost platforms; the truth is, Stripe presents a powerful array of API and SKD documentation and options to information you thru the method. Nevertheless, if plug-and-play is extra your pace, Stripe has tons of of integrations with different software program.

Why I selected Stripe

If you happen to discover success by pulling from a number of revenue streams, you shouldn’t should cringe at the price of customizing your cost instruments simply to supply your clients the most effective checkout expertise.

Stripe takes a novel strategy by letting companies use its developer instruments totally free. So, whereas it presents most of the similar worth propositions of forever-free plans from manufacturers like Sq., you’re not restricted to pre-built customized choices, although Stripe has these, too. That leaves you free to tailor your in-person and on-line checkout platforms as a lot as you need.

Pricing

- No contracts, no month-to-month charges.

- In-person transaction charge: 2.7% + $0.05.

- On-line transaction charge: 2.9% + $0.30.

- Customized pricing packages accessible.

Options

- Choices for speedy payouts.

- Superior instruments for reporting, automation, and different features.

- High-notch security measures.

- Greatest-in-class API and SDK documentation.

Professionals and cons

| Professionals | Cons |

|---|---|

| Receives a commission quicker, probably even with out paying additional charges. | Fewer in-person and POS {hardware} choices than opponents like Sq.. |

| Highly effective cell card readers and terminals. | Doesn’t help high-risk industries (e.g., age-restricted items, and so on.). |

| Consumer-friendly open API. | |

| Lots of of integrations. |

Wave: Greatest for invoicing

Our score: 3.83

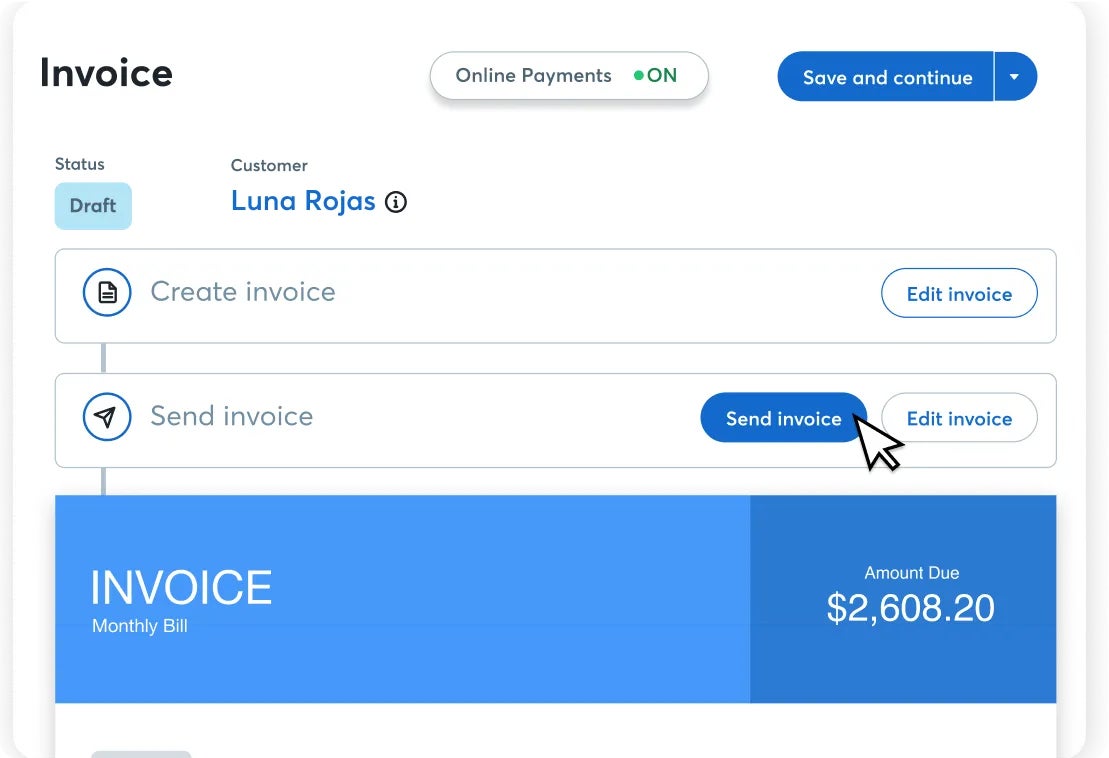

Wave is an outlier on this listing; all the different picks have POS {hardware} choices accessible and can be utilized to gather funds in individual — Wave doesn’t. What Wave does have is essentially the most sturdy invoicing capabilities of the bunch, that are free to make use of.

