SUMMARY

- SpyLoan Rise: SpyLoan apps have elevated by 75% between Q2 and Q3 2024, focusing on customers globally.

- Play Retailer Menace: 15 malicious mortgage apps on Google Play have been downloaded over 8 million occasions.

- How They Work: These apps lure customers with pretend mortgage gives, harvest delicate knowledge, and exploit victims financially.

- International Influence: Excessive prevalence reported in India, Mexico, the Philippines, Kenya, and 7 different nations.

- Staying Protected: Customers ought to analysis apps, keep away from granting extreme permissions, and use antivirus software program.

Cybercriminals are exploiting SpyLoan, or predatory mortgage apps, to focus on unsuspecting customers globally. McAfee cybersecurity researchers report a whopping 75% rise in SpyLoan apps and contaminated units between Q2 and Q3 of 2024. These apps lure customers with guarantees of fast, hassle-free loans however are designed to reap delicate knowledge, leading to extortion, harassment, and monetary losses.

This enhance might be understood by the truth that researchers noticed 15 such apps on the official Google Play Retailer with over 8 million installations worldwide. These apps, particularly focusing on customers in South America, Southern Asia, and Africa, use social engineering techniques to trick customers into offering delicate data and granting extreme permissions.

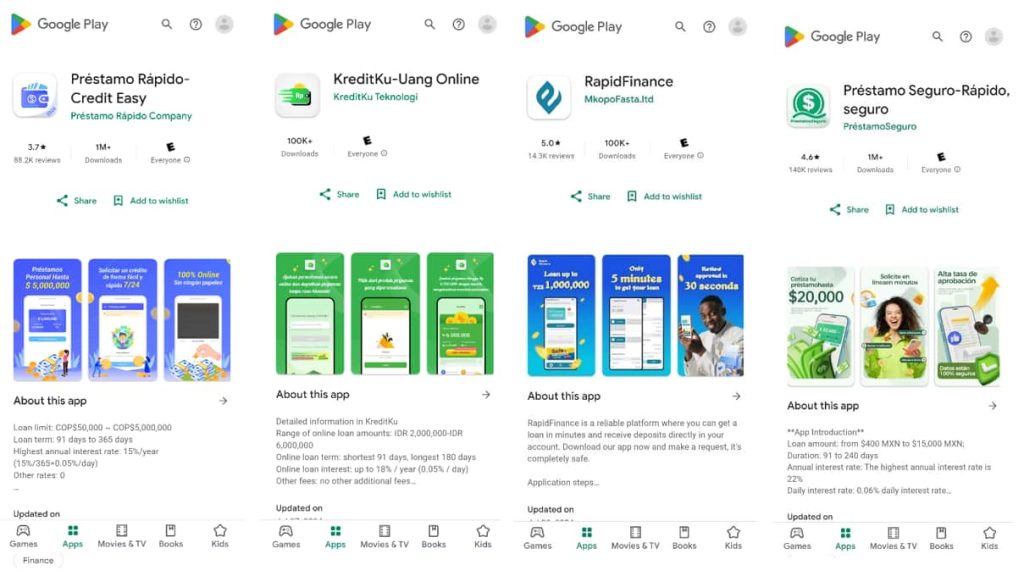

Right here’s a listing of malicious PayLoan apps discovered on the Google Play Retailer:

- Préstamo Seguro-Rápido, seguro – Downloads 1M, Nation: Mexico – Deleted

- Préstamo Rápido-Credit score Simple – Downloads 1M, Nation: Colombia – Accessible

- ได้บาทง่ายๆ-สินเชื่อด่วน – Downloads: 1M, Nation: Senegal – Accessible

- RupiahKilat-Dana cair – Downloads: 1M, Nation: Senegal – Accessible

- ยืมอย่างมีความสุข – เงินกู้ – Downloads: 1M, Nation: Thailand – Deleted

- เงินมีความสุข – สินเชื่อด่วน – Downloads: 1M, Nation: Thailand – Deleted

- KreditKu-Uang On-line – Downloads: 500K, Nation: Indonesia – Deleted

- Dana Kilat-Pinjaman kecil – Downloads: 500K, Nation: Indonesia – Accessible

- Money Mortgage-Vay tiền – Downloads: 100K, Nation: Vietnam – Accessible

- RapidFinance – Downloads: 100K, Nation: Tanzania – Deleted

- PrêtPourVous – Downloads: 100K, Nation: Senegal – Deleted

- Huayna Cash – Préstamo Rápido – Downloads: 100K, Nation: Peru – Deleted

- IPréstamos: Rápido Crédito – Downloads: 100K, Nation: Chile – Accessible

- ConseguirSol-Dinero Rápido – Downloads: 100K, Nation: Peru – Deleted

- ÉcoPrêt Prêt En Ligne – Downloads: 50K, Nation: Thailand – Accessible

How SpyLoan Apps Work

These apps function by utilizing a typical framework to encrypt and exfiltrate knowledge from a sufferer’s system to a command and management (C2) server. They typically use misleading advertising, mimicking respected monetary establishments, and are promoted by means of social media adverts. As soon as put in, they request pointless permissions, comparable to entry to contacts, SMS, storage, and even a microphone or digital camera.

The apps then use an identical onboarding course of, together with a countdown timer to create a way of urgency and require customers to offer delicate identification paperwork and private data. This knowledge is then exfiltrated and used for monetary exploitation, together with hidden charges and excessive rates of interest, in addition to privateness violations, comparable to knowledge misuse and harassment.

The results of utilizing these apps might be devastating. Customers have reported receiving threatening calls and loss of life threats, having private pictures and IDs misused, and experiencing emotional and psychological misery. In some instances, victims have even reported suicidal ideas.

The specter of SpyLoan apps is just not restricted to a single area. They’ve been reported globally, with localized variations. India, Mexico, Philippines, Indonesia, Thailand, Kenya, Colombia, Vietnam, Chile, and Nigeria are among the many prime 10 nations with the very best prevalence of faux mortgage apps.

Legislation Enforcement Actions

Whereas regulation enforcement companies have taken motion in opposition to a few of these operations, the risk persists. In Peru, authorities raided a name heart engaged in extortion and faux mortgage app operations, detaining over 300 people. In Chile, the fee for the monetary market has highlighted tens of fraudulent credit score functions distributed on Google Play.

Defending Your self

To keep away from falling sufferer to those predatory mortgage apps, customers should be cautious when downloading monetary apps. Listed here are some suggestions:

- Learn evaluations and verify scores

- Analysis the app and its developer completely

- Be cautious of apps that request extreme permissions

- Use respected antivirus software program to detect and block malicious apps

- By no means present delicate data with out verifying the app’s legitimacy

RELATED TOPICS

- New Device DVa Detects and Removes Android Malware

- Scammers Utilizing Faux Mortgage Apps for Cash Laundering

- These 8 Apps on Play Retailer Comprise Android/FakeApp Trojan

- “Scary” FakeCall Android Malware Captures Pictures and OTPs

- Octo2 Android Malware Makes use of Faux NordVPN App to Infect Telephones