Whereas you must improve if you’d like a slight discount in processing charges and take away the Wave watermark out of your invoices, you in any other case have full entry to Wave’s performance. Notably, you should utilize Wave to create estimates and invoices and convert the previous into the latter.

By comparability, Helcim doesn’t facilitate estimates; Stripe reserves estimate creation for customers who improve to a plan with the next charge price; and Sq. doesn’t permit estimates to be transformed to invoices with out subscribing to a paid plan.

Why I selected Wave

Not each enterprise wants to have the ability to swipe a card and even let clients buy a storefront. However everybody wants a solution to receives a commission, and it’s useful you probably have a solution to monitor that money move and simplify information for issues like monetary reporting and taxes.

Lastly, Wave has just a few standout add-ons, together with professional help and even full bookkeeping providers, that are dear however doubtlessly price it for peace of thoughts.

Pricing

Pricing plans

- Starter Plan — $0/month, plus processing charges.

- Professional Plan — $16/month, plus processing charges.

Processing charges

- Beginning at 2.9% + $0.60.

- Charges lowered to 2.9% + $0.60 for the primary 10 transactions/month for Professional subscribers.

Out there add-ons

- Digital receipt seize.

- Run payroll.

- Rent a bookkeeper.

Options

- Intuitive, browser-based interface.

- Handy billing performance, permitting purchasers to pay you instantly from a digital bill.

- Useful add-ons for small companies (e.g., payroll, receipt seize, bookkeeping providers).

Professionals and cons

| Professionals | Cons |

|---|---|

| Simple to arrange, use, and receives a commission. | No help for in-person funds. |

| Almost all core performance accessible to free account customers. | Lowered charges for Professional Plan are restricted to the primary 10 funds per 30 days after which Starter Plan pricing after that. |

| Maintain prices low, or improve for boosted performance as wanted. |

How do I select the most effective free service provider account for my enterprise?

When selecting a free service provider account, it’s not solely a matter of “who’s the cheapest” or “who offers the most value for the free version,” as all of those contenders already present the bottom providers totally free. That leaves us with some essential, core elements to look at and examine.

How costly are the processing charges?

Some processors provide lowered charges for one cost methodology however elevated charges for one more. Some flatten the charges out to make every thing straightforward to know and calculate. Some provide reductions for prime quantity. Some reduce their very own revenue margins to go on financial savings.

In different phrases, when evaluating these free-ish choices, you’ll begin from their finest price (normally the one plastered in giant font throughout their pricing web page) and survey the remainder of the charges from there to see in the event that they’ll really be saving you cash primarily based on the way you do enterprise.

How a lot performance do you get totally free?

All of our picks present a service provider account and not using a month-to-month charge, minimal, or long-term contract; the expertise when you’re inside, nevertheless, is totally different from vendor to vendor.

Make an inventory of your must-have options, whether or not it’s a point-of-sale app, on-line checkout, integration together with your accounting software program, and so on., and ensure your must-haves are included totally free.

Particular point out right here for add-ons, optionally available modules, and different upgrades that vary from cheap to breaking the financial institution. Ideally, the free answer you select now will be capable of develop with your small business, so ensure that it has the add-ons and upgrades you’ll need down the highway.

SEE: Greatest service provider providers

What, if something, is the answer unable to help?

Lastly, now we have to contemplate go/fail dealbreakers.

What disqualifies you and yours might differ from that of different professionals and organizations. Do you promote items in a high-risk business? Do you want age-restriction performance? Do you promote to worldwide markets? Are normal POS/processing choices ill-suited to sure eclectic options of your business or enterprise mannequin?

Simply as no restaurant desires to make use of a degree of sale that may’t facilitate gratuity, no enterprise desires to decide to an answer that solely solves a part of their drawback. Even at a value of “free,” some issues aren’t price the price, and also you’re higher off searching for a extra becoming reply to your drawback even when it’s important to pay a bit extra to get what you want.

SEE: Greatest high-risk service provider account suppliers

Methodology

We began broad, appeared on the main gamers within the area, and whittled issues down from there. Then we graded the shortlist and assembled the related info into this text.

Listed below are the particular standards used:

- Pricing and contract: Weighted 30% of the overall rating.

- Account options: Weighted 30% of the overall rating.

- Fee processing instruments: Weighted 25% of the overall rating.

- Consumer evaluations: Weighted 15% of the overall rating.

This text was reviewed by funds professional Anna Dizon and retail professional Meaghan Brophy, who’ve examined many of those platforms hands-on.